The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

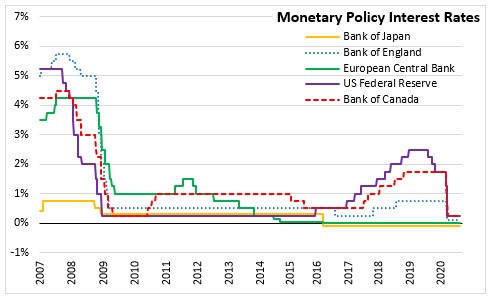

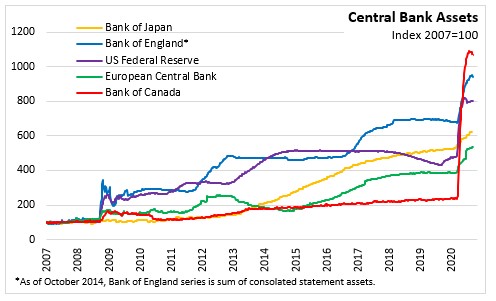

September 17, 2020BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to maintain the negative interest rate of -0.1 per cent on balances of financial institutions at the Bank. The Bank of Japan will also purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit in order to keep the 10-year JGB yields at around zero per cent. However, yields may move up or down depending on economic activity and prices.

In addition, the Bank will actively purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces with upper limit of about 12 trillion yen and about 180 trillion yen, respectively. Commercial paper (2.0 trillion yen) and corporate bond (3.0 trillion yen) holdings by the Bank will be maintained. The Bank will make additional purchases with the upper limit of the amounts outstanding of 7.5 trillion yen for each asset until the end of March 2021.

The Bank will continue with "Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control," aiming to achieve the price stability target of 2 per cent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 per cent and stays above the target in a stable manner.

In response to COVID-19, the Bank will continue to support financing of firms and maintain financial market stability through:

- the Special Program to Support Corporate Financing,

- provision of yen and foreign currency funds without setting upper limits, and

- active purchases of ETFs and J-REITs.

With the easing of some physical distancing measures, Japan’s economic activity started to pick up gradually supported by increased demand for exports and industrial production. While private consumption has started to gain momentum, consumption of services such as eating and drinking, and accommodations has remained at a low level. Housing investment has declined as employment and income levels have been weak. Public investment has continued to increase but financial conditions have been weak for corporate financing.

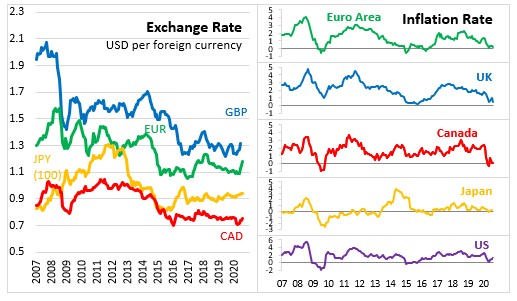

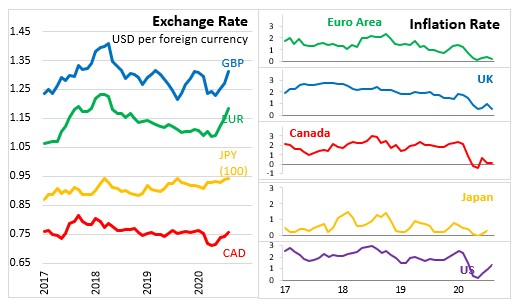

The year-over-year rate of change in the consumer price index (CPI, all items less fresh food) is around 0 per cent, mainly due to lower crude oil prices.

Japan’s economy is expected to continue on an upward trend with support from pent-up demand, accommodative financial conditions, and government’s economic measures. The pace of rebound will be moderate as the global economic conditions remain impacted by COVID-19. The outlook continues to be very uncertain due to the risks of COVID-19 on domestic and global economic conditions.

The Bank will monitor the impact of COVID-19 and is prepared to take additional easing measures if necessary. The Bank expects short- and long-term policy interest rates to remain at their present or lower levels for the time being.

Source: Bank of Japan, Statement on Monetary Policy

<--- Return to Archive