The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

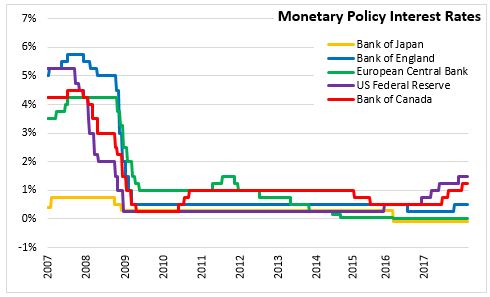

March 07, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.25 per cent. The Bank Rate is correspondingly 1.5 per cent and the deposit rate is 1.0 per cent. The Bank of Canada noted that the economic outlook is expected to warrant higher interest rates over time, but some continued monetary policy accommodation will likely be needed to keep the economy operating close to potential and inflation on target.

The Bank of Canada noted that global growth remains solid and broad based. The US will see a boost to growth in 2018 and 2019 from tax cuts and new government spending, but trade policy is a growing source of uncertainty to the global and Canadian outlooks.

Canada had growth of 3 per cent in 2017, in line with the Bank of Canada's projections. Strong housing data in late 2017 indicate a pulling forward of demand ahead of new mortgage guidelines and other policy measures. The Bank of Canada continues to monitor the economy's sensitivity to higher interest rates, for instance household credit growth has decelerated over the last three months. Inflation is close to 2 per cent and core inflation measures have increased in a manner consistent with an economy operating near capacity. Wage growth remains lower than would be typical in a no labour market slack environment. Temporary factors such as gasoline, electricity and minimum wages are causing inflation to fluctuate.

Bank of Canada

<--- Return to Archive