The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 28, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada (BOC) maintained its target for the overnight rate at the effective lower bound of 0.25 per cent in its scheduled interest rate announcement today. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent. The Bank is recalibrating the quantitative easing (QE) program, shifting purchases towards longer-term bonds, to more directly impact borrowing rates that are most important for households and businesses. QE purchases will be gradually reduced at a rate equal to or exceeding $4 billion a week. These changes are not expected to reduce monetary stimulus from the QE program. The BOC reiterated its commitment to holding the policy interest rate at the effective lower bound to achieve the 2 per cent inflation target, and to continuing the QE program until recovery is well underway.

The BOC notes that global and Canadian economic outlooks have evolved largely as anticipated in their July monetary report. Despite considerable excess capacity, growth has slowed following rapid expansion after COVID-19 containment measures were relaxed. The rebound in employment and GDP was stronger than expected as the economy reopened through the summer. Recovery has begun to moderate with fourth quarter growth expected to slow markedly due in part to rising COVID-19 cases. The economic effects of the pandemic are highly uneven across sectors and are particularly affecting low-income workers. Despite continued low oil prices, the Canadian dollar has appreciated since July, largely reflecting a broad-based depreciation of the US dollar.

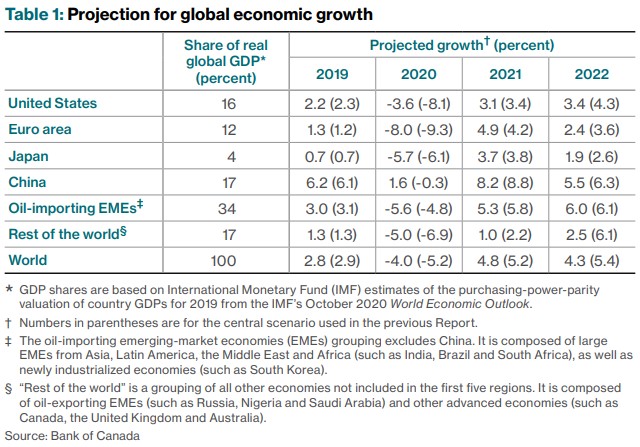

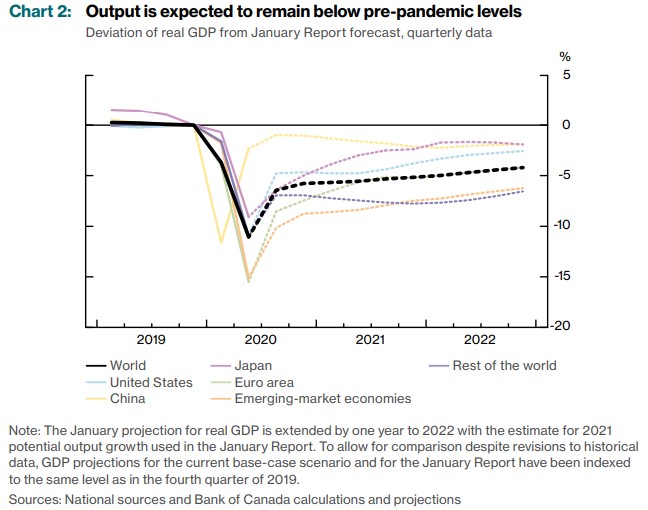

Internationally, economic recovery is mixed. US growth appears to be slowing in recent months after a strong rebound. China’s economic output is back to pre-pandemic levels and the recovery continues to broaden. Emerging-market economies have been hit harder, especially those with severe outbreaks. The recovery in Europe is slowing amid mounting lockdowns. Overall, the BOC expects a global GDP contraction of 4 per cent in 2020, followed by 4.8 per cent growth in 2021 and 4.3 per cent in 2022.

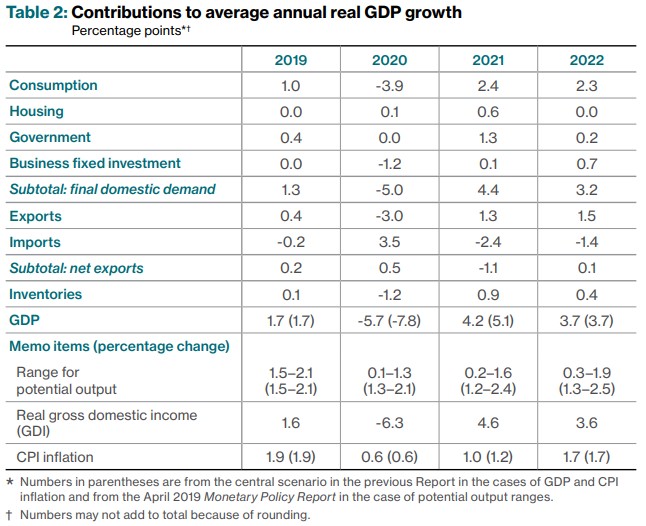

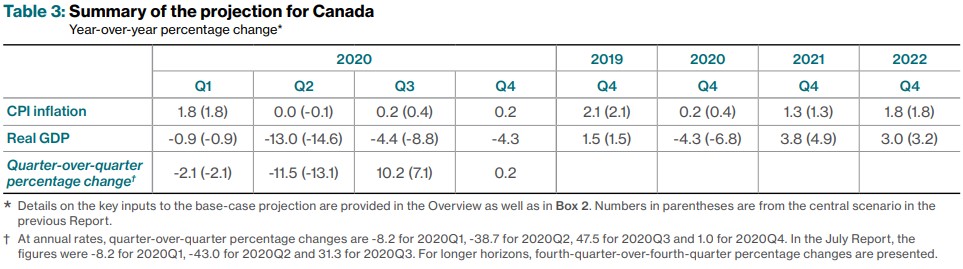

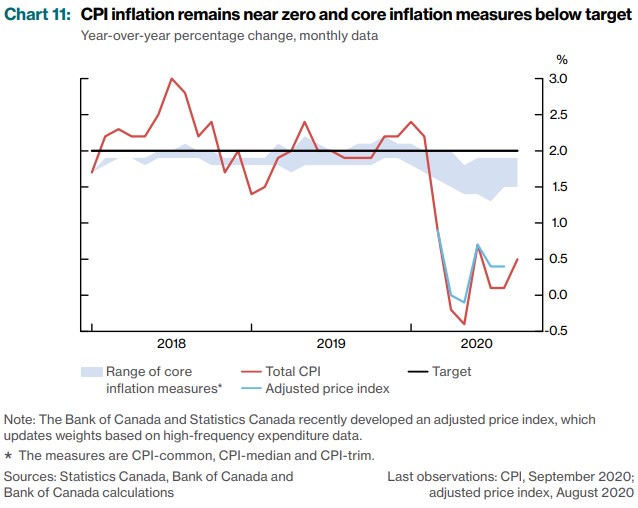

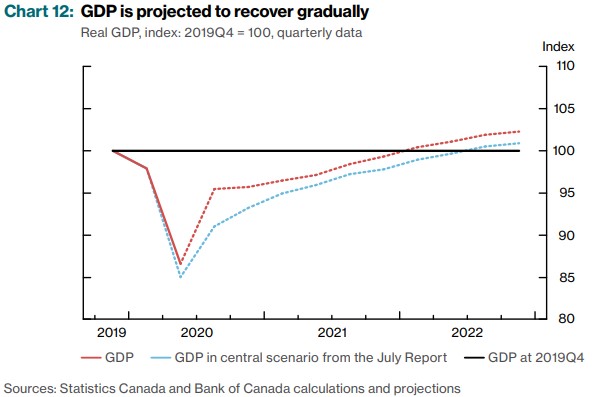

The BOC expects a decline of 5.7 per cent in Canadian real GDP in 2020, with growth rebounding to 4.2 per cent in 2021 and 3.7 per cent growth in 2022. Given the likely long-lasting effects of the pandemic, the BOC has revised down its estimate of Canada’s potential growth over the projection horizon. CPI inflation is expected to stay below the BOC’s target band of 1 to 3 per cent until early 2021, largely due to low energy prices. Core inflation measures are running below 2 per cent, consistent with an economy where supply is exceeding demand.

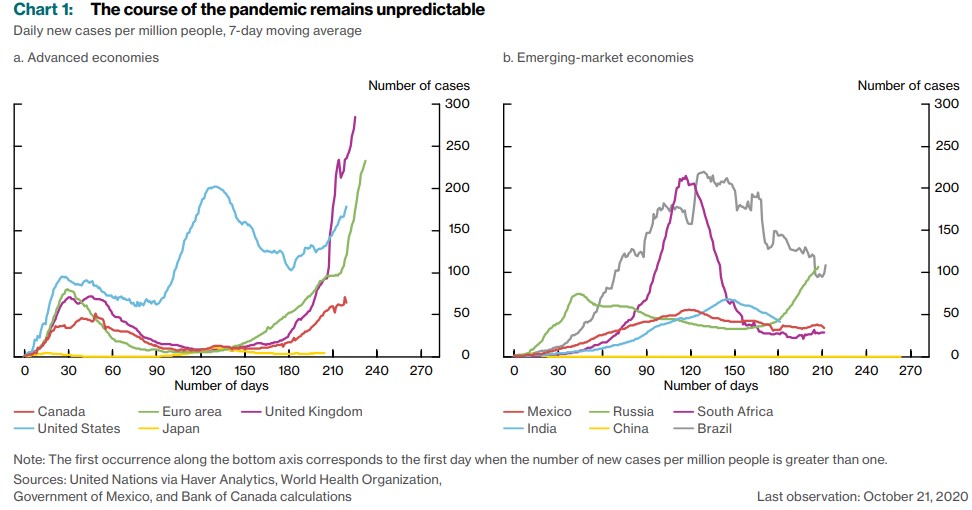

The BOC’s October report highlights the continued uncertainty of the pandemic. Current projections assume that extensive lockdown measures will not be reintroduced, and that vaccines and effective treatments will be widely available by mid-2022. The pandemic is also likely to have persistent effects on the preferences and behaviours of consumers and businesses, making the outlook for Canadian and global economic activity unusually uncertain.

Global Economy

Global economic growth rebounded as economies reopened over the summer. However, activity has since slowed. By the third quarter of 2020, the global economy is estimated to have recovered more than half of its initial loss. Recovery has been more uneven across regions than expected. China experienced milder contractions and stronger rebounds. In contrast, emerging-market economies have been hit harder, especially those with severe outbreaks, such as India and some Latin American countries.

The BOC projects global growth to slow in the fourth quarter, due in part on fading pent-up demand, declining fiscal support, and rising COVID-19 cases. Physical distancing measures and uncertainty about the virus are expected to create a persistent drag in most economies through 2022, when the virus is assumed to be under control. Overall, the BOC expects a global GDP contraction of 4 per cent in 2020, followed by 4.8 per cent growth in 2021 and 4.3 per cent in 2022. Global growth in 2020 is stronger than expected in the July Report, but revised down after 2020 on weaker outlooks for emerging markets and lower potential output growth in all regions.

Global potential output is expected to be about 2 per cent lower by the end of 2022 compared with its pre-pandemic trend. Factors contributing to this decline include costly reallocations of resources, reduced labour force participation, and slower growth in investment and productivity.

US employment and economic activity rebounded quickly after May, exceeding expectations in the July Report. In June, consumption of goods surpassed its pre-pandemic levels, with strong demand for home improvement items and motor vehicles. Residential construction has also picked up strongly. In contrast, services consumption has only partially recovered, and industrial production remains below pre-pandemic levels in many sectors.

Incoming data show gains in US employment and economic activity have eased since July, as the initial surge of demand subsided. US growth is anticipated to slow markedly in the fourth quarter on rising COVID-19 cases and reduced fiscal support. Beginning in mid-2021, consumption growth should gradually pick up but with continued consumers apprehension. The weak consumption outlook and elevated uncertainty will likely slow investment growth. Inflation is anticipated to remain below 2 per cent through 2022 due to persistent excess supply.

The euro area economy contracted most among the major economies, with output in the second quarter falling to 15 per cent below its pre-pandemic level. Policy support has preserved jobs despite large declines in activity and hours worked. Indicators of production and sentiment in the euro area suggest that growth in the third quarter rebounded by somewhat more than expected in the July Report. However, the recent resurgence in COVID-19 cases will likely slow near-term growth. The recovery is expected to be prolonged, reflecting a persistent need for physical distancing measures, and will reduce labour input and total factor productivity growth.

China’s economic recovery has been faster than that of other major economies, exceeding expectations in the July Report. China’s GDP returned to its pre-pandemic level in the second quarter. Investment in infrastructure and real estate has been robust. Exports have benefited from an earlier reopening than other economies and from strong foreign demand. China’s recovery is expected to broaden further as consumption, private sector investment and foreign demand continue to strengthen.

Canadian Economy

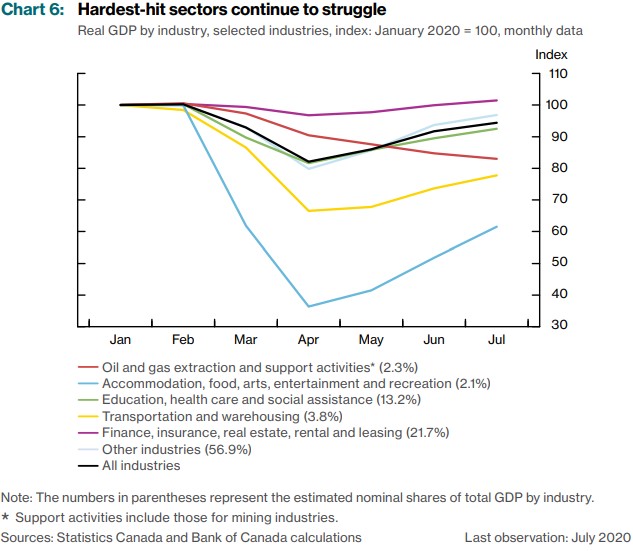

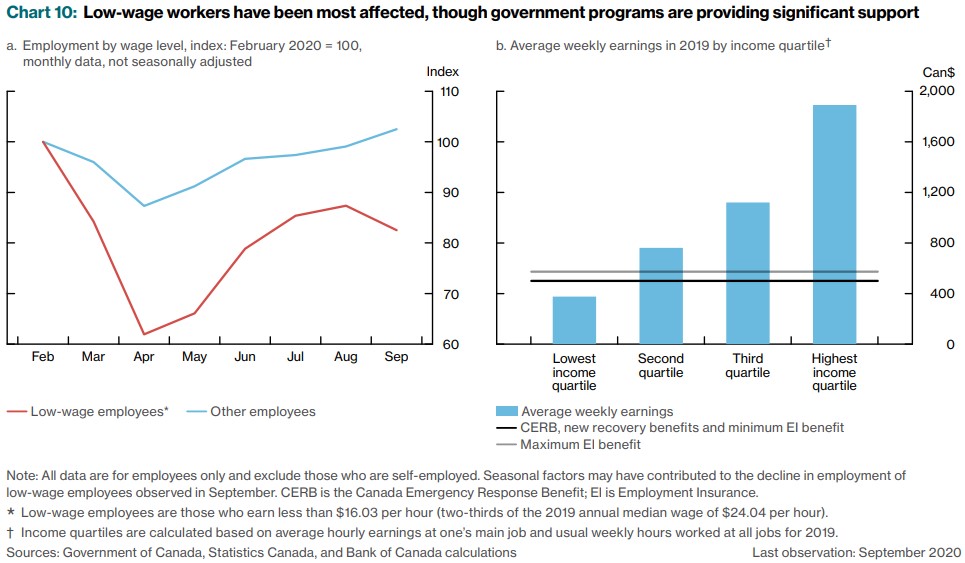

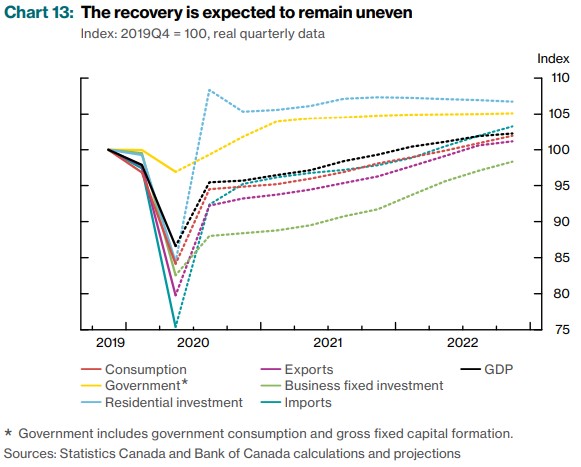

Rapid economic growth in the Canadian economy from easing containment measures over the summer has transitioned to more moderate growth. Growth is estimated to have rebounded strongly in the third quarter, reversing about two-thirds of the decline observed in the first half of the year. Increased activity was spurred by a rebound in foreign demand, release of pent-up demand for housing and some durable goods, and policy support. The economic effects of the pandemic have been highly uneven. Businesses in sectors that require close physical contact continue to be disproportionately affected. The effects have been similarly uneven across households with low-income households more severely impacted.

The economic recovery is projected to be prolonged, underpinned by policy support, but largely influenced by the evolution of the pandemic, ongoing uncertainty, and structural changes to the economy. Overall, the BOC expects a real GDP decline of 5.7 per cent in 2020, with growth rebounding to 4.2 per cent in 2021 and 3.7 per cent growth in 2022. Inflation is expected to remain below the lower end of the BOC’s target range of 1 to 3 per cent until early 2021, largely due to the effects of low energy prices. Economic slack will continue to put downward pressure on projected inflation.

Housing activity recovered sharply in the third quarter. By September, cumulative resales are estimated to have compensated for the activity that was missed during the normally busy spring market. The strength of the housing market recovery, combined with a tight resale market, has led to rapid growth of house prices in some markets. Price growth has been strongest in markets with moderate loan to-income ratios, such as Ottawa, Montréal and Halifax.

Consumers are spending less on services that involve higher risks of infection, such as travel, personal care services and recreation, and relatively more on goods such as groceries and electronics. Overall, sales of most goods are estimated to have recovered in the third quarter to near pre-pandemic levels.

Investment and exports have rebounded from their lows in the second quarter but remain subdued, with significant weakness in some sectors. Some non-commodity exports, such as motor vehicles and parts as well as consumer goods, have recovered quickly. In contrast, exports of industrial machinery and equipment and other capital goods have lagged. Energy exports remain weak amid low oil prices, soft demand and ongoing structural challenges in the industry.

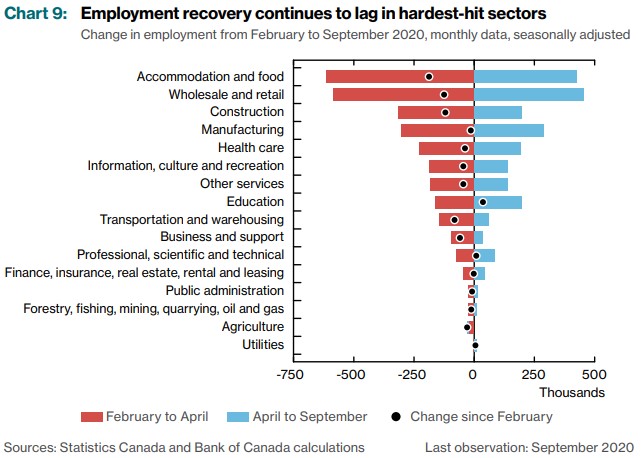

Labour markets have improved significantly but around 720,000 people were still out of work in September because of pandemic-related job losses. Employment continued its strong recovery through the third quarter, although the pace of job gains is expected to slow considerably in the coming months as growth wanes. Recovery in the hardest-hit sectors, such as accommodation and food services, recreation, and travel continues to lag. On average, payments under the Canada Emergency Response Benefit program have offset income losses for those in the lowest income quartile.

The consumer price index (CPI) inflation remains well below the Bank’s target range. Prices for CPI components that fell sharply because of weak demand early in the pandemic, including gasoline and travel accommodations, remain low compared with their levels from a year ago. In addition, prices for products that saw a surge in demand early in the pandemic have started easing. Measures of core inflation have been below 2 per cent, consistent with an economy where demand has fallen by more than supply.

According the BOC, the Canadian economy is in the recuperation phase. Growth is expected to average close to 4 per cent over 2021 and 2022. GDP not expected to be at pre-pandemic levels until the start of 2022, and the output gap is not closed until considerably later. The BOC expects the recovery to remain uneven and only partial until the pandemic is over.

Bank of Canada: Rate announcement Monetary Policy Report – October 2020

<--- Return to Archive