The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 26, 2020STUDY: TRENDS IN STUDENT DEBT OF POSTSECONDARY GRADUATES IN CANADA: RESULTS FROM THE NATIONAL GRADUATES SURVEY, 2018 Earning a postsecondary degree can improve labour market outcomes for young Canadians. However, student debt is a significant financial commitment for many graduates which can delay important life goals such as starting a family, building investments or purchasing a home. Statistics Canada has completed a study using the National Graduates Survey data that examines the important issue of student debt by looking at changes in debt over time and the amount of debt at graduation. The study examines debt by field of study and source of financing, as well as the link between the characteristics of the students with total debt at graduation and the reduction of their debt three years after.

Student debt has remained an important issue for postsecondary students during the COVID-19 pandemic as many students lost their job because of the pandemic. An online survey on student debt and COVID-19 conducted by Statistics Canada found that 68 per cent of survey participants are worried about using up their saving, 51 per cent expect difficulties paying for expenses or for next year’s tuition, and 54 per cent believe they will have to acquire additional student debt.

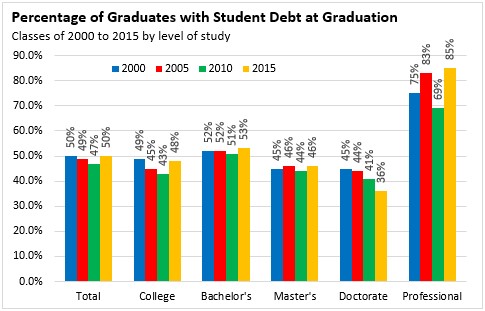

Proportion of Postsecondary Graduates with Student Debt at Graduation

Overall, the proportion of postsecondary graduates with student debt at graduation remained relatively stable between 2000 and 2015, averaging around 50 per cent. This proportion was relatively stable over the 15-year period for college graduates, graduates with a bachelor’s degree and those with a master’s degree.

Graduates with a doctorate degree were among the least likely to have student debt at graduation. The proportion of doctorate degree holders with student debt also decreased steadily between 2000 and 2015, from 45 per cent of doctorial graduates in 2000 to 36 per cent of doctorial graduates in 2015.

Graduates with a professional degree (e.g. law, medicine, dentistry, veterinary medicine, optometry, or pharmacy) were among the most likely to have student debt, with the proportion increasing from 75 per cent in 2000 to 85 per cent in 2015.

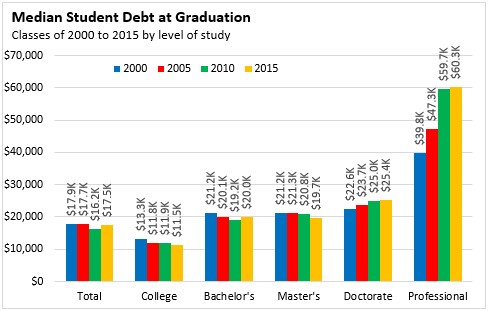

Median Debt at Graduation

From 2000 to 2015, the median student debt at graduation remained relatively stable (2015 constant dollars, excluding those without debt at graduation). Students who graduated in 2015 had a median debt of $17,496 at graduation, down slightly from $17,914 in 2000. College graduates had the lowest median student debt, followed by bachelor’s degree and master’s degree holders.

The median debt at graduation for doctorate degree holders increased from $22,559 in 2000 to $25,401 in 2015. Professional degree holders, which have the highest median debt at graduation, experienced at notable increase in student debt over the study period. Median debt for those with professional degrees increased from $39,810 in 2000 to $60,287 in 2015.

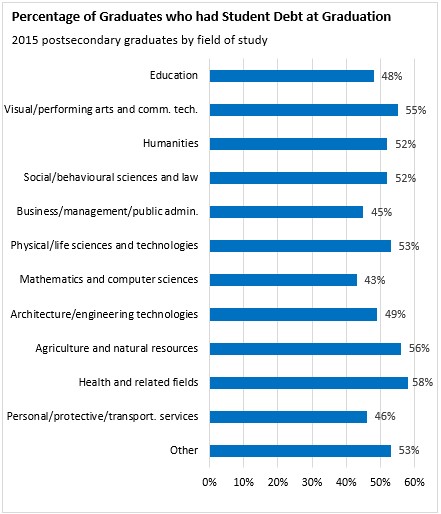

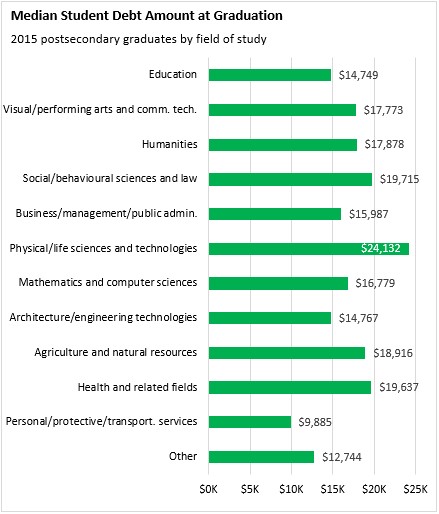

Student Debt by Field of Study

Overall, 2015 graduates of health and related studies programs (58%), agriculture and natural resources (56%), and visual and performing arts and communications technology (55%) were more likely to have student debt than graduates of other fields of study.

Median student debt (for those with debt) was highest for graduates in physical and life sciences ($24,132), social/behavioural sciences and law ($19,715), and health and related fields ($19,637).

Source of Student Debt

Three in four students had loans from only one source in 2015, with government-sponsored student loans being the most common type of student debt. Graduates with a professional degree were more likely to have debt from multiple sources compared to other levels of study, with only 42% having only one source of student debt.

2015 Graduates owed the most on government-sponsored student loans with the median amount owing at $14,992 for all levels of study, followed by bank loans and lines of credit ($12,806), and loans from family or friends ($7,803).

Repayment Status Three Years Later (2018)

Overall, 35.6 per cent of 2015 graduates were able repay all student debt within three years. Regression analysis on the determinants of debt repayment suggests that factors such as smaller debt size at graduation, higher employment income, living in Ontario, being part of a couple with no children, and having student debt from a bank loan, line of credit, or a loan from family or friends were all associated with faster debt repayment after three years. In contrast, living in the Atlantic provinces or Quebec, being a single parent, being a college graduate and a visible minority, and having a disability were associated with slower student debt repayment.

Source: Statistics Canada, Trends in student debt of postsecondary graduates in Canada: Results from the National Graduates Survey, 2018

<--- Return to Archive