The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

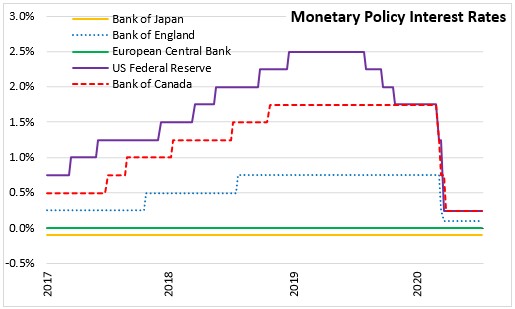

July 29, 2020US MONETARY POLICY The Federal Reserve maintained the target range for the federal funds rate at 0 to 1/4 per cent at its scheduled Federal Open Market Committee (FOMC) meeting statement today. The Committee expects to maintain this target rate until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

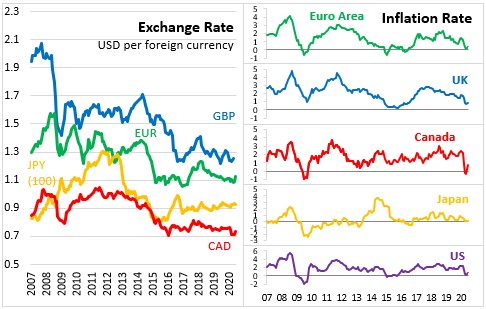

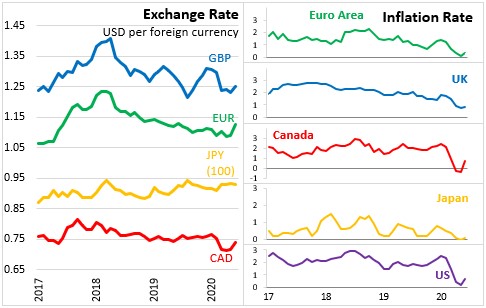

The Federal Reserve noted the tremendous human and economic hardship across the United States and around the world stemming from the coronavirus outbreak. Following sharp declines, economic activity and employment have picked up somewhat in recent months but remain well below their levels at the beginning of the year. Consumer price inflation has slowed on weaker demand and significantly lower oil prices. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

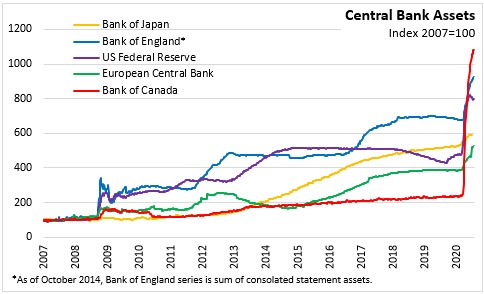

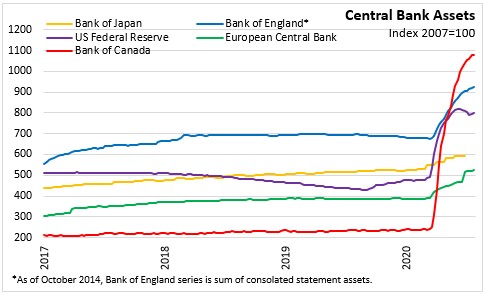

The ongoing public health crisis is expected to weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. The Federal Reserve will continue to monitor information relevant to the economic outlook, including information related to public health, as well as global developments and inflation pressures, and will act as appropriate to support the economy. To support the flow of credit to households and businesses, over coming months the holdings of Treasury securities and agency residential and commercial mortgage-backed securities will increase at the current pace to sustain smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations.

Source: US Federal Reserve

<--- Return to Archive