The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 01, 2018US PERSONAL INCOME AND OUTLAY, JANUARY 2018

The US Bureau of Economic Analysis reports that US personal income increased $64.7 billion, or 0.4 per cent in January (seasonally adjusted, levels at annualized rates). The increase in personal income in January primarily reflected an increase in wages and salaries and Social Security benefits, partially offset by an increase in contributions for government social insurance. There has been positive personal income growth in each of the last seven months and in all but one month of 2017.

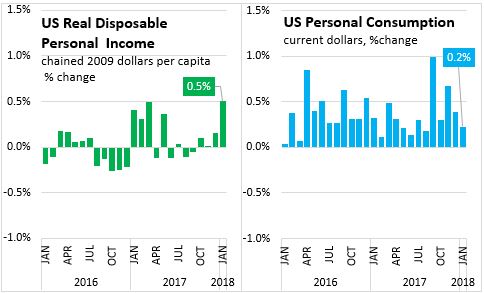

US personal disposable income increased $134.8 billion, or by 0.9 per cent. In real per capita terms, US disposable personal income increased 0.5 per cent.

US personal consumption expenditures increased $31.2 billion, or by 0.2 per cent in January.

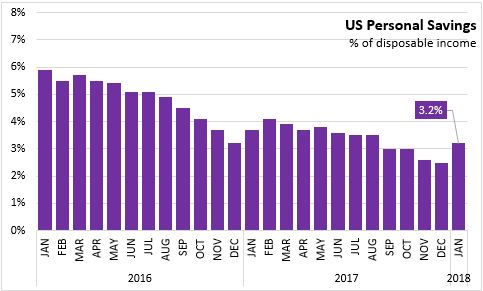

Personal savings (disposable personal income minus personal consumer expenditures, interest paid, and transfers to government and the rest of the world) was $464.4 billion in January. The personal savings rate rose to 3.2 per cent of disposable income.

The January increases in disposable personal income and the personal saving rate mostly result from a decrease in personal current taxes, which reflect the effects of the Tax Cuts and Jobs Act (TCJA). The BEA estimates that this reduced personal current taxes by $115.5 billion at an annual rate.

Source: US Bureau of Economic Analysis

<--- Return to Archive