The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

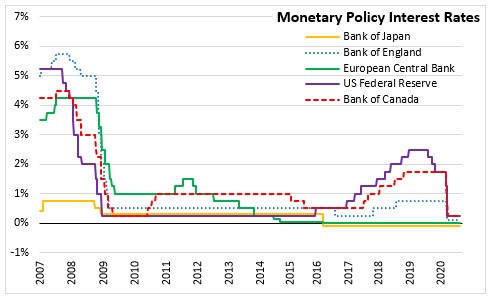

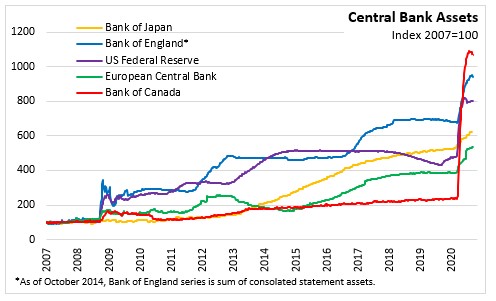

September 17, 2020BANK OF ENGLAND MONETARY POLICY The Bank of England announced today that the bank rate would continue to be 0.1 per cent. The Bank holdings of UK government bonds and sterling non-financial investment-grade corporate bonds would continue with a target total stock of asset purchases of £745 billion.

In line with the Committee’s August Monetary Policy Report projections, recent economic indicators point to a rebound in global economic activity. Domestic conditions continue to recover as social distancing eases and consumer spending picks up. UK GDP in July was about 18.5 per cent above April levels but remains below its 2019 Q4 level. Business investment is expected to recover but somewhat slowly. Unemployment is expected to decline gradually from beginning of 2021 onwards.

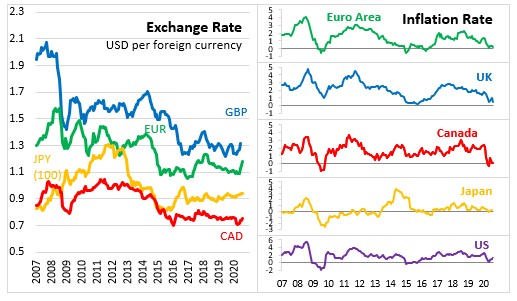

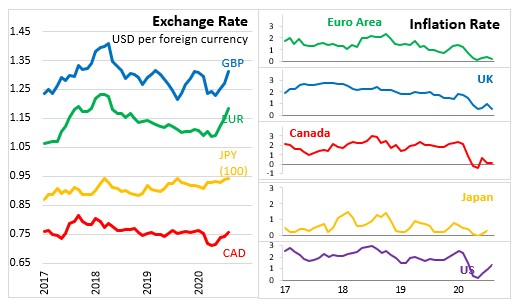

CPI inflation declined from 1.0 per cent in July to 0.2 per cent in August due to the impacts of the Government’s Eat Out to Help Out scheme and the cut in taxes for hospitality, accommodation, and attractions. CPI inflation is expected to remain below 1 per cent until early 2021.

Economic recovery and inflation outlook depend heavily on the evaluation of the pandemic, the measures taken to protect public health, and the transition to a new trade agreement between the European Union and the United Kingdom. The risks to the outlook for GDP are judged to be skewed to the downside.

The MPC will continue to monitor the situation closely and stands ready to take further action as necessary to support the economy and ensure a sustained return of inflation to the 2 per cent target. The Committee does not intend to tighten monetary policy until there is clear evidence that significant progress is being made in eliminating spare capacity.

Source: Bank of England, Monetary Policy

<--- Return to Archive