The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 26, 2019STUDY: DEBT AND FINANCIAL DISTRESS AMONG CANADIAN FAMILIES Today, Statistics Canada released the study “Debt and financial distress among Canadian families”. This study draws on data from the 2016 Survey of Financial Security to examine financial distress indicators for Canadian families with debt and the factors associated with financial distress. The three indicators of financial distress are skipping or delaying a non-mortgage payment, skipping or delaying a mortgage payment, or using payday loans.

Historically, most research has focused on bankruptcy, which may be misleading as an indicator of financial distress. As a last resort, it is an indicator of extreme financial distress, while a family may have experienced financial distress long before bankruptcy. Moreover, the decline in bankruptcy filings since 2009 does not necessarily indicate improved financial conditions for Canadian families but may reflect behavioural changes due to changes in legislation.

Among Canadian families with debt in 2016, 11 per cent missed a non-mortgage payment in the past year while 4 per cent missed a mortgage payment in the past year. In 2016, 4 per cent of families with debt reported at least one member of the family using a payday loan in the previous three years, up from 3 per cent in 2005.

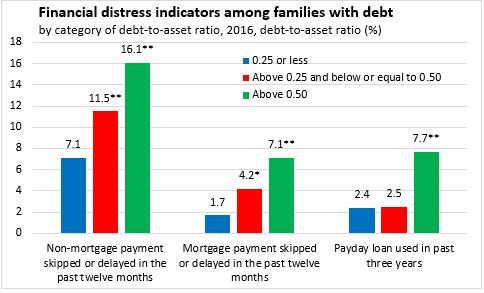

The study looked at the relationship between financial distress indicators and two widely used measured of family indebtedness: the debt-to-asset ratio and the debt-to-income ratio. Families with higher debt-to-asset ratios were more likely to be in financial distress, while families with lower debt-to-asset ratios were less likely to miss a mortgage or non-mortgage payment or use a payday loan.

* significantly different from reference category of families with debt-to-asset ratio of 0.25 or less (p<0.05), ** significantly different from refence category (p<0.01)

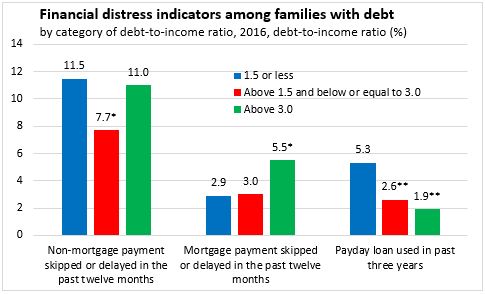

These associations between financial distress and indebtedness were not as clear for the debt-to-income ratio. Higher debt-to-income ratio not always associated with a higher degree of financial distress. Those with higher debt-to-income ratios were less likely to use payday loans. This may be explained by the fact that those who use payday loans have a high debt-to-asset ratio largely because of low values of asset holdings, not because of high debt levels. They are also less likely to be homeowners, for whom the debt-to-income ratio is typically higher.

* significantly different from reference category of families with debt-to-asset ratio of 0.25 or less (p<0.05), ** significantly different from refence category (p<0.01)

The study used an econometric model to determine the relationship between measures of indebtedness and indicators of financial distress while controlling for the family’s socioeconomic characteristics. After taking characteristics such as age, family type, education, region, sex, home-ownership status into account, the study found that a higher debt-to-asset ratio was significantly associated with indicators of financial distress. Homeowners, with or without a mortgage, were less likely to miss a non-mortgage payment than those who were not homeowners, and were also less likely to report using a payday loan. Families in the lowest income quintile were also more likely to skip or delay a payment (both mortgage or non-mortgage) than those in the top twenty percent of the income distribution. Lone parents were more likely to miss a mortgage payment or use a payday loan compared to couples without children. Those with a university degree were less likely to report missing a non-mortgage payment or using payday loans compared to those with high-school education.

The same model was run using debt-to-income ratio instead of debt-to-asset ratio and the results were not statistically significant, indicating that the debt-to-income ratio does not appear to be associated with financial distress. However, the relationships between family characteristics and the three indicators of financial distress were similar.

The study notes that skipping or delaying a payment may not always be an indicator of financial distress (i.e. forgetting to make a credit card payment). The survey also asked respondents who skipped or delayed a payment whether they had done so “due to financial difficulties”. About two-thirds of respondents who missed a non-mortgage payment and about three-quarters of respondents who missed a mortgage payment also responded that they did so due to financial difficulties.

Source: Statistics Canada

Daily release | Full article

<--- Return to Archive