The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

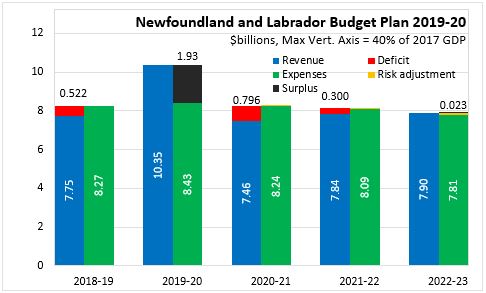

April 17, 2019NEWFOUNDLAND AND LABRADOR BUDGET 2019-20 The Province of Newfoundland and Labrador has released its 2019-20 Budget. Accounting for the $2.5 billion net revenues from the Hibernia Dividend Backed Annuity Agreement, Newfoundland and Labrador is projected to post a $1.93 billion surplus for 2019-20. This $2.5 billion addition to revenues is based on projected Federal revenues ($3.3 billion) as a result of its share in the Hibernia project over the period 2019-2056, which is partially offset by payments of $100 million per year from Newfoundland and Labrador to the Federal government in the period 2045-2052.

After this extraordinary revenue is recorded in 2019-20, Newfoundland and Labrador returns to deficits of $796 million for 2020-21 and $300 million for 2021-22. The province projects achieving a surplus of $23 million in 2022-23. Newfoundland and Labrador's fiscal projections include oil price risk adjustments of $20 million in 2020-21, $50 million in 2021-22 and $70 million in 2022-23.

From 2018-19 to 2022-23, Newfoundland and Labrador's revenues are projected to grow at an annual average rate of 0.5 per cent per year while expenditures are projected to decline by 1.4 per cent per year.

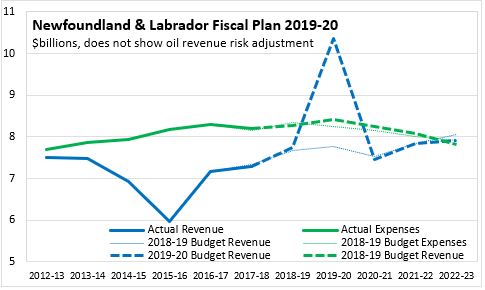

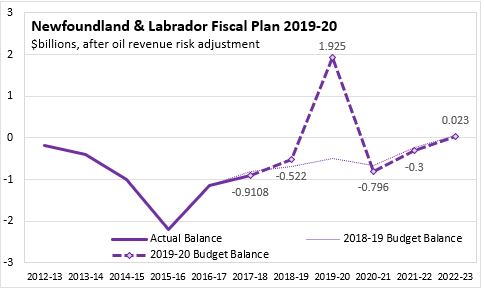

With the one-time offshore revenues of $2.5 billion recorded in 2019-20, Newfoundland and Labrador's revenues are sharply higher than anticipated in the 2018-19 Budget plan. In the subsequent fiscal years, Newfoundland and Labrador's latest fiscal plan is similar to that presented in the 2018-19 Budget. Planned expenditures for 2019-20 and subsequent fiscal years are slightly higher than anticipated in the previous Budget's outlook.

Apart from the extraordinary surplus of $1.925 billion for 2019-20, Newfoundland and Labrador's fiscal plan is only slightly different from the 2018-19 Budget projections. Small increases in planned expenditures lead to slightly larger deficits projected for 2020-21 and 2021-22. The return to surplus remains the same in fiscal year 2022-23 albeit at a slightly lower level of $23 million.

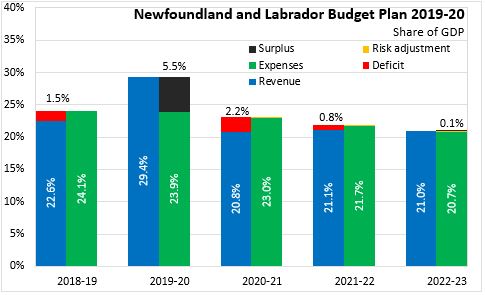

Measured as a share of nominal GDP, the government of Newfoundland and Labrador's footprint in the economy is projected to shrink through 2022-23. After the offshore payment in 2019-20 lifts provincial revenues to 29.4 per cent of GDP, revenues decline to 21 per cent of GDP by 2022-23. With declining expenditures and rising nominal GDP, the size of Newfoundland and Labrador's provincial expenditures are projected to decline from 24.1 per cent of GDP in 2018-19 to 20.7 per cent of GDP by 2022-23.

Newfoundland and Labrador's surplus for 2019-20 amounts to about 5.5 per cent of provincial GDP for 2019. In 2020-21 Newfoundland and Labrador's deficit is projected to be 2.2 per cent of GDP. The one-time surplus amounting to 5.5 per cent of GDP reduces Newfoundland and Labrador's net-debt-to-GDP ratio from almost 45 per cent to under 40 per cent in 2019-20. Over the next three fiscal years, the net debt to GDP ratio will rise, then fall to stabilize at around 40 per cent.

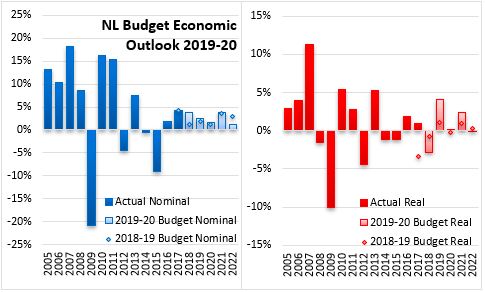

Newfoundland and Labrador's economic outlook is sensitive to investment, production, export and prices of the province's natural resources (especially oil). For 2018, Newfoundland and Labrador's real GDP is estimated to have declined by 2.9 per cent because of lower investment levels in Muskrat Falls and the Hebron oil development as well as reduced iron ore output because of a strike. Nominal GDP was up by an estimated 3.9 per cent on higher prices.

For 2019, Newfoundland and Labrador's real GDP is projected to rebound by 4.1 per cent on higher investments for the West White Rose oil project as well as the underground ming at Voisey's Bay, offset by continued winding up of investment activity for the nearly-completed Muskrat Falls project. Newfoundland and Labrador's economy is also expected to benefit from rising oil and iron production/exports in 2019. Nominal GDP growth is expected to slow to 2.6 per ecnt for 2019 as prices decline.

The Budget projections assume that oil prices ($USD per barrel-Brent, adjusted for risk) will rise from $65 in 2019-20 to $69 in 2021-22, falling to $68 in 2022-23.

Newfoundland and Labrador's medium term economic outlook faces headwinds because of ongoing fiscal restraint as well as declining construction activity after completion of major projects. Over the medium term, Newfoundland and Labrador's prospects for growth are sensitive to investments in development the Bay du Nord oil project as well as exploration activity in other basins.

Key Measures and Initiatives

The government of Newfoundland and Labrador does not anticipate major new spending initiatives while it curtails expenditures on a path to balance.

- The Province is maintaining its commitment to to manage consumer electricity rates at $0.135/kWh in 2021 at a cost of $200 million per year

- The Province is continuing with the planned expiry of the deficit reduction levy on December 31, 2019.

- The Province is reducing the size of the public service through attrition.

- The Province is focusing on industrial diversification to reduce the exposure to the oil industry.

Newfoundland and Labrador Budget 2019-20

<--- Return to Archive