The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 19, 2020MULTIFACTOR PRODUCTIVITY GROWTH, 2018 Statistics Canada has released provincial results for multifactor productivity and related variables for the business sector for 2018.

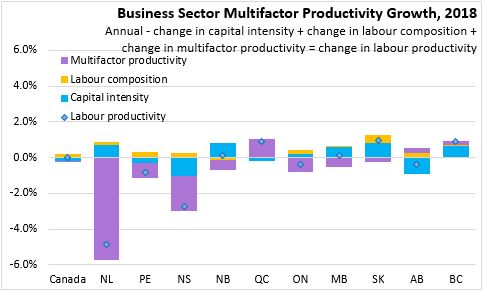

Growth in Real GDP can be decomposed into growth in hours worked and growth in labour productivity. Growth in labour productivity can be further decomposed into growth in capital intensity (ie: the amount of capital used in production), labour composition (ie: skills upgrading) and multifactor productivity. Multifactor productivity is the residual of economic growth that cannot otherwise be accounted for and is meant to reflect intangible contributions to economic growth from unobserved variables such as branding, economies of scale, technology or management practice.

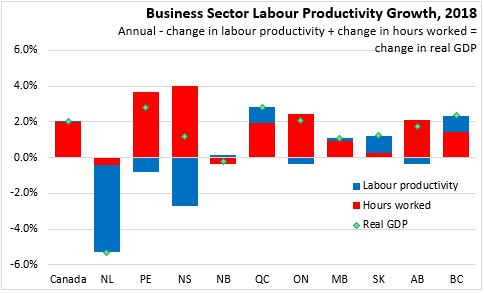

Previously-released data showed that Canadian labour productivity was flat (+0.01 per cent) in 2018 and real GDP growth only came from a rise in hours worked. Productivity growth was concentrated in British Columbia, Quebec and Saskatchewan. There were notable declines in labour productivity in Newfoundland and Labrador, Nova Scotia, Prince Edward Island, Ontario and Alberta.

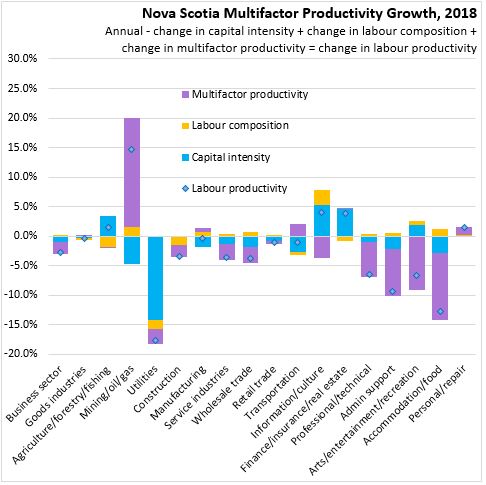

New results released today further decompose the sources of provincial labour productivity growth and decline in 2018. Declining labour productivity in Newfoundland and Labrador and Ontario is attributable largely to reduced declining multifactor productivity. Lower labour productivity in Alberta is the result declining capital intensity. In both Prince Edward Island and Nova Scotia, labour productivity fell because of a combination of lower capital intensity and reduced multifactor productivity. In British Columbia and Saskatchewan, labour productivity gains were largely attributable to rising capital intensity while labour productivity in Quebec increased on improvements to multifactor productivity.

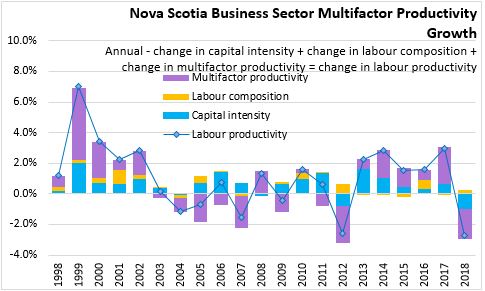

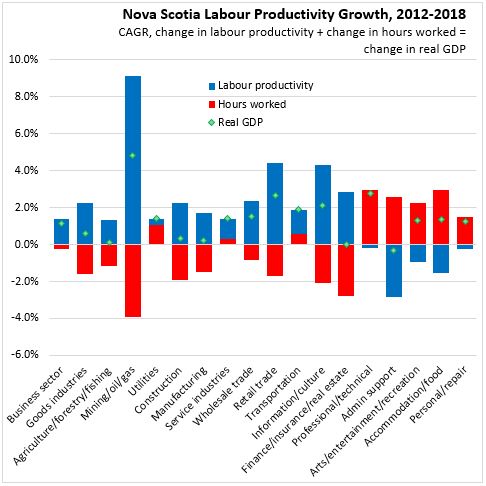

From 2013 to 2017, Nova Scotia's labour productivity rose in each year, posting the strongest growth since the late 1990s. This productivity gain was partially reversed in 2018, though a large rise in the number of hours worked kept Nova Scotia's real GDP growth positive for the year.

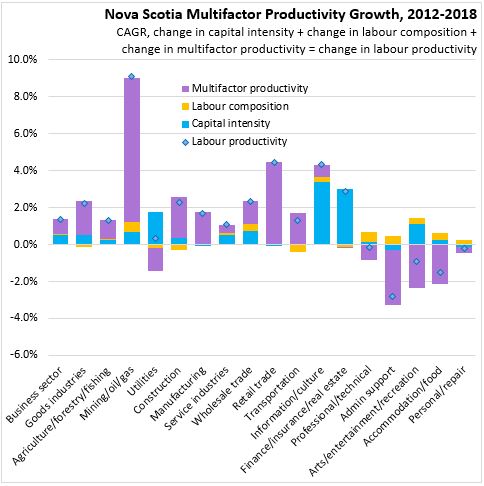

From 2013-2017, Nova Scotia's labour productivity growth was attributable to rising capital intensity and multifactor productivity. Both capital intensity and multifactor productivity of Nova Scotia businesses declined in 2018.

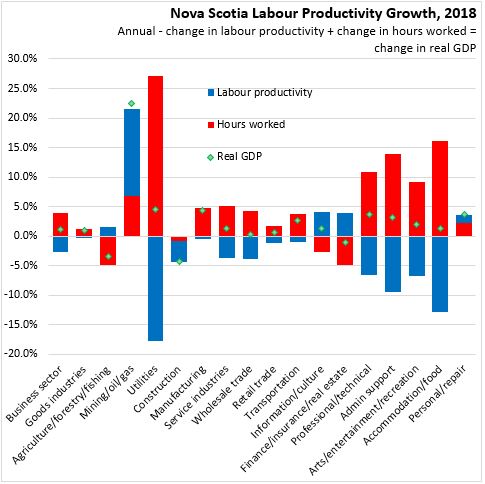

Among industries, Nova Scotia's 2018 labour productivity growth was strongest in mining/oil/gas, agriculture/forestry/fishing, information/culture, personal/repair services and finance/insurance/real estate/leasing. There was a notable decline in labour productivity for utilities, professional/technical services, administrative support (which includes call centres), arts/entertainment/recreation and accommodation/food.

The rise in labour productivity for mining/oil/gas and personal/repair services was attributable to multifactor productivity gains. Increases in capital intensity lifted labour productivity in information/culture and finance/insurance/real estate/leasing. The labour productivity of utilities declined because of a fall in capital intensity while multifactor productivity reduced labour productivity in professional/technical services, administrative support (including call centres), arts/entertainment/recreation and accommodation/food.

Since 2012, hours worked have increased faster in professional/technical, administrative support (including call centres), arts/entertainment/recreation, accommodation/food, personal/repair services, transportation and utilities. Growth in all other industries relied on productivity gains to boost output. Multifactor productivity growth has been negative in all these industries over this period.

Statistics Canada. Table 36-10-0208-01 Multifactor productivity, value-added, capital input and labour input in the aggregate business sector and major sub-sectors, by industry; Table 36-10-0211-01 Multifactor productivity and related variables in the aggregate business sector and major sub-sectors, by industry

<--- Return to Archive