The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 24, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.0 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that an accommodative policy interest rate continues to be warranted and will evaluate the appropriate degree of accommodation as new data arrives.

Global Growth

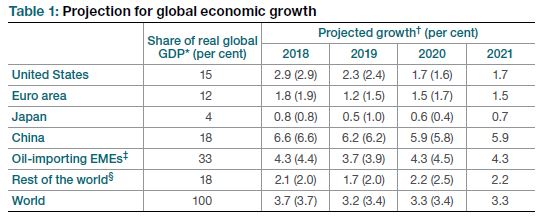

Global economic growth moderated due to cyclical factors and trade policies with growth slowing more than previously anticipated. Central banks have signalled a slower pace to monetary policy normalization and perceived progress in US-China trade talks have improved global financial conditions and commodity prices. Global GDP growth is expected to pick up and grow around 3.25 per cent per year over the forecast horizon.

Chart Source: Bank of Canada

The recent broad-based slowdown in global growth has been notably related to global trade and business investment. The total drag from US and other country tariffs implemented over the past two years are expected to reduce global GDP by 0.4 per cent by end of 2021. Trade between the US and China for tariffed goods has generally declined from levels occurring before the imposition of tariffs.

The US economic expansion moderated towards the end of 2018 due to previous interest rate increases impacting household spending, residential investment contracting, and trade tensions. Business investment has been growing at a strong pace with support from tax changes and deregulation. Economic growth is projected to be around 2.25 per cent in 2019 before further slowing as effects of fiscal stimulus are diminished.

Euro area growth has been weaker than expected with contraction in manufacturing sector and deteriorating consumer confidence. The effects of Brexit, global trade uncertainty, fiscal challenges, protests and domestic factor have weighed on growth. Some temporary factors will wane and growth is expected to pick up going forward.

The Chinese economy is gradually slowing amid deleveraging and trade tensions that are expected to continue to challenge growth. Modest fiscal and monetary stimulus policies have been enacted with further additional policy support being signalled should it be required.

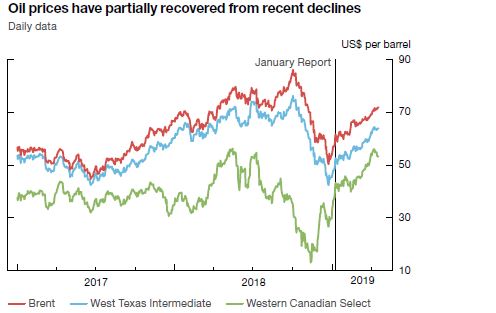

Oil prices have increased since the beginning of 2019. Saudi Arabia production cuts and risks to production in some countries have contributed to the increase in world prices. Western Canadian Select spreads have narrowed with production curtailments and higher demand amid US sanctions against Venezuela. Non-energy prices have risen in recent months with improved market sentiment, but Canadian canola prices are lower after Chinese government actions

Chart Source: Bank of Canada

Canada Growth Outlook

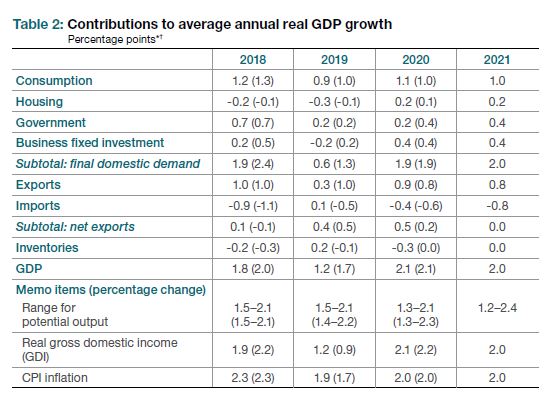

Previous dampening effects from low oil prices, housing policies, rising borrowing rates should ease over 2019, but the trade environment and housing policies are having a more adverse impact than previously anticipated. Improved financial conditions, strong immigration and the global economy are expected to continue to support the Canadian economy through 2021. However, the outlook for real GDP growth for 2019 has been revised down to 1.2 per cent - 0.5 percentage points lower than the January 2019 outlook and 0.9 percentage points lower than the October 2018 outlook. Canada real GDP growth projected to increase to 2.1 per cent in 2020 and 2.0 per cent in 2021.

Chart Source: Bank of Canada

The Bank of Canada has revised down slightly its estimate range for potential output growth and the neutral rate of interest. Trend labour productivity is lower based on less accumulation of capital, notably in the energy sector, while labour input growth is up on higher immigration. Overall, potential output growth is estimates at around 1.8 per cent (range: 1.2-2.5) with a drag from an aging population expected. . The neutral rate of interest re-assessment resulted from improved modelling and lower global natural rate. The range for the neutral nominal policy rate is 2.25-3.25 per cent.

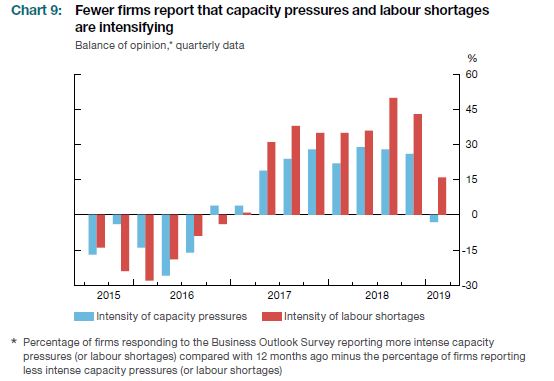

The Canadian economy is operating with modest excess capacity after being near capacity for most of the past two years. The Business Outlook Survey shows capacity pressures and labour shortages are less severe. Labour markets continue to be healthy with stronger wage gains showing up for job changers and outside oil-intensive regions. The slack in the economy is more concentrated in some industries and regions. The economy expected to grow above potential in 2020 and 2021.

Chart Source: Bank of Canada

Household consumption and housing market remain underpinned by strong employment and wage gains. By 2020, housing and mortgage finance policies are no longer expected to slow spending growth. Recent easing of household borrowing rates have helped by lowering renegotiated five-year fixed mortgages payments. Households are expected to be more cautious amid elevated indebtedness and changing home prices. Housing markets developments continue to be regional in nature with stabilization expected for house prices in British Columbia and Ontario, ongoing challenges in Alberta, and an expected lift in Montreal amid the strong economy and investor interest. After declining in 2018 and 2019, residential investment expected to expand in 2020 with multi-unit residences rising to meet demand for less-expensive homes. Government spending contribution to growth has been lowered with the recent Ontario budget.

Business investment, outside the oil and gas sector, will be contributing to growth with favourable factors for rising investment that include capacity constraints, operating profits, financing costs, and investment incentives. Elevated trade uncertainty is projected to continue to be dampening factor and downside risk. Strong spending intentions among services-oriented firms are consistent with ongoing digitalization of business activity and should support of research and development, computer and software investments. The oil and gas sector continues to make structural adjustments and face transportation constraints.

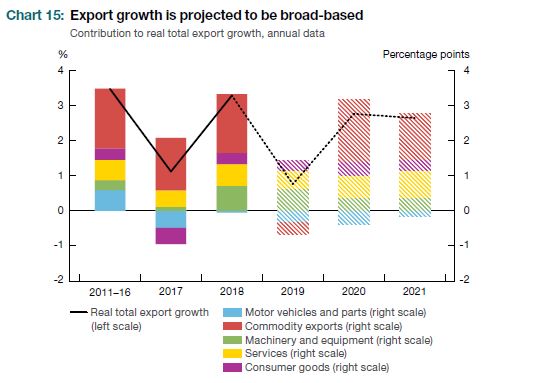

Non-energy exports are expected to expand moderately with global trade policies and competitiveness challenges continuing to be impediments. Foreign demand and new capacity will support a broad-based expansion outside of energy and autos. Service exports, notably travel services (including tuition and foreign student spending in Canada) and commercial services will make important contributions to export growth.

Chart Source: Bank of Canada

Inflation Outlook

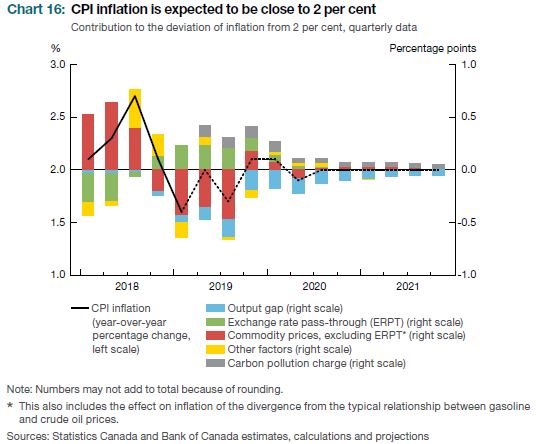

CPI inflation is expected to return to 2 per cent earlier than anticipated with increasingly firm oil prices. Temporary lower gasolines prices will lower headline inflation through most of 2019. The temporary airfare price surge and the new federal carbon pollution charge on fossil fuels are expected to be a modest lift to inflation. Inflation is expected to remain close to 2 per cent through 2020 and 2021.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is May 29, 2019. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on July 10, 2019.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive