The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 29, 2020SURVEY ON BUSINESS CONDITIONS, IMPACT OF COVID-19: MARCH 2020 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has partnered with the Canadian Chamber of Commerce to conduct a Canadian Survey on Business Conditions. Respondents from 12,600 businesses participated. As participation in this questionnaire was voluntary and unrestricted, the results should not be considered representative of the Canadian economy (as would be expected with one of Statistics Canada's probability-based sample designs).

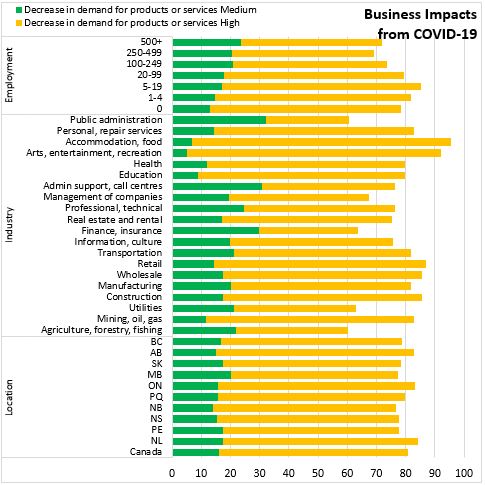

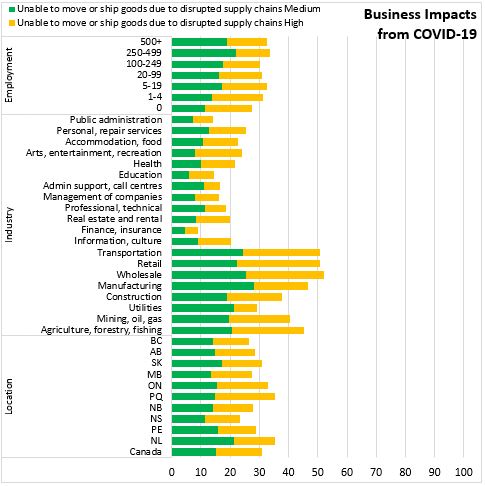

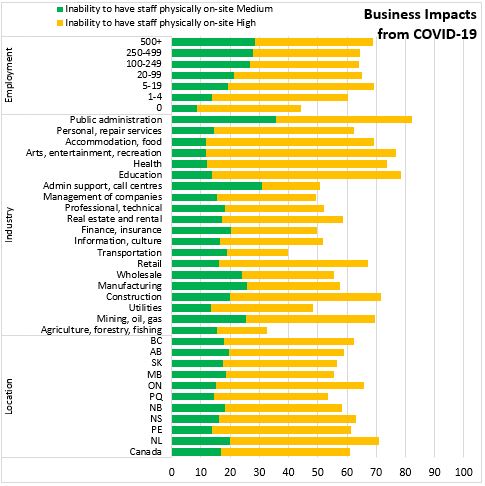

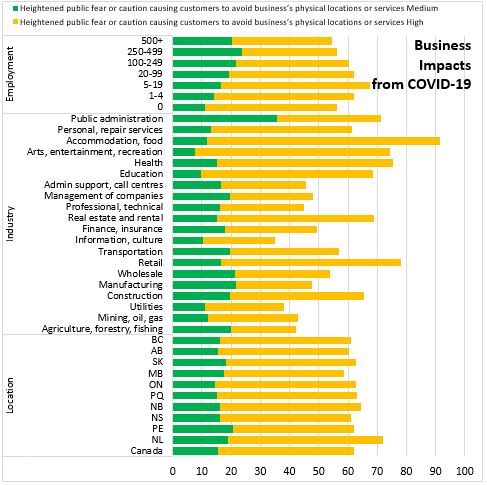

The results reported here are a selection of the impacts found by province, by industry and by size of business (measured by number of employees). The horizontal axis in all charts measures the share of survey respondents reporting each outcome.

Over 80 per cent of respondent businesses reported medium or high impacts because of a decrease in demand for their products or services. Among provinces, these impacts were more prevalent in Newfoundland and Labrador, Ontario and Alberta. Among industries, decreases in demand were most acute in accommodation/food services as well as arts/entertainment/recreation. Smaller businesses were more likely to report medium to high impacts from decreased demand.

Supply chain disruptions have had more of an impact among respondents in Ontario, Quebec and Newfoundland and Labrador as well as those in the construction, manufacturing, wholesale, retail and transportation industries. There have also been disruptions in delivering product reported by respondents from natural resource industries.

The cancellation of services has had greater impacts for respondents in health, education, arts/entertainment/recreation, accommodation/food, personal/repair services and public administration. Smaller businesses report more impacts from cancellation of services.

Impacts from inability to have staff on site have been more pronounced among respondents in Newfoundland and Labrador, Ontario and Nova Scotia. The largest impacts by industry are reported by respondents in retail, education, health, arts/entertainment/recreation, accommodation/food, personal/repair services, public administration as well as agriculture/forestry/fishing and construction.

Business impacts from heightened public fear/avoidance of physical location was higher for respondents in construction, retail, real estate/rentals/leasing, education, health, arts/entertainment/recreation, accommodation/food, personal/repair services and public administration. These impacts were less prevalent in information/culture and resource industries.

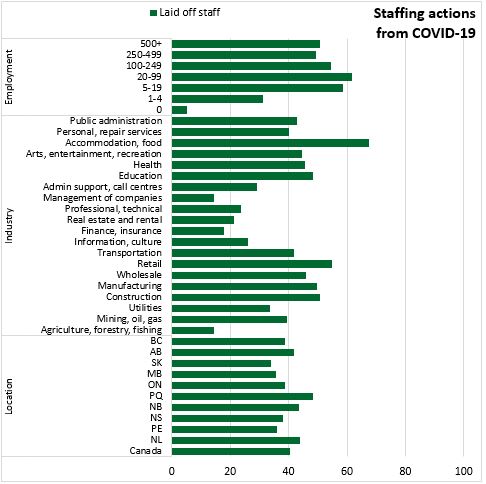

As a result of COVID-19, over 40 per cent of respondent businesses have laid off staff. This was notably higher in accommodation/food and retail industries. A higher share of respondent businesses laid off staff in Newfoundland and Labrador, New Brunswick and Quebec. Layoffs had less of an impact in agriculture/forestry/fishing, professional/technical services, real estate/rentals/leasing, finance/insurance and information/culture.

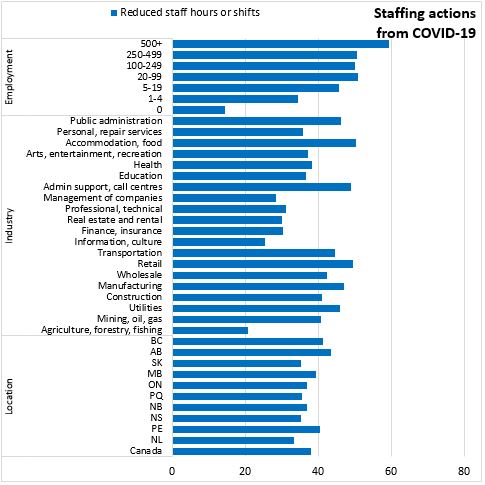

Among respondent businesses, over 38 per cent reported reductions in staff hours/shifts. This response was more common in British Columbia, Prince Edward Island and Alberta. Reduced hours/shifts were more widespread among larger businesses. Reductions in hours/shifts were less common in agriculture/forestry/fishing, information/culture, finance/insurance, real estate/rentals and professional/technical services. Reductions in hours/shifts were more common in accommodation/food, administrative support (including call centres), retail, public administration, manufacturing and utilities.

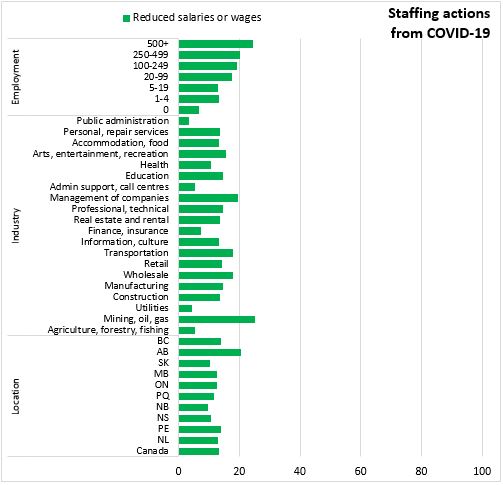

Salary reductions were notably more common in larger company respondents as well as those in the mining/oil/gas industry and those in Alberta.

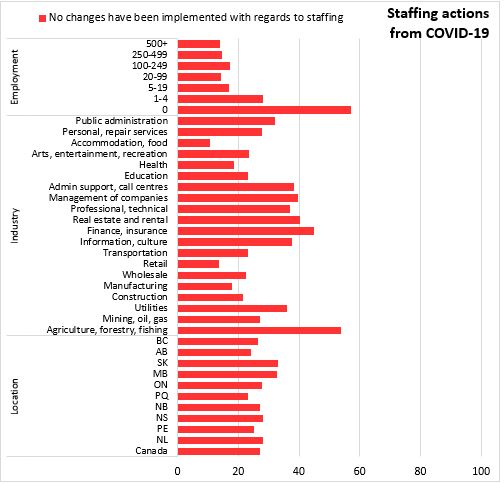

Among respondent businesses, 27 per cent reported no staffing changes. Respondent businesses were most likely to report no staffing changes in agriculture/forestry/fishing, finance/insurance, administrative support (including call centres), professional/technical services, information/culture and real estate/rentals.

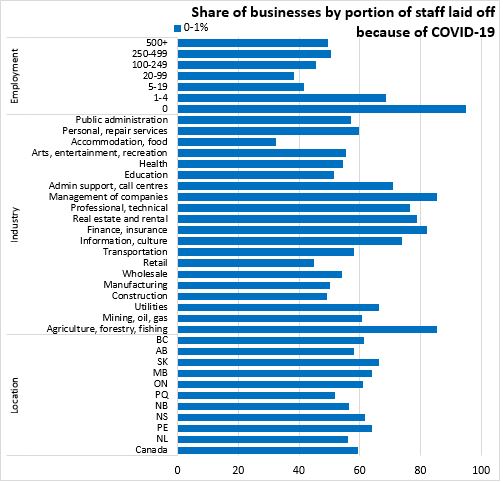

Just under 60 per cent of respondent businesses reported COVID-19 related layoffs between zero and one per cent of employment.

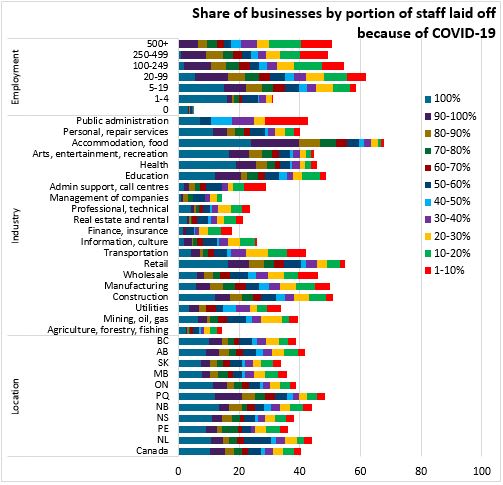

The extent of layoffs resulting from COVID-19 were most severe (>80 per cent of staff laid off) in accommodation/food, retail, education, health, arts/entertainment/recreation, personal/repair services and construction. These severe layoffs (>80 per cent of staff) were more prevalent among respondents in Quebec.

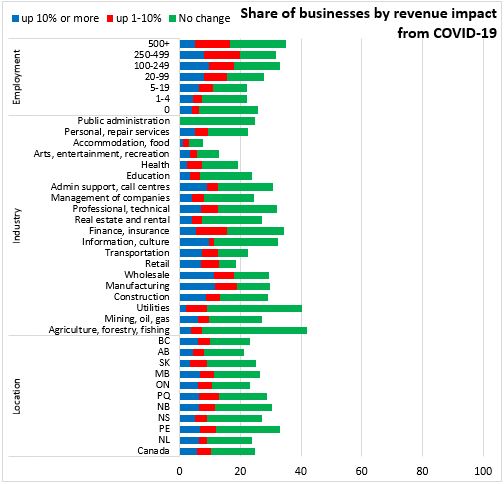

Almost one-quarter (24.8 per cent) of respondent businesses reported no change in revenue or increased revenues. This was a more common response from those in agriculture/forestry/fishing, utilities, finance/insurance, information/culture, professional/technical services and administrative support (including call centres). Respondents from larger businesses were more likely to report unchanged or increasing revenues.

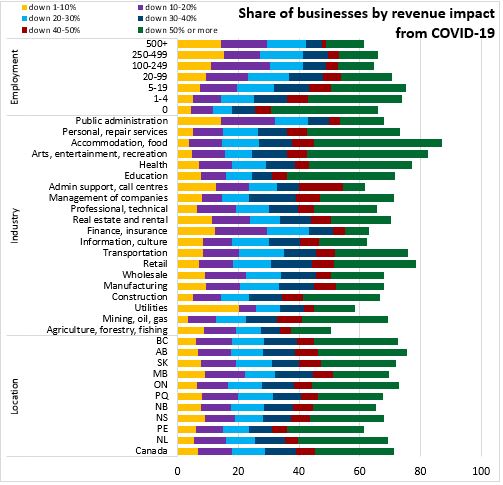

Over three quarters (75.2 per cent) of businesses reported revenue reductions. Those respondents who reported revenue declines in excess of 30 per cent were most common in accommodation/food, arts/entertainment/recreation, retail, health care, education, personal/repair services and mining/oil/gas.

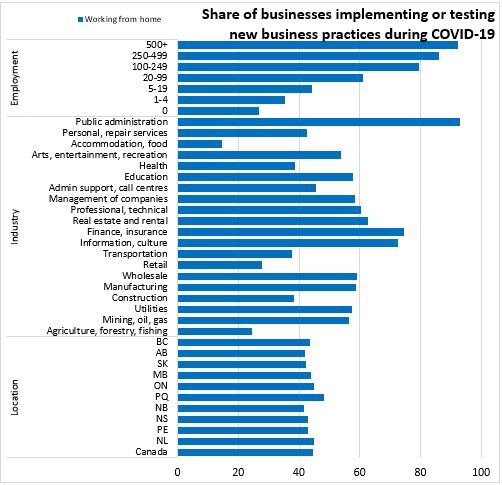

In response to the challenges from COVID-19, many businesses are adopting or testing new practices. Notably, working from home has been tested/implemented by 44.5 per cent of respondent businesses. This is more common among respondents from larger businesses as well as those in public administration, finance/insurance, information/culture, real estate/rentals, professional/technical services, wholesale trade, manufacturing, education, utilities and mining/oil/gas. Working from home was less prevalent among respondents in the Maritimes, Saskatchewan and Alberta.

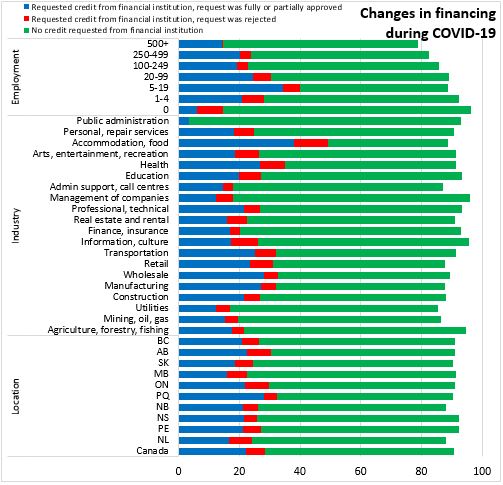

With revenues impaired by COVID-19, many businesses are turning to financial institutions to seek additional credit. Among respondent businesses in Canada, 22.1 per cent reported seeking credit from a financial institution that was fully or partially approved. An additional 6.5 per cent reported that their request for credit from a financial institution was rejected. Most businesses (62.1 per cent) reported no credit request from a financial institution.

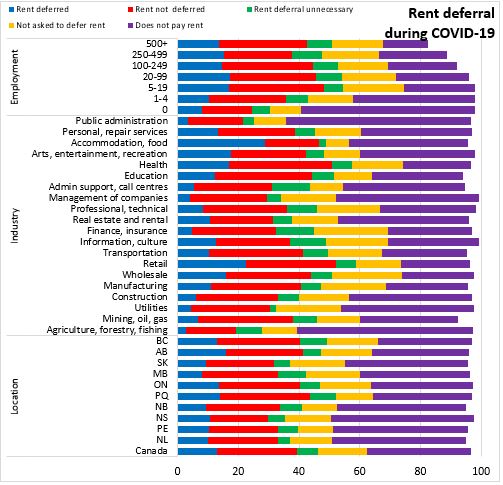

Although many businesses have reduced variable costs as revenues decline, fixed costs such as rent are still due to be paid. More than one third (34.5 per cent) of respondent businesses reported that they do not pay rent. A further 15.9 per cent of respondent businesses have neither asked for nor been offered rent deferral while 7.1 per cent of respondents indicated that a rent deferral was not necessary. Over one quarter (26.2 per cent) of respondent businesses reported that their rent has not been deferred while 13.1 per cent reported that their rent payments have been deferred.

Additional results about the impact of COVID-19 on respondent businesses are available from Statistics Canada.

Source: Statistics Canada. Table 33-10-0229-01 Extent of various impacts experienced by businesses because of COVID-19, by business characteristics

<--- Return to Archive