The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 25, 2020QUARTERLY FINANCIAL STATISTICS FOR ENTERPRISES, Q2 2020 In Q2 2020, Canadian enterprise net income before taxes declined (seasonally adjusted) 8.0 per cent compared to the previous quarter. The decline of $4.5 billion left corporate net income before taxes at $52.3 billion in Q2 2020. Operating revenue declined 11.6 per cent in the quarter with a larger decrease during period of economic lockdown.

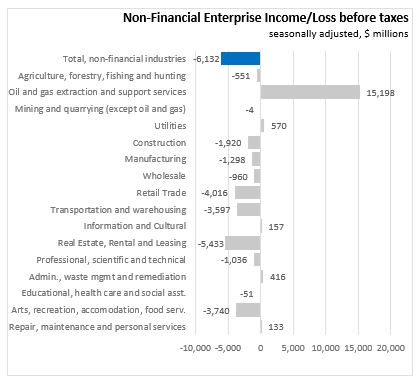

Net income before taxes was down 20.0 per cent or $6.1 billion in the non-financial sector. Transportation and warehousing had a decline in net income of $3,597 million to be operating at a $363 million loss in Q2. Reflecting $1,710 million net income for pipelines, $222 million for warehousing, and a $2,295 million loss in other transportation services. Air transportation led the decline with COVID-19 pandemic leading to border restrictions and quarantines for international travellers.

Other sectors operating at a loss in Q2 2020 included: oil and gas extraction (-$9,232 million), mining (-$1,217 million), and arts, entertainment, recreation, accommodation and food services (-$1,589 million).

Retail trade net income before taxes declined 67.7 per cent in Q2 with declines in all subsectors and online sales not rising enough to offset lost sales in brick-and-mortar stores.

Manufacturing net income before taxes was down 19.3 per cent (-$1.3 billion) as plants operated below capacity. Clothing, textile and leather manufacturing, furniture and other manufacturing led the decrease. Air, rail and ship products and other transportation equipment manufacturing decreased 92.6 per cent. Motor vehicle and parts net income turned negative in Q2 (-$54 million). Wood product and paper manufacturing net income was up $1.1 billion on rising lumber sales.

Net income before taxes was down $3.7 billion to a loss of $1.6 billion in the arts, entertainment, and recreation and accommodation and food service sector. The industry had operating revenues decline 22.1 per cent. Expenses fell 11.4 per cent, particularly labour expenses as employers were forced to scale back or shut down.

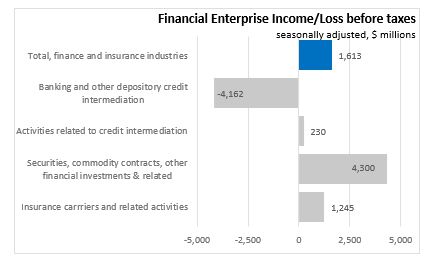

Financial corporate net income before taxes increased $1.6 billion or 6.2 per cent to $27.7 billion compared to Q1 2020. Banking sector had a $4.2 billion decline due to large loan loss provisions and lower revenue. Accounting for losses on distressed loan increased during the quarter due to COVID-19, lower oil prices, and lengthy period of low interest rates. Overall loans to businesses increased in Q2 as firms faced difficulties accessing debt markets. Commodity and securities and related activities and the insurance sector saw increase in income that offset declines in the banking sector.

Source: Quarterly financial statistics for enterprises, second quarter 2020

Statistics Canada. Table 33-10-0226-01 Quarterly balance sheet and income statement, by industry, seasonally adjusted (x 1,000,000)

<--- Return to Archive