The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

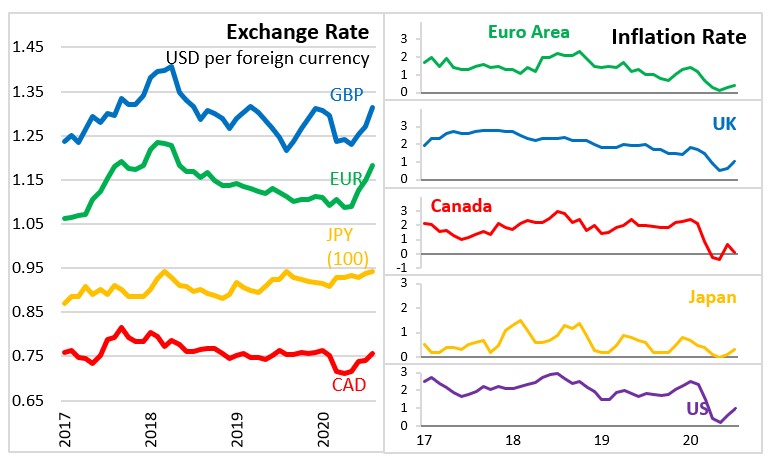

September 10, 2020EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank announced today that key interest rates would remain unchanged at their current levels given the need to continue monetary policy stimulus to support economic recovery and price stability. They are expected to remain at their present or lower levels until the inflation outlook converge to a level sufficiently close to, but below the target rate of 2 per cent consistently.

Euro area real GDP declined by 11.8 per cent in the second quarter of 2020. Recent indicators since the last monetary policy meeting in July points to a strong rebound in activity, although the level of activity remains below pre-COVID levels. Domestic demand has shown a significant improvement however growth in consumer spending and business investment is limited by the uncertainty in the global economic outlook. While there were gains in the manufacturing sector, momentum in the services sector has slowed down recently. The pace of economic recovery is very uncertain and depends largely on the evaluation of the pandemic and the policy support in place.

Against a very uncertain outlook, the Governing Council reconfirmed their accommodative monetary policy. The monetary policy elements include:

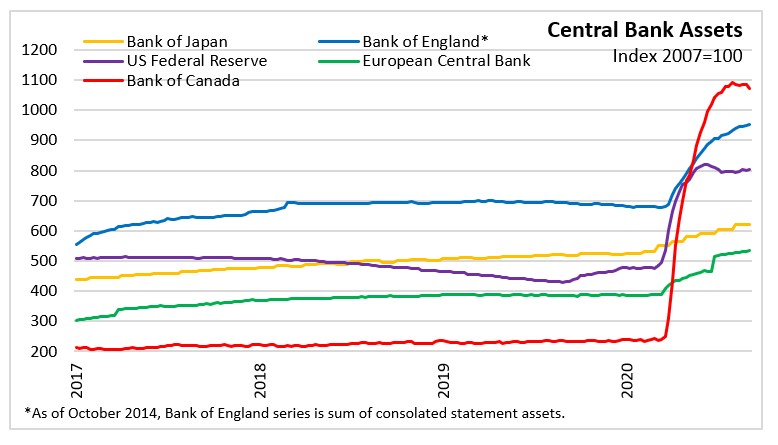

- Continuation of purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,350 billion. These purchases contribute to easing the overall monetary policy stance, thereby helping to offset the pandemic-related downward shift in the projected path of inflation.

- Continuation of net purchases under the asset purchase programme (APP) at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

- Continuation of refinancing operations, particularly the latest operation in the third series of targeted longer-term refinancing operations (TLTRO III).

The Governing Council will do everything necessary within its mandate and is fully prepared to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

Source: European Central Bank: Monetary Policy Decision, Remarks

<--- Return to Archive