The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 30, 2019BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.0 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted that the resilience of the Canadian economy will be increasingly tested as trade conflicts and uncertainty persist. The Bank will be monitoring if the global slowdown spreads beyond manufacturing and investment and how Canada's consumer spending and housing activity perform.

Global Growth

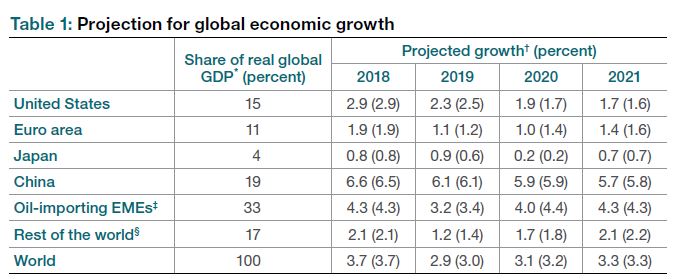

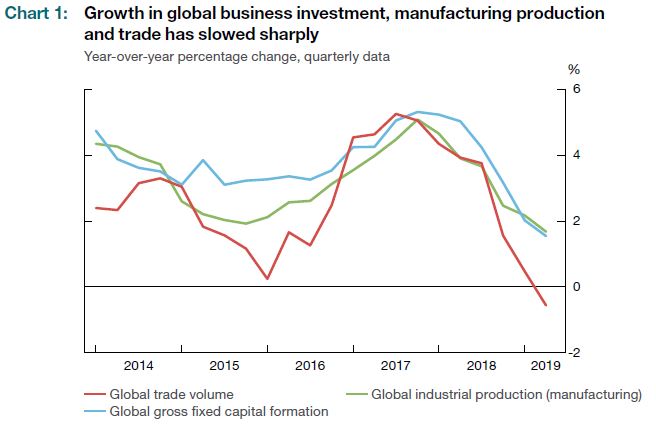

Trade conflicts are weakening the world economy and global growth in 2019 is projected to be at it's weakest pace since 2007-09 global financial crisis. There has been a slowdown in manufacturing sector and business investment and global trade is contracting. The United States and China have announced additional trade actions, although negotiations have shown some signs of progress. Tariff increases and retaliatory measures have raised costs, disrupted global supply chains, reduced business confidence, and created uncertainty about future trade relationships. The Bank of Canada estimates that trade measures and uncertainty would remove 1.3 percent from global GDP by the end of 2021 in absence of any offsetting actions. The Bank of Canada projects global GDP to be lower at 2.9 per cent in 2019, 3.1 per cent in 2020 and 3.3 per cent in 2021.

Chart Source: Bank of Canada

Weaker growth prospects and soft inflation expectations has led over 35 central banks to ease monetary policy since the summer. Markets expect further monetary policy easing will occur in 2019. The trade war between the United States and China has increased demand for high-quality assets while the search for yield in global low interest rate environment continues. Demand for US government bonds have increased, but yields have risen from recent lows. The US dollar has seen ongoing strength and the Canadian dollar has traded in a narrow range against the US dollar while appreciating against other currencies.

Chart Source: Bank of Canada

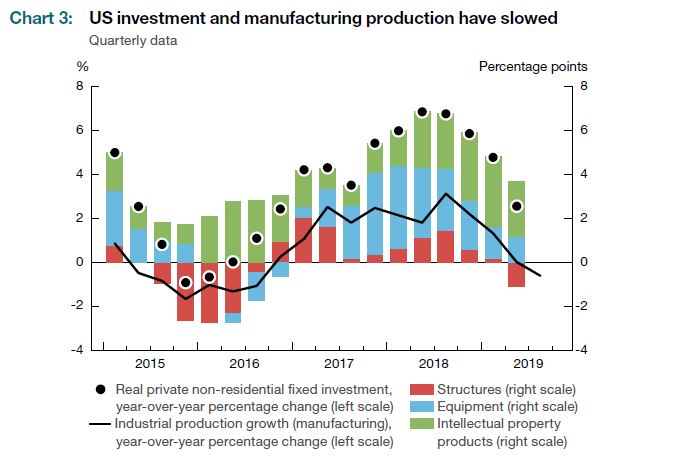

The US economy has been growing at moderate pace with support from consumer spending, strong labour market and wage gains. The US housing market is showing signs of improving after weakness over the past few years. Trade protectionism has increased business uncertainty. Core personal consumption expenditure price inflation was up to 1.8 per cent in August. New tariff increases on Chinese imports will increasingly target consumer products and are expected to have greater impact on consumer prices going forward. The Bank of Canada's outlook for US growth is little changed as US growth moderates toward potential growth over the next two years.

Chart Source: Bank of Canada

Euro Area growth is expected to be weaker as global trade and geopolitical risks weigh on business confidence and exports. Manufacturing output declines, particularly in the auto sector, have increased the risk of recession in Germany. Household spending and employment data outside manufacturing or export dependent regions has been resilient. Inflation remains tepid and European Central Bank has cut the deposit facility rate and restarted quantitative easing.

China's economy is facing multiple headwinds. Financial vulnerabilities from high debt levels remain and efforts to address the problem has dampened growth. The US and China trade war has exacerbated the slowdown. Industrial production and private fixed investment has slowed over the past year. Imports of manufactured products and non-petroleum raw materials have contracted.

Lower global demand concerns have led to lower commodity prices since July. Oil prices have declined despite temporary disruption and geopolitical tensions in the Middle East. Uncertainty around future oil prices remains elevated as prices could fall if OPEC members relax production cuts or increase due to a renewed risks premium.

Canada Growth Outlook

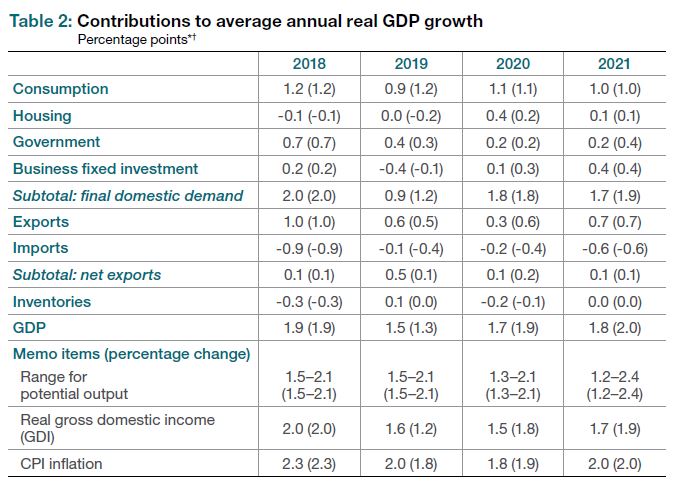

Growth in first half of 2019 was strong, but the Bank of Canada expects it to be pulled down during second half of 2019 with outright declines in exports and business investment. For 2020 and 2021, Canada's economy is anticipated to grow near potential. Consumer spending will maintain a steady pace while housing activity continues to recover. Investment and export growth will be moderate. The Bank of Canada projections for GDP growth were raised in 2019 to 1.5 per cent and lowered by 0.2 percentage points in 2020 and 2021.

Chart Source: Bank of Canada

The Bank of Canada estimates that the economy was operating with an output gap between -1 and 0 per cent in Q3. Evidence of excess capacity persist in energy-producing regions, but other regions show labour shortages. National measures of labour market conditions continue to be healthy with unemployment rates near historic lows and participation rate among prime-age workers near historical highs. Job creation has been robust in the service sector and for full-time jobs. Rising wages have occurred in both energy and non-energy regions with the Bank of Canada's preferred wage measure growing 3 per cent in Q3 after 2.3 per cent in first half of 2019.

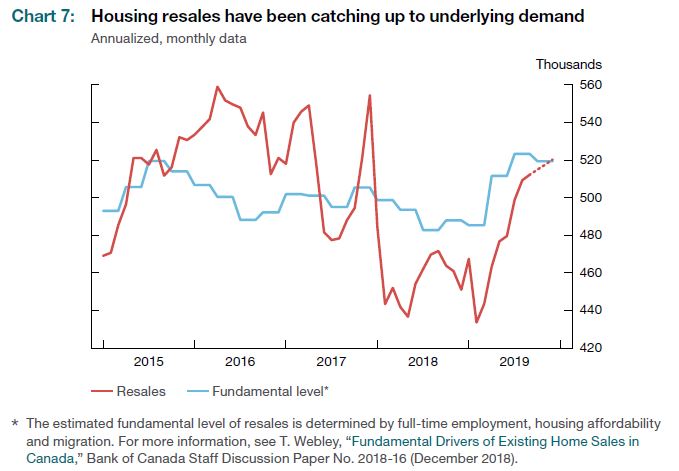

Over the projection horizon, household spending will be supported by growth in disposable income, lower mortgage rates and larger working-age populations. However, given high levels of debt, households are expected to be cautious in spending decisions. Housing activity is anticipated to continue to recover toward levels consistent with solid income, low borrowing costs and a growing population. Residential investment is projected to increase 5 per cent in 2020 before slowing to 1 per cent in 2021. Housing markets continue to reflect regional economic conditions with Quebec and Ontario being main drivers of growth.

Business investment and exports are expected to resume expansion in 2020 after slowing during second half of 2019. Growth in these sectors reflect both soft growth in foreign demand and restraint due to trade policy uncertainty. The oil and gas sector is supported by improved transportation capacity and rebound in production. Non-energy commodity exports are projected to remain subdued. Service and consumer goods excluding motor vehicles should remain strong.

Business investment is supported in the service sector and with the digitalization of economy. Recent announcements suggest Canada is attracting investments by foreign firms in knowledge-intensive fields and business services. The LNG Canada project will boost spending, but exporters overall have modest investment intentions.

Chart Source: Bank of Canada

Inflation Outlook

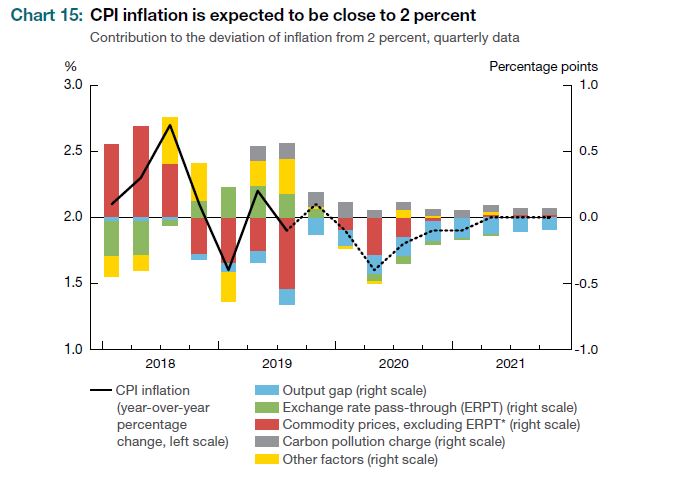

CPI inflation is forecasted to be around 2 per cent over the projection horizon. Economic slack is expected to be a source of modest downward pressure that is largely offset by the federal carbon pollution charge. In 2020, inflation is expected to decrease temporarily due to drag from energy prices.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is December 4, 2019. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on January 22, 2020.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive