The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

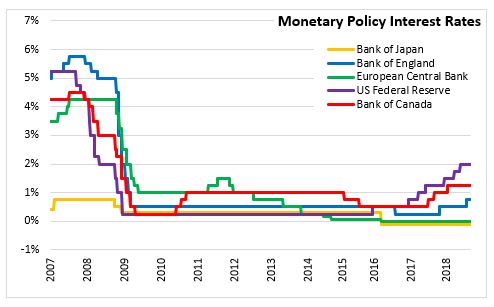

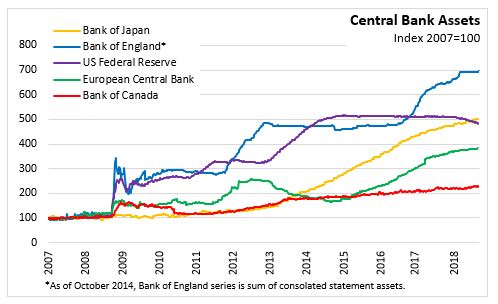

September 13, 2018MONETARY POLICY: EURO AREA At today’s meeting, the Governing Council of the European Central Bank (ECB) announced that the key ECB interest rates are unchanged with the interest rates on main refinancing operations, marginal lending facility and the deposit facility at 0.00%, 0.25% and -0.40% respectively. The rates are expected to remain at their present levels at least through the summer of 2019, and in any case for as long as necessary in order to converge inflation levels to around 2 per cent over the medium term. Monthly asset purchases will run at the current pace of €30 billion per month until the end of this month. After September, the Governing Council will reduce the monthly pace of net asset purchases to €15 billion per month until December, after which it is expected that net purchases will end.

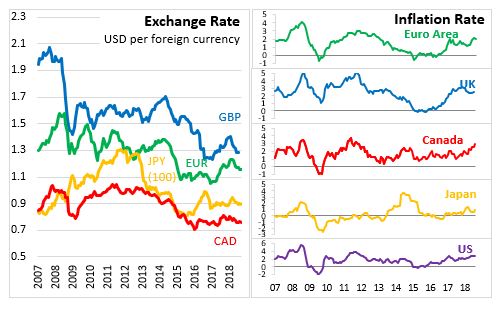

Euro area real GDP grew 0.4 per cent in Q2, following growth of the same rate in the previous quarter. The latest economic indicators confirm ongoing broad based growth of the euro area economy. Private consumption is supported by ongoing employment gains, partly reflecting past labour market reforms and wage growth. Expansion in the global economy is expected to continue, supporting euro area exports.

Euro area inflation was 2.0 per cent in August, down from 2.1 per cent in July. Given oil future prices, headline inflation is likely to remain at current levels for the remainder of the year. Wage growth is being pushed up by strong domestic cost pressures, high levels of capacity utilization, and tight labour markets. Underlying inflation is expected to pick up towards the end of the year and thereafter, to increase gradually over the medium term.

Sources:

European Central Bank

<--- Return to Archive