The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 28, 2018FEDERAL BUDGET 2018-19 Canada's Federal government has released its Budget for the 2018-19 Fiscal year.

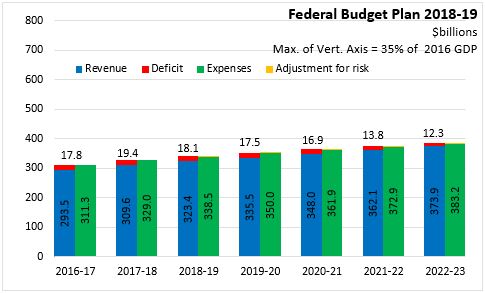

The Federal deficit is projected to be $18.1 billion in 2018-19, following a deficit of $19.4 billion in 2017-18. Revenues are expected to grow by 4.5 per cent in 2018-19 to $323.4 billion while expenditure growth is projected to be 2.9 per cent, reaching $338.5 billion.

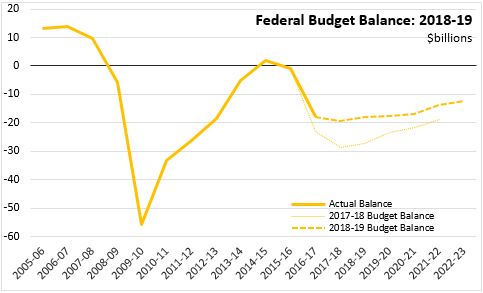

Over the next four fiscal years, the Federal deficit is expected to narrow in each year, reaching $12.3 billion in 2022-23. The Federal Budget does not indicate any specific plan to return to balance. There is a $3 billion provision in each year of the fiscal plan to accommodate any adjustments needed for forecast risks.

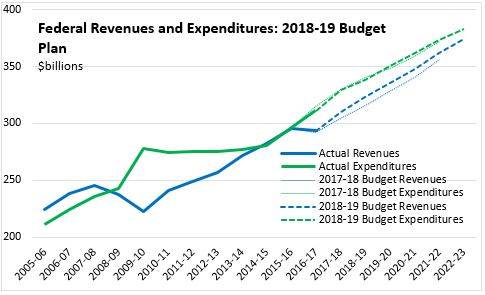

After stronger than expected economic growth in 2017, revenues for the 2017-18 fiscal year grew by 5.5 per cent while expenditures (including policies announced during and after the Fall Economic Statement) were up 5.7 per cent. Over the remaning period of the fiscal plan, stronger revenues are expected throughout the medium term while expenditures remain very similar to the plan announced in last year's Budget.

While overall expenditures are similar to last year's plan, there are reductions in near term infrastructure funds. These are reprofiled to medium- and long-term spending plans, allowing for funding new priorities in the short run.

With stronger revenue growth and little change in expenditure plans, projected federal deficits are over $9 billion smaller in both 2017-18 and 2018-19.

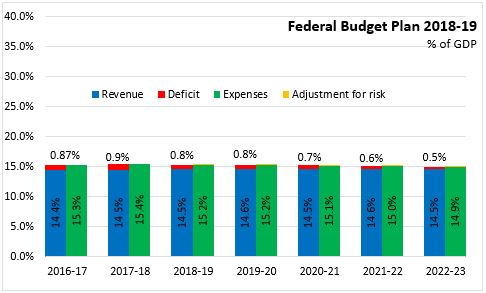

Over time, the Federal government's revenues as a share of GDP are projected to remain stable at 14.5 per cent of nominal GDP. Expenditures are projected to decline moderately over the medium term, falling from 15.4 per cent of GDP in 2017-18 to 14.9 per cent of GDP in 2022-23. Although there are deficits projected for each year of the fiscal plan, they are all less than 1 per cent of GDP and declining in each year. The Federal Budget plan anticipates that debt-to-GDP will decline in each of the next 5 fiscal years.

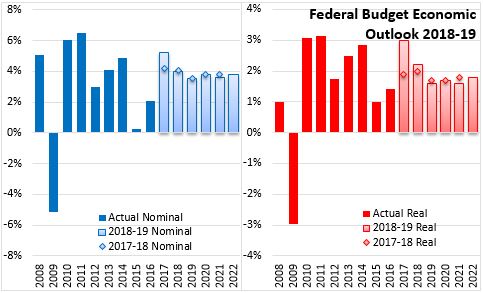

Canada's economic growth was stronger than expected in 2017 with 3.0% real GDP growth and 5.2% nominal GDP growth. Although this pace of real GDP growth was projected in the Fall Economic Statement, a lower outlook for broad price growth (GDP deflator) has reduced the outlook for nominal GDP. In 2018, Canada's economic growth is projected to moderate to a more sustainable rate (2.2% real; 4.0% nominal) as rising confidence, strong labour markets and earnings growth support consumer spending. The Federal Budget notes that Canada's economic growth should be expected to slow as excess capacity disappears. With output nearing potential GDP, economic growth will slow as monetary policy tightens and fiscal stimulus wanes. Housing prices are expected to realign with income and demographic conditions, especially as new mortgage rules temper demand.

The medium term outlook for Canada's economy anticipates real GDP growth slowing to between 1.6 and 1.8 per cent, consistent with the pace of long-run potential for economic growth.

Key Measures and Initiatives

With stronger economic growth and re-profiled infrastructure funds, Canada's Federal government is implementing new initiatives for new priorities. These include improving equality of labour market outcomes between women and men, research and innovation for future economic growth and reconciliation with Indigenous Peoples.

- Enhancing EI parental benefits with an additional 5 weeks of benefits

- Implementing a proactive pay equity regime for organizations and businesses in federally-regulated sectors

- Increasing access to capital for women entrepreneurs and supporting women-owned businesses.

- Committing $4 billion over 5 years to research granting councils, research chairs and other innovation funds

- Raising funding by $5 billion over 5 years for improvements to Indigenous communities and economic opportunities for Indigenous Peoples.

There are a number of tax changes and other initiatives as well in the 2018-19 Federal Budget.

- Replacing the Working Income Tax Benefit with the refundable Canada Workers Benefit. The benefit is equal to 26 per cent of earned income in excess of $3,000 to a maximum of $1,355 for individual earners and $2,335 for families. There will be a slower phase out of the benefit as incomes rise (compared with WITB).

- Reducing eligibility for the small business deduction for firms with higher passive investment earnings (>$50,000)

- Increasing tobacco taxes by $1 per carton of cigarettes and implementing annual increases in line with growth in the CPI

- Laying out a harmonized taxation framework for cannabis

- Enhancing EI benefits for seasonal workers to accommodate periods of income volatility

- Initiatives to promote multiculturalism and consult Canadians on anti-racism, including funding to Statistics Canada for a Centre on Gender, Diversity and Inclusion Statistics

- Increasing funding for the Youth Employment Stratedy by $448.5 million over 5 years

- Establishing a Canadian Centre for Cyber Security as well as RCMP initiatives on cyber crime

- $167.5 million over 5 years to study the health of whales

- Committing $1.3 billlion over 5 years for conservation of lands and waters, including a $500 million contribution to a Nature Fund to partner with corporate, not-for-profit and provincial agencies to secure private land and protect species at risk.

- Improving service delivery capacity at Veterans Affairs Canada and starting a program for maintaining gravesites and markers

- $231.5 million over 5 years to address Canada's opiod crisis

- Funding to explore the next generation of rural broadband technologies using low Earth orbit satellites

- Renewing small craft harbours with cash funding of $250 million over 2 years

- Supporting cost-shared initiatives in Atlantic Canada to prevent the spread of spruce budworm

Canada's Federal Budget 2018-19

<--- Return to Archive