The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 20, 2020STUDY: CANADIAN PERSPECTIVES SURVEY SERIES 1: IMPACTS OF COVID-19 ON JOB SECURITY AND PERSONAL FINANCES Statistics Canada has released another examination of COVID-19 on the economy with an examination of effects on job security and personal finance. The data is from 4,600 people in the 10 provinces surveyed over March 29 to April 3.

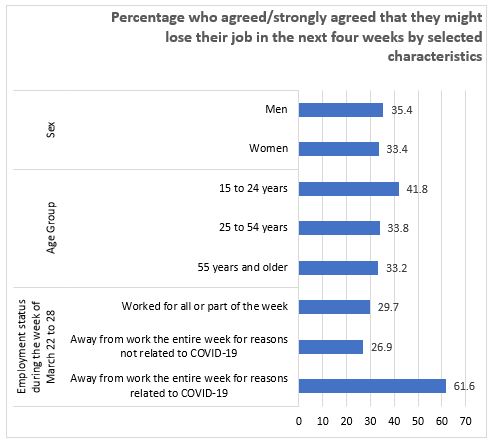

Over one-third of workers (34.5%) are concerned they might lose their job (or self-employment income) in the next 4 weeks. Insecurity about work was notably higher among those that have been absent from work the prior week for reasons related to COVID-19 (61.6%) compared to those who had worked the previous week (29.7%) – week of March 22 to 28. COVID-19 related reasons for not being at work include self-isolation after travel, caring for children who would otherwise be in school, business closures, or temporary lay-off. Among those that were working during the week, there was little difference in job insecurity feeling between those that had switched to working from home compared to those that continued to work outside the home. Almost five million additional people were working from home during March 22 to 28.

Youth (aged 15 to 24) were more likely to feel insecure about continued employment (41.8%) compared to core aged workers (aged 25 to 54) at 33.8 per cent and workers over 55 at 33.2 per cent. There was little difference in job security concerns between men and women.

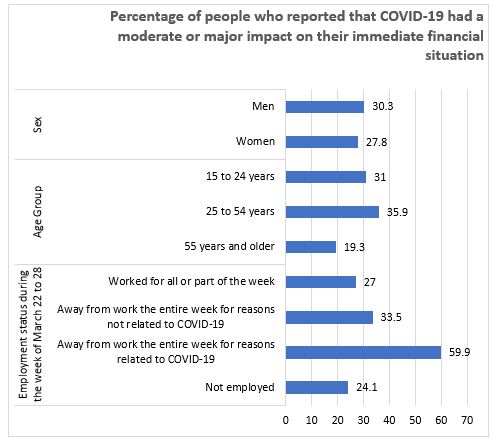

Around 29.0 per cent reported that the COVID-19 situation is having a moderate or major impact on their ability to meet financial obligations such as rent, mortgage, utilities, and groceries. Around a quarter said it was too soon to tell if would have impact and 47.2 per cent reported minor or no impacts.

Persons who had been absent from work were more likely to report moderate or major concerns around meeting financial obligations. Moderate and major impacts were more likely to be felt by those that were insecure about continued employment. Canadians aged 55 and over were least likely (19.3 per cent) to report moderate or major impact on their ability to meet financial obligations or essential needs compared to youth (31.0 per cent) and those aged 25-54 (35.9 per cent).

The share reporting fair or poor mental health (as opposed to good, very good or excellent) was twice as high among those for which the COVID-19 situation is having moderate or major impact on financial obligations or essential needs (25.2%) compared to those for whom there is little to no financial impact (12.8 per cent).

Statistics Canada: Canadian Perspectives Survey Series 1: Impacts of COVID-19 on job security and personal finances, 2020

<--- Return to Archive