The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

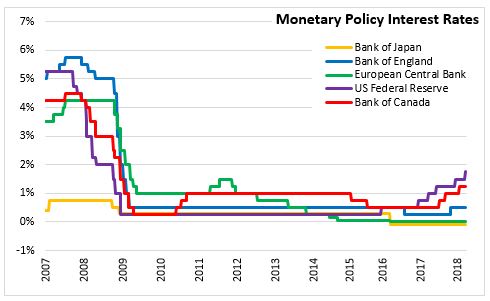

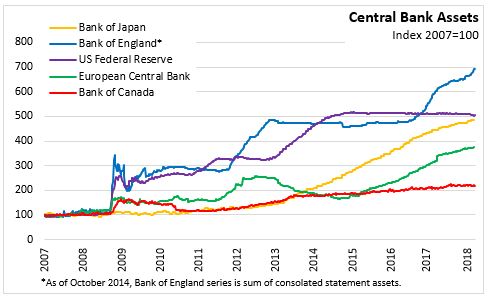

March 22, 2018MONETARY POLICY: UK The Bank of England's Monetary Policy Committee (MPC) voted to maintain the Bank Rate at 0.5% and to maintain the UK non-financial corporate bonds stock of £10 billion and the stock of UK government bond purchases at £435 billion. The MPC notes that the erosion of slack in the economy has reduced the degree in which it is appropriate to accommodate an extended period of inflation above target and that it is appropriate to set monetary policy so that inflation returns to its target at a more conventional horizon.

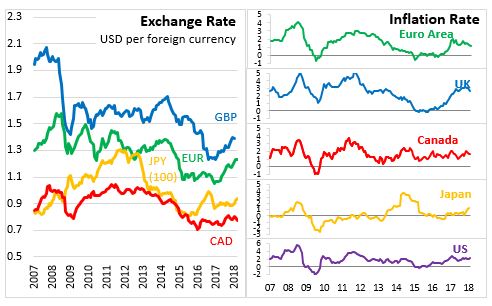

Global economic growth has continued to be strong and financial conditions remain accommodative. UK GDP was revised down in Q4 to 0.4 per cent with less net trade and business investment than had been expected. Other indicators of exports and investment point to a stronger picture and recent indicators suggesting Q1 2018 GDP continuing on a similar pace of growth as Q4. CPI inflation decreased from 3.0 per cent to 2.7 per cent in February and is expected to ease further but remain above the 2 per cent target. Pay growth continues to pick up and unemployment rate remains low. Developments around the United Kingdom's withdrawal from the EU remains the most significant influence and risk on the economic outlook.

Bank of England

<--- Return to Archive