The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

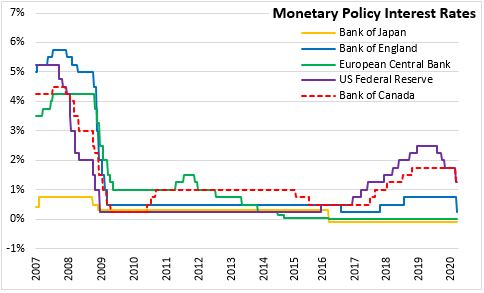

March 12, 2020EUROPEAN CENTRAL BANK MONETARY POLICY Following its regular meeting, the Governing Council of the European Central Bank announced that interest rates would remain unchanged (0% on main refinancing, 0.25 per cent on the marginal lending facility and -0.5% on deposit facilities). These rates are expected to remain in place or be reduced until the Euro Area's inflation outlook converges to a level near 2 per cent.

The ECB announced several measures to provide liquidity to the financial system in light of the spreading novel coronavirus (COVID-19).

COVID-19 has been a shock to global growth prospects and has contributed to instability in economic activity. Even if temporary, the ECB notes that COVID-19 will have a significant impact on economic activity - slowing production, disrupting supply chains, reducing domestic demand (because of necessary containment measures) and adding to uncertainty in expenditure planning/financing. The impacts of COVID-19 on the Euro Area economy are evolving rapidly and the ECB's economic outlook does not factor in the latest containment measures.

The Governing Council agreed on monetary measures to support households and firms in light of this disruption and uncertainty:

1. Though banks appear to have sufficient liquidity at the moment, the ECB will temporarily conduct additional long term refinancing operations at interest rates equal to the average rate on the deposit facility.

2. The ECB will modify the parameters of its third series of targeted longer term refinancing operations, reducing the interest rate to be equal to the average rate for Eurosystem refinancing operations and increasing the maximum amounts counterparties may borrow. Interest on targeted longer term refinancing can even be as low as the 25 basis points below the average interest rate on the deposit facility for those who exceed their net lending benchmark (until March 2021). The maturity of these operations is extended to three years from their settlement date and earlier repayment will be permitted.

3. The ECB will add an envelope of €120 billion in asset purchases by the end of December, supporting private financing during the period of heightened uncertainty.

European Central Bank: Monetary Policy Decision, Introductory Statement

<--- Return to Archive