The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 27, 2020CAPITAL AND REPAIR EXPENDITURES SURVEY, 2019 (PRELIMINARY) AND 2020 (INTENTIONS) Statistics Canada has released the results of its annual survey of capital expenditures for non-residential construction and machinery and equipment. The preliminary estimate for 2019 and intentions for 2020 are based on a sample survey of 25,000 private and public organizations conducted over September 2019 to January 2020.

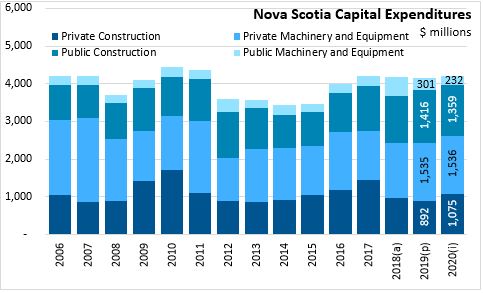

Capital expenditures include both non-residential capital construction and machinery and equipment spending. After increasing 5.4 per cent in 2017 and declining 0.4 per cent in 2018, capital expenditures declined 0.9 per cent in 2019 in Nova Scotia. The decline in 2019 was due to a decrease in public machinery and equipment(-39.2%, -$194.1 million) and private construction (-6.9%, -65.9 million). Increases in private machinery and equipment (+4.1%,+$61.0 million) and public construction(+12.9%, +$161.9 million) offset most of the decline so that total capital expenditures fell $37 million to $4,144 million in 2019. The decline in 2019 was less than the intentions estimate for 2019 (-5.8%, -$240 million).

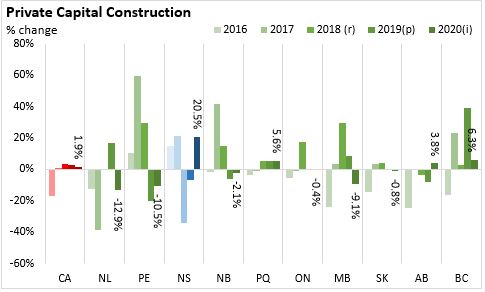

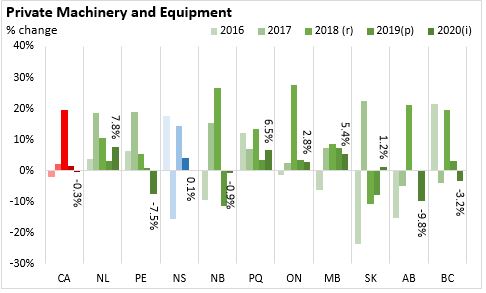

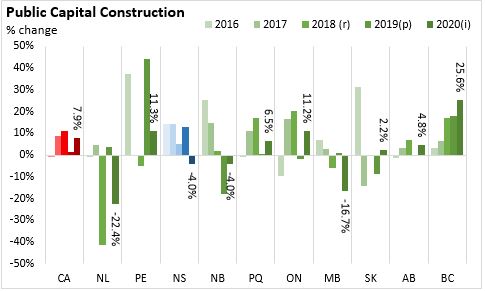

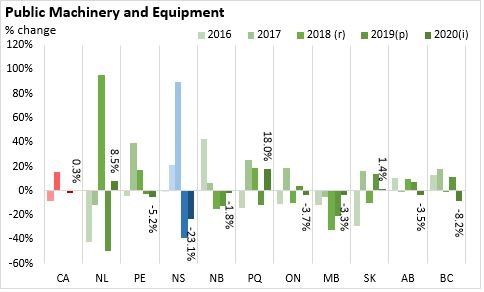

Capital expenditure intentions for 2020 are for an increase of 1.4 per cent or by $58.4 million to $4,202 million. Private construction (+20.5%, +$183.3 million) and private machinery and equipment spending (+0.1%, +$1.2 million) are intended to increase. After five years of increases, Public capital construction is expected to decline 4.0 per cent or $56.6 million. Intentions for public machinery and equipment (-23.1%, -$69.4 million) are a return to historical levels after higher expenditures in the past 2 years.

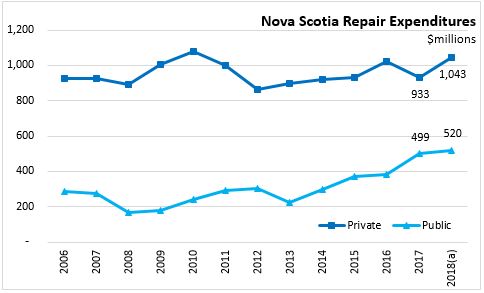

Repair expenditures increased 9.1 per cent in 2018, a pick up from the 1.9 per cent in 2017. Repair expenditures increased structures (+29.8%) and declined machinery and equipment (-6.5%). Repair expenditures increased for both private (11.7%) and public (+4.2%) in 2018.

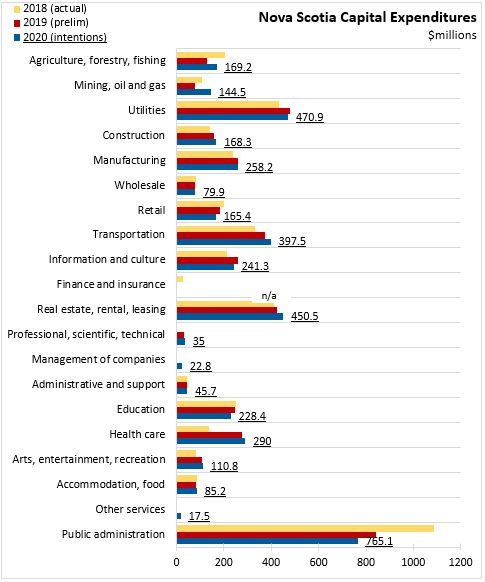

On an industry basis, the $37 million decrease in capital expenditures occurring in 2019 was due to declines in agriculture, forestry, fishing and hunting (-$78 million),mining and oil and gas extraction (-$28 million), wholesale (-$4 million), retail trade (-$14 million), education services (-$6 million), accommodation and food services (-$4 million) and public administration (-$246 million). Increase in capital expenditures occurred with utilities (+$46 million), construction (+$16 milling), manufacturing(+$21 million) transportation/warehousing (+$42 million), information/cultural (+$46 million), real estate/rental (+$11 million), administration services (+$1 million), health care (+$139 million) and arts, entertainment and recreation (+$27 million)

For 2020, total capital expenditures are expected to increase by 1.4 per cent or $59 million. Capital intentions for 2019 are higher for agriculture, forestry, fishing (+$43 million), mining (+$66 million), construction (+$11 million), transportation/warehousing (+$26 million), real estate/rental (+$27 million), health care (+$15 million) along with small increases in professional services, administrative services, arts and recreation, and accommodation and food services. Intentions for 2020 are lower in utilities (-$9 million), manufacturing (-$2 million), retail trade (-$20 million), information/cultural (-$17 million), education services (-$18 million) and public administration (-$78 million).

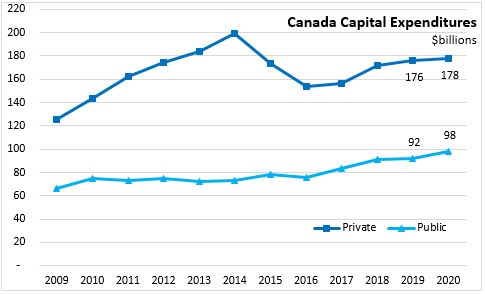

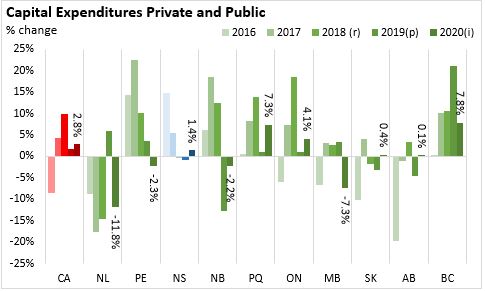

Canada is expected to see an increase of 2.8 per cent in capital expenditures in 2020 following on increases of 1.7 per cent in 2019 and 9.8 per cent in 2018. Growth is expected in capital construction with a 4.5 per cent increase while machinery and equipment spending is expected to edge down 0.2 per cent. British Columbia, Ontario, and Quebec are expected to led growth while Newfoundland and Labrador will decline for the fourth time in the past five years. Manitoba is anticipated to have a 7.3 per cent decline and only small changes are expected for Alberta (+0.1%) and Saskatchewan(+0.4%). Prince Edward Island (-2.3%) and New Brunswick (-2.2%) are expected to have lower capital spending in 2020.

Both public and private capital expenditure are expected to increase in 2020. Transportation and warehousing sector growth of 25.7 per cent is anticipated from increase in transit and ground passenger transportation, air transportation and support activities. Utilities spending anticipated to rise with major water, sewage and other systems subsector projects in British Columbia and Ontario. Public administration spending is expected to grow 2.3 per cent due to spending at local level while federal government public administration spending is anticipated to decline $1.5 billion to $4.0 billion. Mining, quarrying and oil and gas capital outlays are anticipated to decrease 1.4 per cent (-$636 million) to $43.7 billion after declines of $6.2 billion in the previous two years. Lower metal ore mining (-$1.1 billion) offsetting anticipated increase in oil and gas extraction subsector. Manufacturing capital spending is anticipated for a 1.2 per cent increase in 2020.

Non-residential capital and repair expenditures, 2018 (revised), 2019 (preliminary) and 2020 (intentions)

<--- Return to Archive