The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

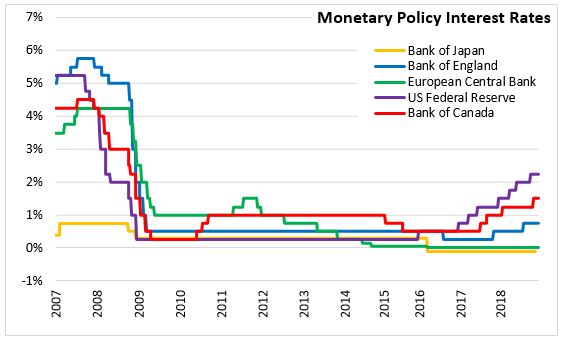

December 05, 2018BANK OF CANADA MONETARY POLICY The Bank of Canada maintained the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.00 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that the policy interest rate will need to rise into a neutral range to achieve the inflation target with the pace of increase dependent on the effect higher interest rates have on consumption and housing, global trade policy developments, evolution of business investment, and the persistence of the oil price shock.

The Bank of Canada noted that the global economic expansion is moderating as expected, but emerging trade conflicts are weighing more heavily on global demand with both potential upside and downside risks around trade policy developments. Growth in major advanced economies has slowed, while activity in the United States remains above potential.

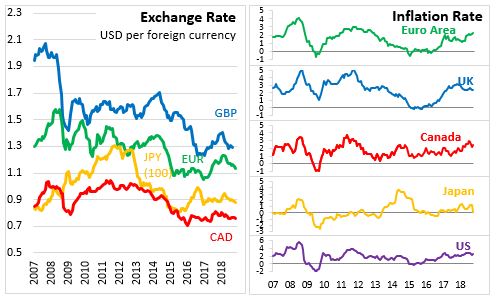

Oil prices have fallen sharply due to geopolitical developments, uncertainty about global growth prospects, and growing US shale oil production. Transportation constraints and inventory buildup have pulled down western Canadian oil prices. Lower prices and associated production cutbacks will likely weaken activity in the energy sector. The Bank of Canada noted that the Canadian economy has grown in line with projections in the third quarter, but with less momentum going into the fourth quarter. Business investment declined in Q3 due to heightened trade uncertainty during the summer, but is expected to strengthen outside the energy sector with the signing of the USMCA, new federal government tax measures, and existing capacity constraints. Increases in productive capacity and foreign demand will support growth in exports.

Inflation has been evolving as expected and core measures are near 2 per cent, consistent with an economy close to capacity. CPI inflation in October 2018 was 2.4 per cent, above target but expected to ease going forward due to lower gasoline prices. Downward historical revisions by Statistics Canada to GDP and recent developments indicate there may be additional room for non-inflationary growth.

Bank of Canada

<--- Return to Archive