The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 22, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 1.75 per cent. The Bank Rate is correspondingly 2.0 per cent and the deposit rate is 1.50 per cent. The Bank of Canada noted it will be watching closely to see if the recent slowdown in growth is more persistent than forecasted, paying particular attention to consumer spending, housing market and business investment.

Global Growth

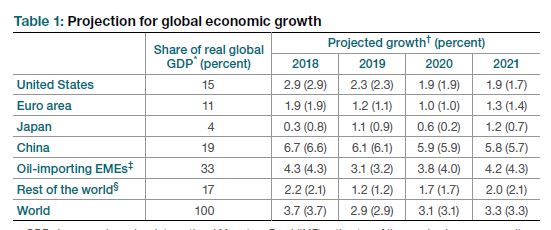

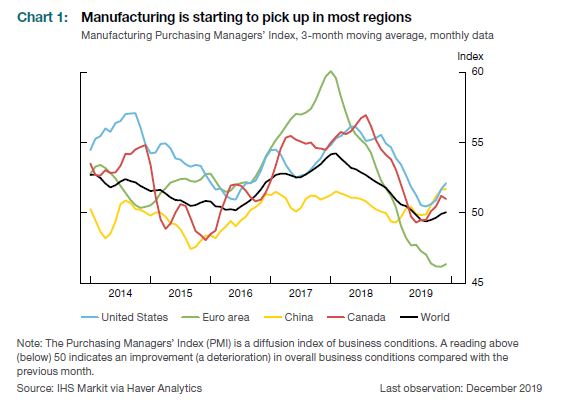

After a period of slowing, the global economy is showing signs of stabilizing and global growth is projected to gradually strengthen . Manufacturing activity is starting to pick up in many regions and unemployment rates continue to be near historic lows in many advanced economies. The phase one US-China trade agreement and pending CUSMA ratification are positive trade developments. The drag on global growth from trade uncertainty is expected to gradually dissipate but leave global GDP lower by 1.2 per cent by the end of 2021. Market sentiment has improved reflecting a perception of diminished risk with equity prices rising and credit spreads narrowing. Widespread central bank easing has occurred but expectations are for more moderate policy stimulus going forward. The Bank of Canada projections of global GDP are unchanged at 2.9 per cent in 2019, 3.1 per cent in 2020 and 3.3 per cent in 2021.

Chart Source: Bank of Canada

Chart Source: Bank of Canada

The US economy continued to grow faster than potential in 2019 but at a pace slower than 2018 as a drag was felt from trade tensions and the shrinking stimulus effect from 2018 tax cuts. Business investment, trade and industrial production were impacted by the trade conflict with China and lower aircraft production. Manufacturing was held back by weak production of motor vehicles. The labour market remains solid and spending on consumer durables goods and housing activity have picked up with lower borrowing costs. The Bank of Canada projections are for US growth to slow and be in line with potential for the next two years as US fiscal policy becomes broadly neutral. US business investment and industrial production, which are important sources of Canada export demand, are projected to pick up,

Chart Source: Bank of Canada

Euro area growth has remained subdued with headwinds from Brexit, trade policy uncertainty, and auto sector regulatory changes weighing on the economy. Positive signs have been seen with the stabilization of the previous declines in business sentiment and the manufacturing sector. The euro area labour market remains solid and growth is projected to pick up later in 2020 and 2021 with support from foreign demand and previous monetary easing.

China's growth in 2019 was constrained by trade tensions and regulatory efforts to contain financial system vulnerabilities. Growth in China will continue to moderate in line with an expected easing in itspotential growth rate and still need efforts to handle financial system risks.

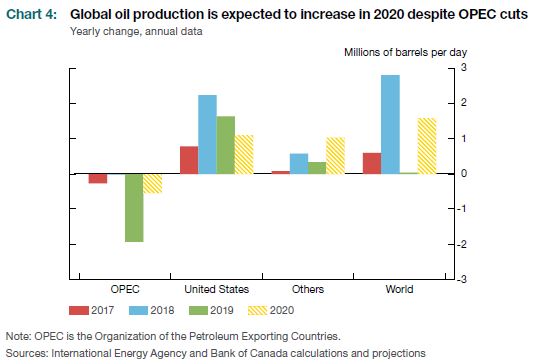

Oil prices are around US$5 higher than the Bank of Canada assumed in October report in part due to geopolitical tensions and further oil production cuts by OPEC. Global oil output is expected to increase in 2020 with an increase in US production. The spread between WTI and WCS widened in recent months due to temporary disruption in oil transportation. Going forward, oil production is expected to increase with transportation capacity.

Canada Growth Outlook

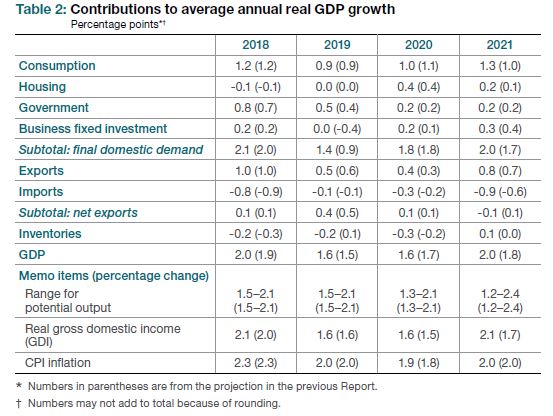

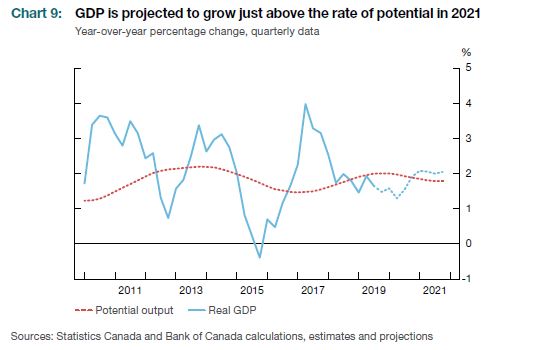

Economic growth in Canada slowed at the end of 2019 and this is likely to continue in Q1 2020. Afterward, economic activity will pick up and remain just above potential. The recent slowdown has been related to both global and domestic factors. Global trade conflicts have weighted on business investment and exports. Weaker demand may have spilled over to soften household spending. The Bank of Canada projections for GDP growth were raised in 2019 to 1.6 per cent, lowered to 1.6 per cent in 2020 and lifted to 2.0 per cent 2021.

Chart Source: Bank of Canada

The Bank of Canada estimates that the economy was operating with an output gap between -1.25 and -0.25 per cent in Q4 2019. Excess capacity remains concentrated in energy-producing regions; elsewhere indicators of capacity pressure and labour shortages suggest little slack. The labour market continues to be healthy - job vacancies remain elevated and the unemployment rate is close to historic lows. Of concern is a recent decline in the average number of hours worked in manufacturing and service sector and in regions with little slack, but this maybe due to tight conditions drawing in more young and older workers who typically work fewer hours. Wage growth was firm in 2019 with a broad-based pickup across regions.

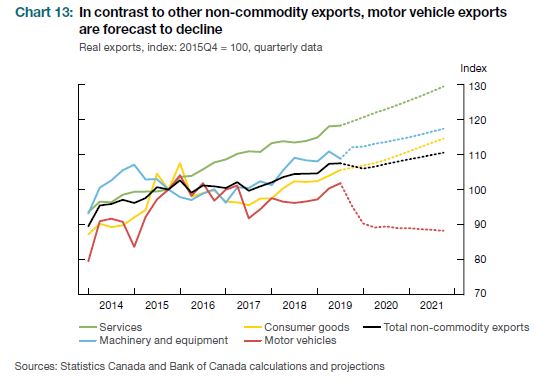

The Bank of Canada anticipates growth to pick up through 2020 and be growing just above potential rate in 2021. Household spending is expected to strengthen and grow at moderate pace. Exports will improve with foreign demand, diminished trade policy uncertainty and oil transportation capacity. Business investment outside oil and gas sector is expected to grow at a moderate pace with positive intentions around digitalization efforts, LNG Canada and Trans Mountain projects. Government spending is expected to slow in line with fiscal measures announced in provincial budgets. Housing activity will continue its recovery in 2020 with new construction driving the sector

Chart Source: Bank of Canada

Chart Source: Bank of Canada

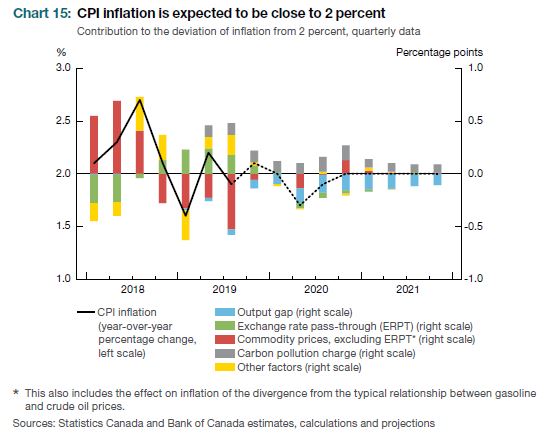

Inflation Outlook

The Bank of Canada forecasts CPI inflation to be around the 2 per cent inflation target over the projections horizon with small fluctuations in 2020 from energy prices. The Federal carbon pollution charge impact is roughly offset by modest downward pressure from economic slack.

Chart Source: Bank of Canada

The next scheduled date for announcing the overnight rate target is March 4, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on April 15, 2020.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive