The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

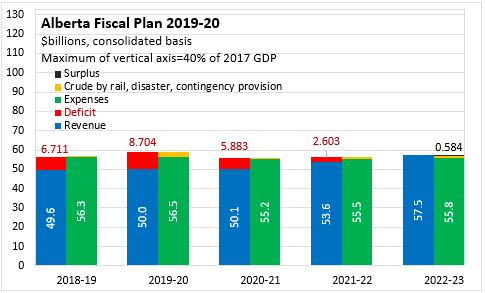

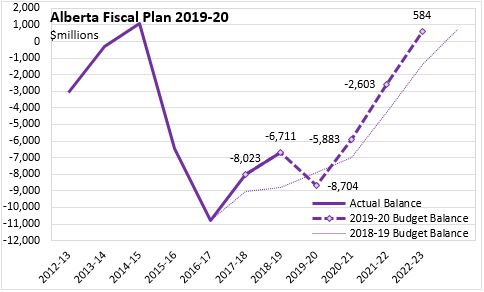

October 28, 2019ALBERTA BUDGET 2019-20 Following an election, Alberta's new government tabled its 2019-20 Budget on October 24. The 2019-20 Alberta Budget anticipates a deficit of $8.7 billion, including a $1.5 billion provision in 2019 for ending shipments of crude oil by rail. The government expects to return to balance by 2022-23 as expenditures are reduced while revenues grow. These projections include contingency provisions.

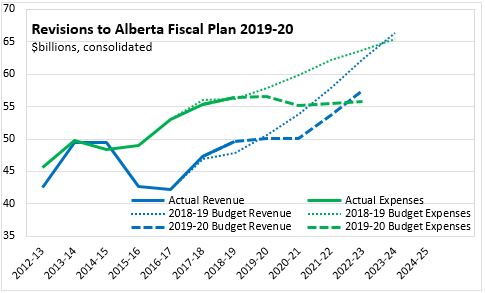

Alberta's revenues for 2018-19 were stronger than estimated at the time of the 2018-19 Budget while expenditures were closer to expectations. In the near term, the new government expects slower revenue growth after implementing reductions in the corporate tax rate, but the pace of growth returns in 2021-22. The plan for expenditures (before any contingency or the provision for ending crude-by-rail shipments) is considerably lower for 2019-20 and 2020-21 with little growth anticipated by 2022-23. Between 2018-19 and 2022-23, Alberta's revenues are projected to grow by 3.8 per cent per year (CAGR) while expenditures are projected to decline by 0.3 per cent per year.

With slower growth in revenues offset by declining expenditures, the Alberta government's plan anticipates a return to balance one year sooner than outlined in the 2018-19 fiscal plan. The Alberta government's deficit (including contingency and crude-by-rail cancellation provision) is now projected to fall to $5.9 billion in 2020-21 and $2.6 billion in 2021-22. By 2022-23, the Alberta government expects to post a surplus of $584 million.

In 2019-20, Alberta's deficit amounts to 2.4 per cent of provincial nominal GDP (including contingencies and provisions for ending crude-by-rail). The deficit is projected to fall to 1.6 per cent of GDP in 2020-21 and to 0.7 per cent of GDP in 2021-22. Alberta government expenditures are projected to decline from 16.2 per cent of GDP in 2018-19 to 13.5 per cent of GDP in 2022-23. Over the same time, revenues are projected to fall from 14.2 per cent of GDP in 2018-19 down to 13.5 per cent of GDP in 2020-21 before rising back up to 13.9 per cent of GDP in 2022-23.

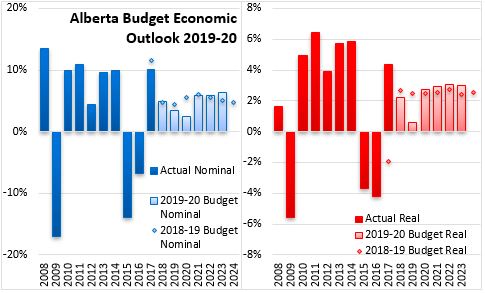

Alberta's economy continues to recover from the severe recession in 2015 and 2016, though growth is now projected to be slower (real GDP growth of 0.6 per cent) in 2019 because of production limits. The Alberta economic outlook expects new oil production and investment to spur growth in 2020 and beyond, buoyed by lower corporate tax rates and easing constraints on pipeline capacity. Real GDP growth is projected to rise to 2.7 per cent in 2020, 2.9 per cent in 2021 and 3.0 per cent in the next two years. However the Alberta Budget does not anticipate oil prices rising above $63 (USD/bbl WTI) and oil investments are not anticipated to recover to the levels observed in 2010-2014.

Key Measures and Initiatives

The new Alberta government, informed by the advice of the MacKinnon Panel, focuses on reducing provincial expenditures to levels that are more comparable to peers in larger provinces such as Ontario and British Columbia. The government has prioritized competitiveness as well as tax and exenditure reductions.

Key measures in the 2019-20 Alberta Budget:

- Lowering corporate income tax rates from 12 per cent to 8 per cent

- Supporting a broad-based, low-rate tax regime by eliminating targeted tax credits: Alberta Investor Tax Credit, Community Economic Development Corporation Tax Credit, Capital Investment Tax Credit, Interactive Digital Media Tax Credit, Scientific Research and Experimental Development Tax Credit

- Reducing red tape with an aim of saving taxpayers $140 million/year

- Creating $1 billion Alberta Indigenous Opportunities Corporation

- Along with other restraint aimed at bringing expenditures in line with other provinces, Alberta's "...budget does not contain any provision for wage increases."

- In the coming years, the Alberta government expects to reduce the size of the public service, primarily through attrition and hiring restraint.

Alberta Budget 2019-20

<--- Return to Archive