The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

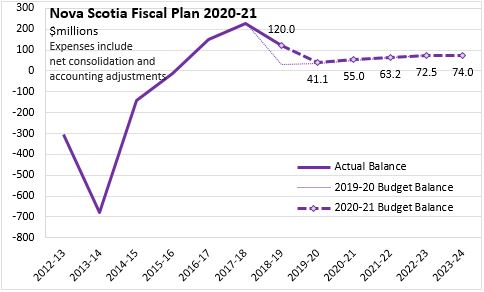

February 25, 2020NOVA SCOTIA BUDGET 2020-21 Nova Scotia has tabled its 2020-21 Budget, including a $55 million surplus on revenues of $11.597 billion and expenditures of $11.616 billion along with consolidation adjustments of 73.9 million. This follows from a forecast surplus of $41.1 million for the 2019-20 fiscal year. Surpluses are projected for each of the next three fiscal years, rising to $74 million by 2023-24.

Compared with last year's fiscal plan, Nova Scotia has experienced an increase in revenues from both Federal and Provincial sources. There have been increases in expenditures alongside these revenue increases, keeping the value of surpluses consistent with last year's fiscal plan.

Nova Scotia's revised surplus projections are consistent with the fiscal plan from the previous budget.

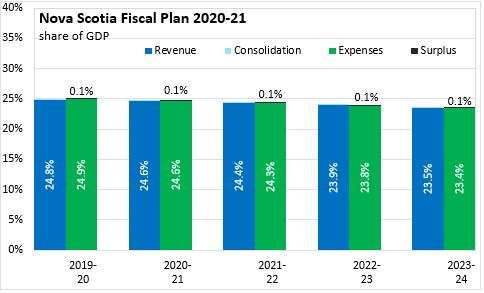

Nova Scotia's revenues and expenditures amounted to just under 25 per cent of provincial GDP in 2019-20. With revenue and expenditure rising at a pace slower than growth in nominal GDP, the footprint of government in the economy is projected to decline to 24.6 per cent of GDP in 2020-21. By 2023-24, Provincial government revenues are projected to fall to 23.5 per cent of GDP while expenditures fall to 23.4 per cent of GDP. Current and projected surpluses all amount to about 0.1 per cent of GDP. Nova Scotia's debt to GDP ratio is forecast at 33 per cent in 2019-20, rising to 33.3 per cent in 2020-21 and 34.5 per cent by 2023-24 because of higher capital spending.

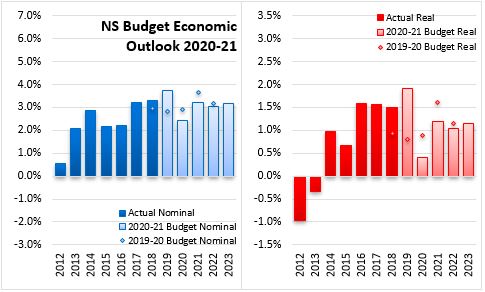

Rising population and productivity growth helped stabilize Nova Scotia's real GDP growth at 1.5-1.6 per cent over 2016-2018. Nova Scotia's growth for 2019 is estimated at 1.9 per cent - the strongest pace of growth since 2010. The faster pace of GDP growth in 2019 is based on the largest increases in employment (+2.2 per cent) and labour force (+1.9 per cent) since 2004, the lowest unemployment rate (7.2 per cent) since the early 1970s, as well as strong gains in wages, exports and construction. Nova Scotia's near term economic outlook has been reduced from previous projections in light of the closure of the Northern Pulp mill. Real GDP growth is projected to slow to 0.4 per cent in 2020 before accelerating to 1.2 per cent in 2021. Nominal GDP growth is forecast to slow to 2.4 per cent in 2020, before rising to 3.2 per cent in 2021. Medium-term recovery in growth assumes continued population and productivity gains, major project activities at the Halifax shipyard and large provincial infrastructure projects.

Key Measures and Initiatives

Nova Scotia's 2020-21 Budget focuses on priorities in four areas: improving the lives of Nova Scotians, building on economic success, investing in infrastructure and confidence in a brighter future.

Improving the lives of Nova Scotians

- Increasing the low income threshold for the Nova Scotia Child Benefit (up to $34,000) and fully funding the standard household rate for income assistance

- Expanding support for youth with complex needs as well as programming for children and families at risk

- Residential placements and supports to protect sexually exploited youth

- Increasing programs for adults and children with disabilities, including transitioning residents out of rehabilitation care facilities into community-based settings, supporting people with disabilities who live at home with family and residential placements for children with complex needs

- Supporting the Accessibility Directorate towards an accessible Nova Scotia by 2030

- Additional Sherriff Services for courtroom security and increased support for First Nations Policing

- A comprehensive provincial approach to combatting human trafficking

- A new library funding model and Library Development Fund

- Doubling the Emergency Service Providers Fund

- Increasing funding for the second year of the Nova Scotia Action Plan for Affordable Housing and doubling the Down Payment Assistance Program

- Starting at Integrated Action Plan to Address Homelessness

- Sustaining the Affordable Renters Program

- Funding for the new Doctor's Master Agreement to improve recruitment and retention of medical professionals as well as development of collaborative care teams

- Additional medical/residency placements and nursing seats at Universities

- Funding for implementation of the Human Organ Tissue Donation Act

- Enhanced long term care funding to implement the findings of the Expert Panel on Long Term Care, support clients with complex needs and convert under-utilized residential care beds to long-term care beds.

- Additional funding for medications

- Supporting a more active, inclusive and healthy population through Let's Get Moving Nova Scotia

- Increasing support for the Red Cross Health Equipment Loan Program

- Sustaining and expanding mental health services and supports as well as increasing funding for Nova Scotia Health Authority and IWK operating budgets

- Introducing a tax on vaping products and increasing tobacco tax rates

- Rolling out 48 additional pre-primary communities in 2020-21 along with bus service for eligible pre-primary students

Building on Our Economic Success

- Reducing the corporate tax rate by 2 per cent to 14 per cent and the small business tax rate by 0.5 per cent to 2.5 per cent.

- Raising funding for the Nova Scotia Film and Television Production Incentive Fund

- Extending Digital Animation and Digital Media tax credits to December 31, 2025

- Starting a new Forestry Innovation Rebate program and increasing investments in ecological forestry

- Continuing the operating grant for the Yarmouth Ferry

- Supporting the Office of Immigration for extension of the Atlantic Immigration Pilot

Investing in Modern Infrastructure

- Investing in large hospital redevelopments in Halifax and Cape Breton as well as in other communities around the province

- Construction/renovation of 16 schools and purchase of 30 P3 schools

- Continued investment in highways/bridges, including highway twinning projects

- Ongoing construction activities for the Halifax waterfront Arts district and the Marconi Campus of the Nova Scotia Community College in Sydney.

Confidence in a Brighter Future

- Continued implementation of the recommendations of the Commission on Inclusive Education

- Increasing university operating grants and student loan forgiveness

- Increasing the Home Warming program at Efficiency Nova Scotia

- Investing in green initiatives as part of the Investing in Canada Infrastructure Program

- Using the Green Fund to support the cap-and-trade program as well as adaptation and planning initiatives

Nova Scotia Budget 2020-21

<--- Return to Archive