The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 28, 2020US S&P CORELOGIC CASE-SHILLER HOME PRICE INDICES, MAY 2020 S&P Dow Jones Indices today released data for the S&P CoreLogic Case-Shiller Indices for May 2020. Due to deed availability delays at the local recording office caused by the COVID-19 crisis, sale transaction records for May 2020 for Wayne County, MI-Detroit have not been accounted for. Since Wayne is the most populous county in the Detroit metro area, S&P Dow Jones Indices and CoreLogic were unable to generate a valid May 2020 update of the Detroit S&P CoreLogic Case-Shiller indices.

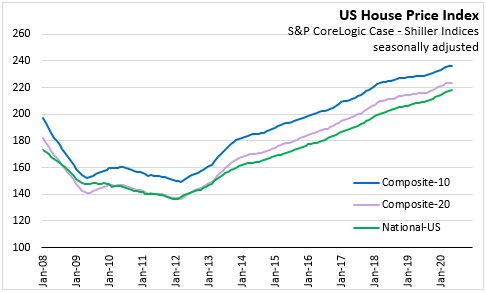

S&P Dow Jones Indices reports that US national house prices, as measured by the S&P CoreLogic Case - Shiller Indices rose by 1.0 per cent nationally in May 2020 (seasonally adjusted) from the previous month. The 20-City Composite and the 10-City Composite indices were nearly unchanged month-to-month.

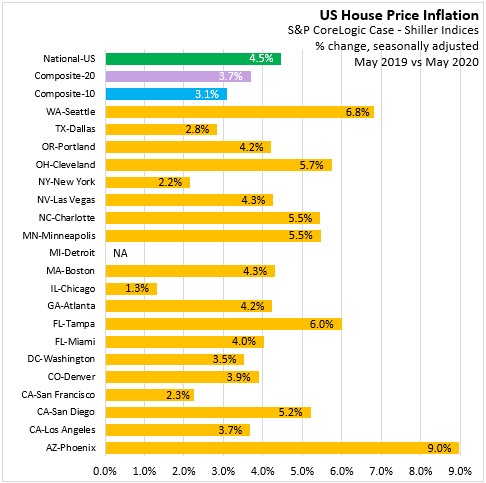

All cities in the 20-city composite, excluding Minneapolis (-0.7%), San Francisco (-0.5%), Seattle (-0.2%), New York (-0.1%), Las Vegas (-0.1%), Atlanta (0.0%), and Detroit for which May data is unavailable, saw monthly price increases.

Compared with May 2019, national US house prices grew by 4.5 per cent (seasonally adjusted). The pace of year-over-year price growth among larger urban centres slowed in 2019, then accelerated through the first four months of 2020, before slowing from 4.6 per cent in April to 4.5 per cent in May. The 10-city composite price index was up 3.1 per cent year-over-year in May, while the 20-city composite price index was up 3.7 per cent.

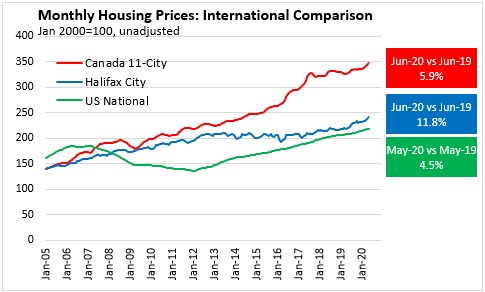

Starting from the same base period (setting the index=100 for January 2000), Canadian house prices did not experience the same rise and fall as US house prices did during the 2008-2009 financial crisis and recession. Comparable Canadian city averages and the Halifax average grew at a more stable pace through 2007-2012. From 2012 to 2017, Halifax house prices remained largely stable while Canadian and US prices continued to grow. The Canadian house price index grew much more rapidly through 2016 and 2017, mostly because of accelerating prices in the Toronto and Vancouver markets. Growth in the Canadian house price index has slowed somewhat since August 2017. In June, Canada 11-city (+5.9%) and Halifax (+11.8%) average prices increased over the previous year.

Among the major metropolitan areas monitored, the strongest year-over-year house price growth occurred in Phoenix (+9.0%), Seattle (+6.8%), Tampa (+6.0%), Cleveland (+5.7%), Minneapolis (+5.5%) and Charlotte (+5.5%). Year-over-year house price growth was slower in Chicago (+1.3%), New York (+2.2%), San Francisco (+2.3%) and Dallas (+2.8%).

Note: The 20-City Composite Index includes Atlanta, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Las Vegas, Los Angeles, Miami, Minneapolis, New York, Phoenix, Portland, San Diego, San Francisco, Seattle, Tampa, and Washington DC. The 10-City Composite Index includes Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco, and Washington DC.

Source: S&P Dow Jones Indices

<--- Return to Archive