The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 15, 2018NATIONAL BALANCE SHEET ACCOUNTS, Q4 2017

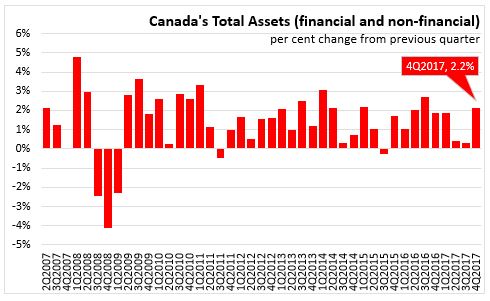

In the fourth quarter of 2017, Canadian national net worth increased 2.2 per cent (or $243.5 billion) to $11,169.7 billion. Growth in household residential real estate continued to be relatively weak with a 0.6 per cent increase after two quarters of no growth. Canada's net foreign asset position increased $115.4 billion to $400.7 billion in Q4 and nearly doubled over 2017 on the strength of foreign stock markets. On a per capita basis, national net worth increased to $302,300 at the end of the quarter.

Total assets, including financial and non-financial assets increased by 2.2 percent to $36.7 trillion at the end of the fourth quarter 2017. Total financial assets increased by 2.6 per cent.

Household sector

In the fourth quarter 2017, Canada’s household sector net worth at market value increased 2.1 per cent to $10.9 trillion. The increase in net worth was mainly attributable to an increase in financial assets led by equity and investment funds as domestic and foreign markets ended 2017 on a strong note. Growth in the value of household residential real estate continued to be weak, growing at 3.4 per cent in 2017 as home prices moderated throughout the year. Growth in residential real estate value was at its slowest pace since 2009.

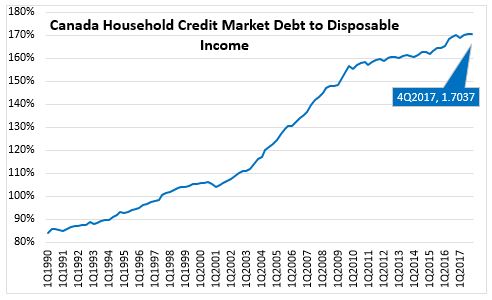

Growth in consumer credit debt was 3.9 per cent and mortgage debt grew 4.9 per cent in 2017, both at a slower pace than 2016. Households credit market debt to disposable income ratio was relatively unchanged, at 170.37 in the fourth quarter 2017. Household leverage, the ratio of total household debt to total assets, declined to 16.6 per cent as total assets expanded 1.9 per cent versus the value of total debt growth of 1.1 per cent. Household leverage has generally trend down since 2008. Mortgage borrowing was up 4.1 per cent after five consecutive quarters of quarterly decreases ahead of new mortgage rules that came into effect in 2018.

Government sector

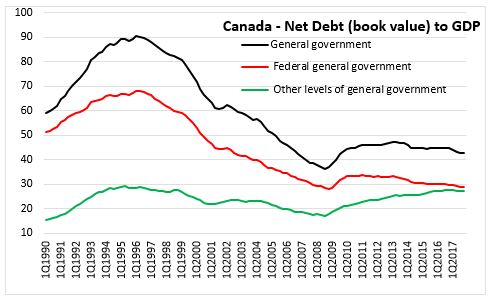

At the end of the fourth quarter 2017, general government net debt (book value) was mostly unchanged at 42.93 percent of GDP, compared to 42.92 per cent in the previous quarter. The federal government's net debt to GDP ratio fell from 29.06 to 28.85 per cent, while other levels of government saw an increase in net debt to GDP to 27.40 per cent from 27.35 per cent in the previous quarter.

Corporate sector

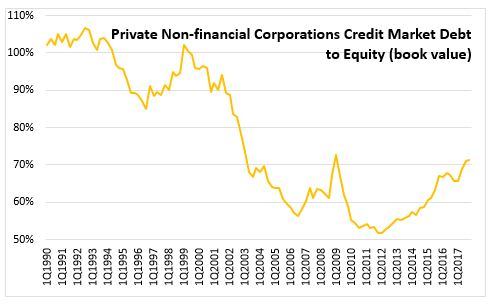

The credit market debt to equity ratio of non-financial private corporations was 71.39 cents of credit market debt for every dollar of equity in the fourth quarter 2017, up from 71.15 cents in the previous quarter. Demand for funds by non-financial private corporations tapered off at the end of 2017 after stronger merger, acquisitions, and other borrowing during the first half of 2017.

Statistics Canada: National Balance Sheet and financial flow accounts

<--- Return to Archive