The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 11, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada increased its target for the overnight rate by 0.25 percentage points to 1.50 per cent. The Bank Rate is correspondingly 1.75 per cent and the deposit rate is 1.25 per cent. The Bank of Canada expects that higher interest rates will be warranted to keep inflation near target but will continue to take a gradual approach while monitoring the economy's adjustment to higher interest rates, capacity and wage pressures, and trade actions.

Global Growth

Global economic growth continues to be solid, but trade tensions pose considerable risk. Monetary policy is gradually being normalized at different speeds across advanced economies.

Chart Source: Bank of Canada

The US economy is expanding at solid pace with net exports being unexpectedly robust due to temporary factors and business investment rising. US consumption will continue to rise with strong labour market, income tax cuts, and elevated household net worth. Private demand and corporate tax cuts will drive business investment growth but US businesses are starting to report that trade policy uncertainty as a dampening factor. The Bank of Canada forecasted US GDP to grow above potential at 3.0 per cent in 2018 and 2.5 per cent in 2019, before returning to around 2 per cent in 2020 as fiscal and monetary policy support diminishes. The US Federal Reserve is expected to continue to raise interest rates and the US dollar has appreciated. US wage growth has been modest but is expected to pick up with a tightening labour market.

Euro Area economic growth was weaker than anticipated at the beginning of 2018 but is expected to rebound in Q2 and grow by 2.25 per cent in 2018 and around a potential afterwards as monetary policy becomes less accommodative. China's GDP growth in Q1 was slower than anticipated due to a rise in imports to build inventory. Monetary policy in China has been eased to help offset the downside from slower credit growth and trade policy developments. The Bank of Canada projects growth in China to ease from 6.5 per cent in 2018 to 6.0 per cent in 2020.

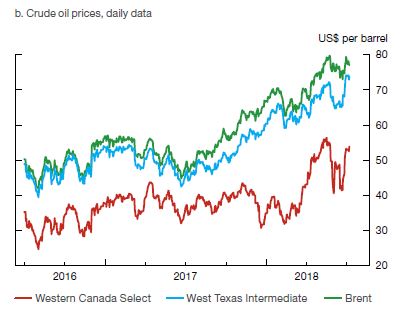

Crude oil prices have continued to rise in 2018, driven in part from unplanned output declines in Venezuela and Iran, slower US shale drilling, and demand growth. Canadian lumber prices have remained high despite US duties while base metal prices have declined with global trade tensions and market concerns for GDP growth in China.

Chart Source: Bank of Canada

Canada Growth Outlook

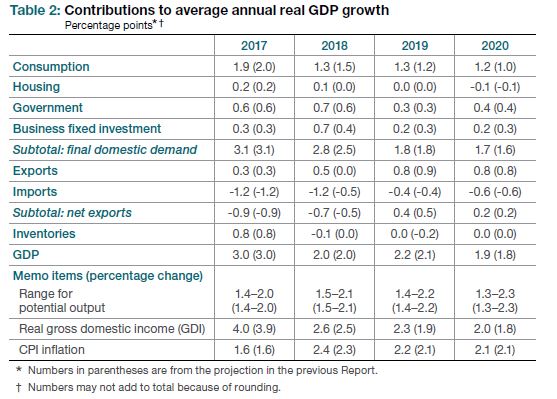

The Canadian economy is operating close to full capacity and is expected to grow somewhat faster than potential while the composition of growth shifts away from household spending and towards exports and business investment. Households are adjusting to higher interest rates and new mortgage guidelines. Household credit growth has continued to slow and is now below the rate of household income growth. Housing resale activity was significantly lower the first few months of 2018, but is expected to rebound in Q3. Consumption contribution to growth will slow over next few years as will growth in new residential spending.

Chart Source: Bank of Canada

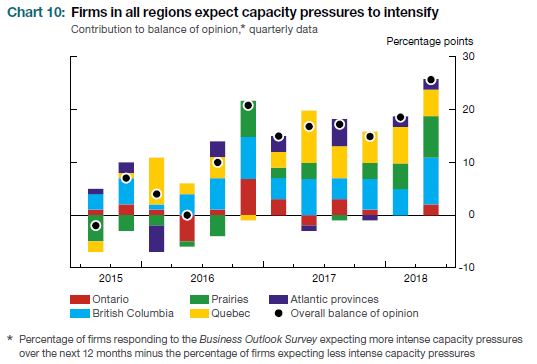

Labour market conditions are healthy but the pace of employment and hours worked growth have slowed. The unemployment rate has been steady near a 40-year low. Areas of slack remain in the labour market, particularly in energy-producing regions, among long-term unemployed, and a subdued participation rate in youth labour market. Firms reported in the Bank of Canada's Business Outlook Survey that capacity pressure and labour shortage have intensified.

Chart Source: Bank of Canada

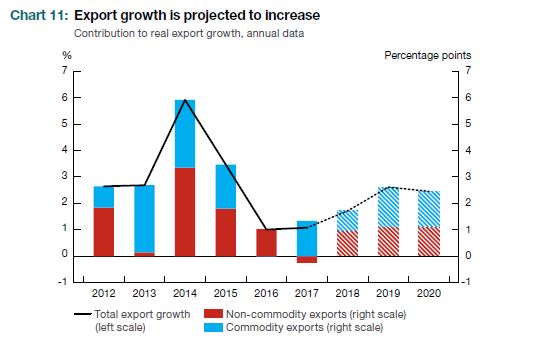

Exports and business investment were solid over the first half of 2018 with firms expanding capacity and an increase in oil exports lifting activity. Exports and investment are expected to continue to make larger contributors to GDP growth than they have been in recent years, even after incorporating the restraining effects of implemented tariffs and trade uncertainty. Export growth will be supported by solid foreign demand growth and higher oil prices.

The Bank of Canada estimates that US steel and aluminum tariffs and Canadian countermeasures will reduce real exports and imports by 0.6 per cent, respectively. Overall, trade policy uncertainty and implemented US tariffs are estimated to subtract 0.67 per cent from the level of GDP by the end of 2020.

Chart Source: Bank of Canada

Inflation Outlook

The Bank of Canada estimates that tariffs will lift inflation by about 0.1 percentage point. CPI inflation is projected to rise temporarily to 2.5 per cent due to higher gasoline prices, the impact of minimum wage increases, new tariffs, and the depreciation of the Canadian dollar. These factors will dissipate by mid-2019 when CPI inflation will be close to 2 per cent. Core inflation measures are consistent with an economy close to potential at around 2 per cent.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is September 5, 2018. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 24, 2018.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive