The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 30, 2018NEW BRUNSWICK BUDGET 2018-19 New Brunswick is the first province to table its budget for the 2018-19 fiscal year.

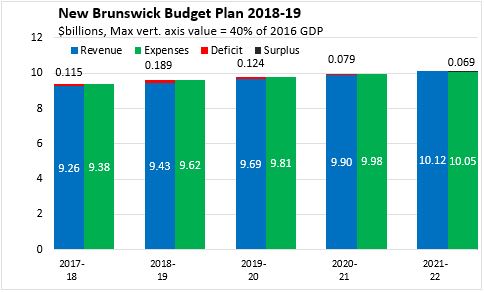

New Brunswick's deficit is estimated to be $189 million in 2018-19 after forecasting a narrower-than-planned deficit of just $115.2 million in 2017-18. New Brunswick's fiscal plan now anticipates returning to surplus in the 2021-22 fiscal year.

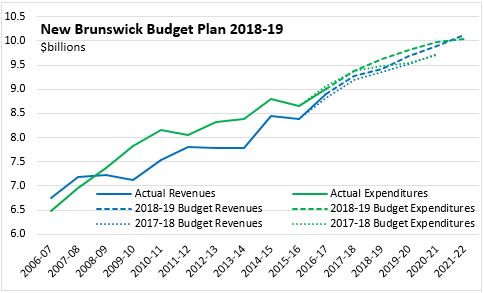

From 2017-18 through 2021-22, New Brunswick's revenues are expected to grow at an annual average pace of 2.2 per cent while expenditures are projected to grow by 1.7 per cent.

New Brunswick's 2017-18 defict was smaller than originally estimated owing to stronger revenue growth and somewhat lower expenditures than planned. The revised 2018-19 fiscal projections anticipate slightly higher revenues over the fiscal horizon while there is an increase in the expenditure outlook and a one-year delay in the projected return to surplus.

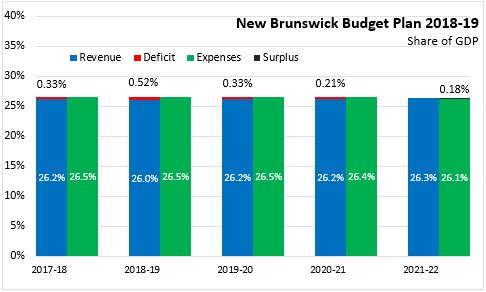

After stronger than expected economic growth in 2016 and 2017, the New Brunswick government's planned revenues and expenditures fall within a narrow band of 26.0-26.5 per cent of GDP over the fiscal plan. New Brunswick's near term deficits narrow from 0.5 per cent of GDP in 2018-19 to 0.2 per cent in 2020-21. The surplus planned for 2021-22 amounts to 0.2 per cent of projected GDP.

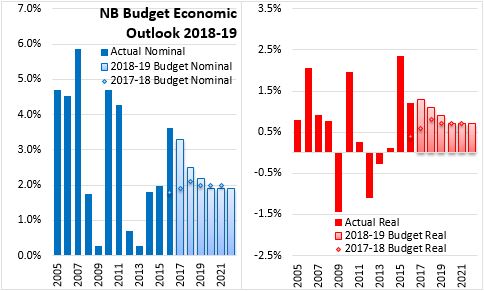

New Brunswick's economic growth in 2016 was stronger than the 2017-18 Budget had anticipated. The estimates and outlook for 2017 and 2018 maintain this more positive expectation for the provincial economy. The Budget's economic assumptions note rising population, retail sales, housing starts, manufacturing shipments, tourism and employment as signals of more robust growth in the New Brunswick economy. The Budget assumes that New Brunswick real GDP will rise by 1.1 per cent in 2018 with rising employment along with rising resource sector outputs (mining, fishing, agriculture, forestry) lifting exports. The development of a logalized recretaional-use cannabis market is expected to have a positive impact on investment and employment in New Brunswick in 2018. Private sector investment is expected to widn down on completion of existing projects, but public investment in infrastructure is expected to offset this over the medium term. The Budget expects New Brunswick real GDP growth of 0.9 per cent in 2019 before settling to an average pace of 0.7 per cent in 2020-2022. In the long run, the New Brunswick economic outlook anticipates that an aging population will slow the pace of potential GDP growth.

Key Measures and Initiatives

The New Brunswick government has implemented numerous tax and program changes over its mandate. The 2018-19 Budget notes many of these and adds new initiatives:

- Lowering the small business tax rate again, to 2.5 per cent effective April 1, 2018

- Supporting productivity enhancements for small export-oriented businesses

- Initiatives to support the innovation eco-system, business start-ups and technological improvement in the fishery

- Additional funding for initiatives in mental health, senior care, employment of seniors in tourism, and youth employment

New Brunswick Budget 2018-19

<--- Return to Archive