The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

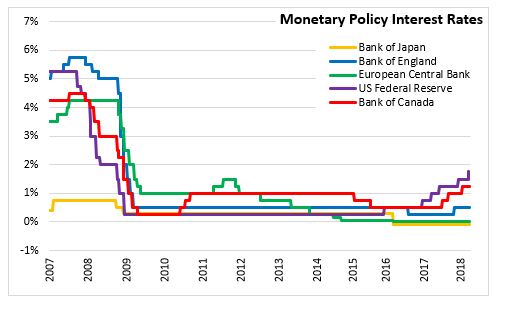

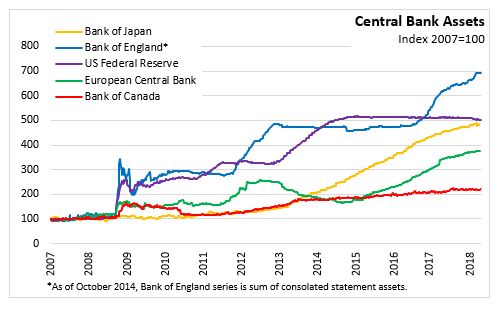

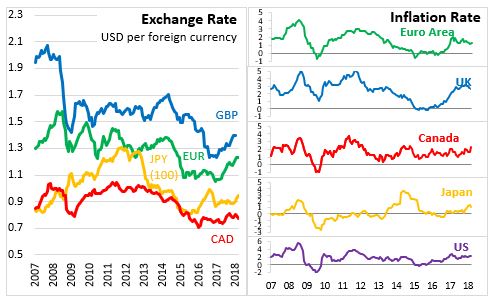

April 27, 2018BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to continue with "Quatitative and Qualitative Monetary Easing with Yield Curve Control", aiming to achieve the price stability target of 2 per cetn. It will continue expanding the monetary base until the year on year rate of increase in the observed CPI exceeds 2 per cent. The Bank of Japan will continue to apply a -0.1 per cent to Policy-Rate Balances for current accounts held by the Bank and they will purchase government bonds to keep the 10-year yield around zero per cent. Purchases for Japanese government bonds will be around 80 trillion yen per year and the Bank will continue purchasing exchange-traded funds at 6 trillion yen per year and real estate investment trusts at 90 billion yen per year. Commercial paper and corporate bond holdings by the Bank will be maintained.

A summary of the Bank of Japan's Outlook has the economy growing at a pace above its potential in fiscal 2018, and from fiscal 2019 through 2020, the economy is expected to continue on an expanding trend supported by external demand, although the growth pace is projected to decelerate due to a cyclical slowdown in business fixed investment and the effects of the scheduled consumption tax hike. CPI growth has continued to be relatively weak, but is expected to rise and continue on an uptrend toward the 2 per cent per year target.

Source: Bank of Japan's Statement on Monetary Policy

<--- Return to Archive