The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 14, 2019PRIVATE SHORT-TERM ACCOMMODATION, 2015-2018 Statistics Canada has released a new report on measuring private short-term accommodation in Canada and starting with reference year 2015 will incorporate the economic activity into national and provincial economic accounts. Private short-term accommodation are listing and rental of privately owned dwellings on a short-term basis via an intermediary digital platform. Hosts, individuals or businesses, provide short-term accommodation services, set prices, and availability to earn accommodation revenue from guests. Digital intermediary platforms (i.e. Airbnb, VRBO, HomeAway, Flipkey) operate online matching and processing systems to facilitate transaction between hosts and guests and charge fees to both for the service. Currently, all of the major intermediary platforms for short-term accommodation market are foreign companies, so the services are classified as imports.

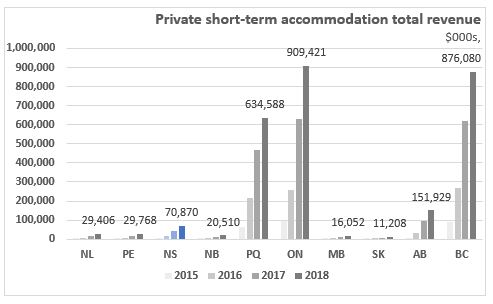

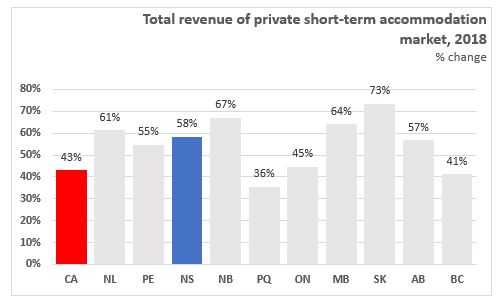

Private short-term accommodation revenue has grown rapidly in the past four years in Canada rising from $265 million in 2015 to $2.8 billion in 2018. All provinces have seen increases in revenue. In Nova Scotia, private short-term accommodation total revenue grew from $1.1 million in 2015 to $70.9 million in 2018. Growth in the sector was strong in 2018 with an increase in revenue of 58 per cent in Nova Scotia and 46 per cent in Canada compared to 2017.

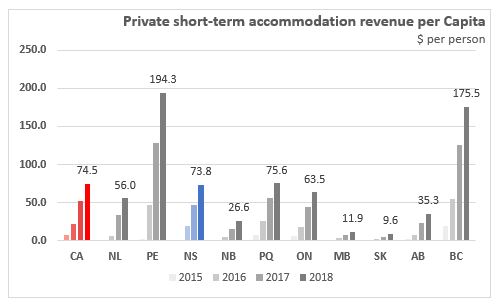

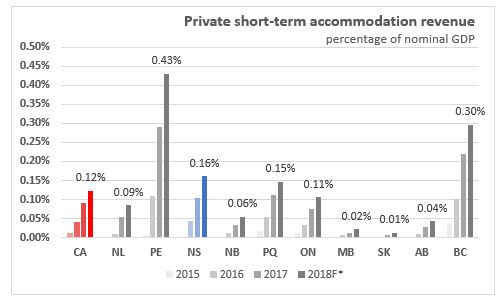

The relative size of the revenue in each province can be examined by looking at the revenue per capita or the sector's revenue as a share of GDP. All provinces have seen growth in relative size of the sector since 2015. The relative size of the private short-term accommodation sector is larger in Prince Edward Island, Nova Scotia, Quebec, and British Columbia. The sector is relatively smaller in Manitoba and Saskatchewan.

*nominal GDP for 2018 has been forecasted based on private sector average as of November 9, 2018.

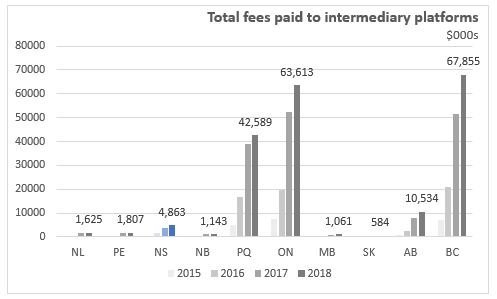

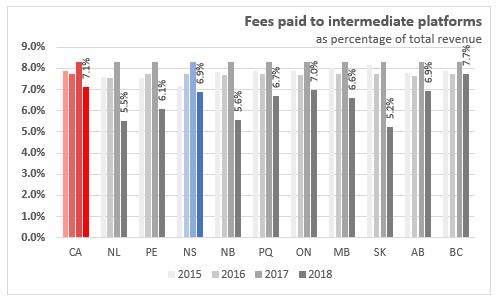

The fees paid to the digital intermediary platforms have also grown since 2015 with platforms earning reaching $4.9 million in Nova Scotia and $196.6 million in Canada in 2018. The fees paid to the intermediary platforms have been estimated based on the midpoint of fee range data available to Statistics Canada with this value declining as a share of total revenue in 2018 in all provinces.

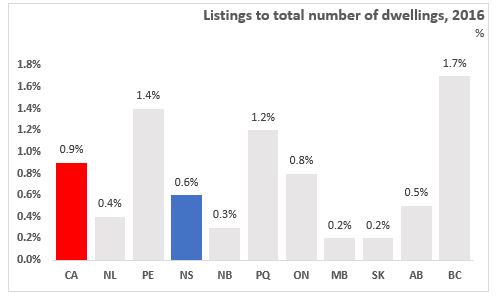

The number of listing and hosts on the platforms have grown in recent years, and correspondingly has increased the number of reservations. For Canada reservations of the platforms increased from 1.7 million in 2015 to nearly 10 million in 2017. Listings primarily consist of entire home/apartments (64%) with the remainder being a private room in a home (34%) and shared rooms (2%). The number of listings compared to the total dwelling stock remains less than 2 per cent in all province. Nova Scotia had listings accounting for 0.6 of the total dwelling stock in 2016.

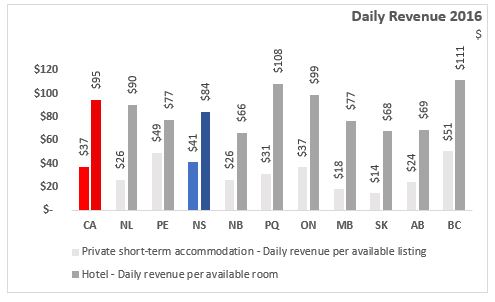

The daily revenue per listing generated form short-term accommodation rentals was $41 in Nova Scotia in 2016. Prince Edward Island, Nova Scotia, and British Columbia had higher daily revenue than the national average. Daily revenue from private short-term accommodation was less than hotel daily revenue per room for all the provinces in 2016.

Statistics Canada: Measuring private short-term accommodation in Canada

<--- Return to Archive