The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

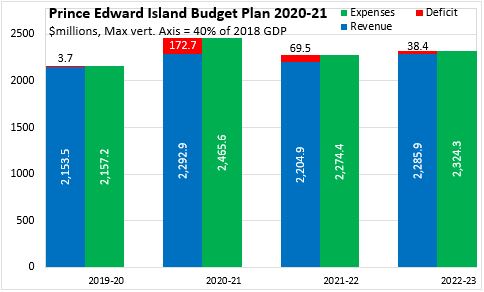

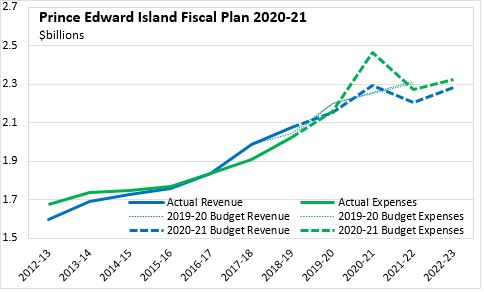

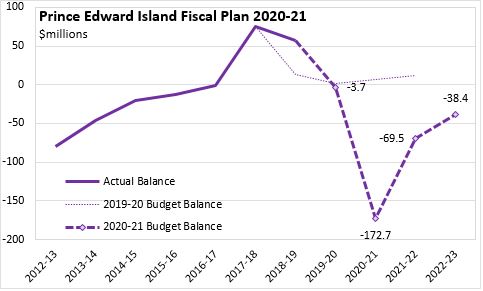

June 18, 2020PRINCE EDWARD ISLAND BUDGET 2020-21 The government of Prince Edward Island has tabled its 2020-21 Operating Budget and supporting documents. Prince Edward Island anticipates a deficit of $172.7 million for 2020-21, followed by deficits of $69.5 million in 2021-22 and $38.4 million in 2022-23. Revenues are projected to rise in 2020-21, followed by a decline in 2022-23. Expenditures are also projected to be higher in 2020-21 before declining in 2021-22.

In its 2020-21 fiscal plan, the government of Prince Edward Island anticipates $35 million higher revenues than were planned in the 2019-20 Budget. This includes the combined effects of stronger than anticipated economic growth in 2019 and the effects of COVID-19 on the province's economic outlook for 2020. The government of Prince Edward Island expects higher revenues in 2020-21 from taxes, investments, and Federal transfers, but lower revenues from fees/services, licenses/permits, government business enterprises and other own-source revenues.

Expenditures have been revised up by $215 million, with immediate expenditures to help mitigate the impact of COVID-19 on workers, families and businesses. The Province has provided over $45 million in direct supports to individuals/families, $40 million in direct support to business, over $100 million in loans and working capital to business (including $50 million for tourism) as well as $14 million for additional health care supports.

Considering the possibility of a second wave of COVID-19 cases or other similar setback, the Budget also includes provision for a contingency allowance.

Prince Edward Island's deficit of $172.7 million is a notable deviation from last year's plan for balanced budgets and the fiscal plan does not anticipate a return to balance in the next three years.

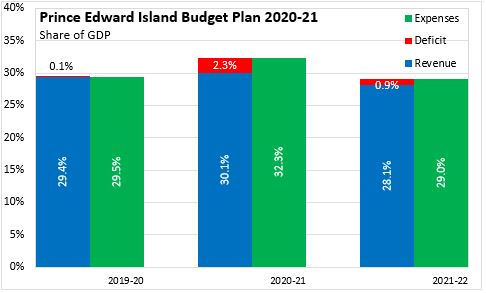

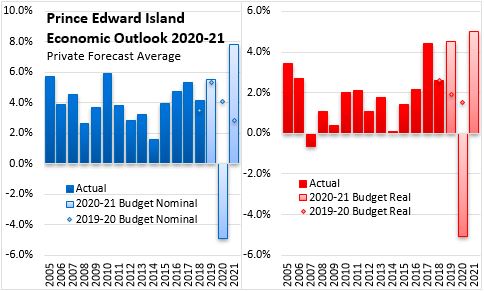

Prince Edward Island's deficit amounts to about 2.3 per cent of GDP in 2020-21 and 0.9 per cent of GDP in 2021-22 (using the average of private forecasts of nominal GDP growth). With the economy projected to contract in 2020, the provincial government's footprint in the economy is projected to rise above 30 per cent. Revenues are expected to climb to 30.1 per cent of GDP and expenditures to 32.3 per cent of GDP. Revenues are projected to decline to 28.1 per cent of GDP in 2021-22 as revenues fall while the economy returns to growth. Expenditures for 2022 are expected to fall to 29 per cent of GDP.

The Prince Edward Island economy has enjoyed among the strongest growth among Canadian provinces in recent years. Although starting from a strong position, Prince Edward Island's economy is expected to face a temporary setback in 2020, with a partiuclar concentration of impacts in tourism industries. Real GDP declines projected by the private sector forecasters cited in the Budget averaged -5.1 per cent for 2020. Prince Edward Island's economy is projected to rebound with growth of 5.5 per cent in 2021.

Key Measures and Initiatives

The government of Prince Edward Island announced several initiatives and measures as part of the 2020-21 Budget:

- funding to acquire personal protective equipment, conduct testing, operate cough/fever assessment clinics and provide mental health services

- increasing the basic personal amount for personal income tax by $500 to $10,500

- reducing the small business corporate income tax rate to 2 per cent

- preparing adaptations to education if students are unabe to return fully to school in the fall due to a second wave of COVID-19 infections

- increasing the Island Advantage Bursary for post-secondary education

- acclerating infrastructure projects

- developing virtual health care tools

- expanding the school lunch progam

- securing core funding for social sector partners

- starting a Telework Adaptation Fund

- starting a Climate Challenge Fund

Prince Edward Island Budget 2020-21

<--- Return to Archive