The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

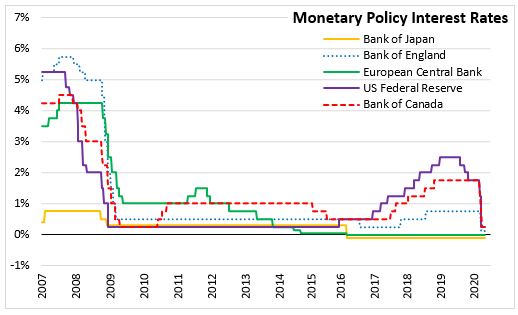

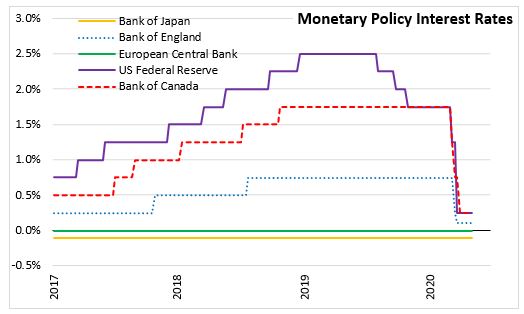

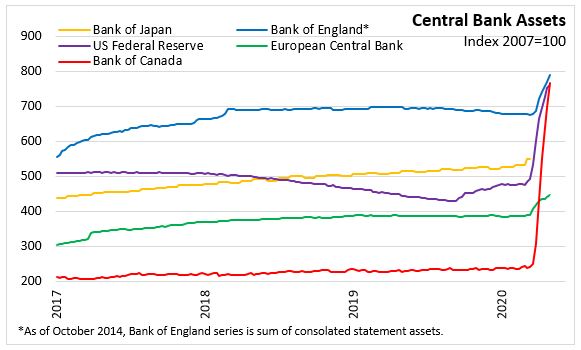

May 07, 2020BANK OF ENGLAND MONETARY POLICY The Bank of England announced today that the bank rate would continue to be 0.1 per cent. The Bank holdings of UK government bonds and sterling non-financial investment-grade corporate bonds will continue with a £200 billion increase to a total of £645 billion. In the current circumstances, and consistent with the Monetary Policy Committee’s (MPC) remit, monetary policy is aimed at supporting businesses and households through the crisis and limiting any lasting damage to the economy. The MPC will continue to monitor the situation closely and stands ready to take further action as necessary to support the economy and ensure a sustained return of inflation to the 2 per cent target.

The outlook for the UK and global economies is unusually uncertain. The MPC has constructed an illustrative economic scenario due to the uncertainties. This scenario is based on a set of stylised assumptions about the pandemic and the responses of governments, households and businesses, and, as usual, on the prevailing levels of asset prices and the market path for interest rates. While the scenario is highly conditional, it helps to illustrate the potential impact of Covid-19 on the economy and the channels through which the impact is felt. The MPC also includes a number of estimates of the sensitivity of the economy to a selection of key variables

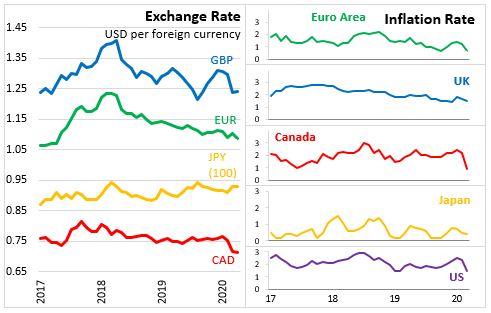

The illustrative scenario incorporates a very sharp fall in UK GDP in 2020 H1 and a substantial increase in unemployment in addition to those workers who are furloughed currently. Given the assumed path for the relaxation of social distancing measures, the fall in GDP should be temporary and activity should pick up relatively rapidly. A degree of precautionary behaviour by households and businesses is assumed to persist, the economy takes some time to recover towards its previous path. CPI inflation is expected to fall further below the 2 per cent target during the second half of this year, largely reflecting the weakness of demand.

In the scenario UK GDP falls by 14 per cent in 2020. Activity picks up materially in the latter part of 2020 and into 2021 after social distancing measures are relaxed. In 2021, GDP growth rises to 15 per cent and in 2022, 3 per cent. Annual household consumption growth follows a similar pattern. On average over the scenario period, consumption growth is weaker than household income growth. Business investment declines 26 per cent in 2020, and rebounds with growth of 19 per cent in 2021 and 12 per cent in 2022. CPI inflation is 0.6 per cent in 2020, 0.5 per cent in 2021 and 2.0 per cent in 2022.

Bank of England: Monetary Policy

<--- Return to Archive