The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 13, 2020SURVEY ON BUSINESS CONDITIONS, IMPACT OF COVID-19: AUGUST 2020 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has conducted a third iteration of the Canadian Survey on Business Conditions. This third iteration provides more detailed data by province compared to previous releases. From mid-September to late October, Statistics Canada surveyed businesses to collect information on the pandemic's impact throughout the summer, and on businesses' expectations moving forward. The current data were assigned a reference month of August 2020.

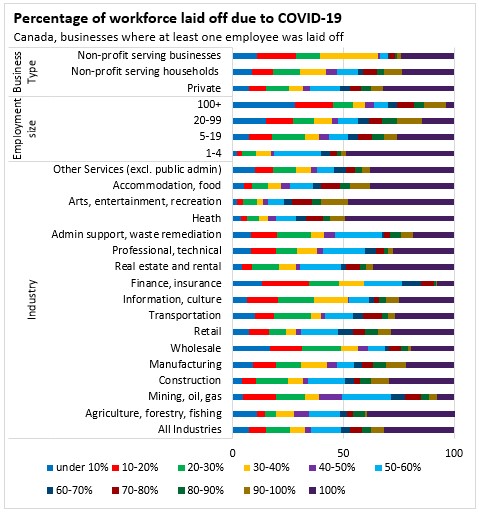

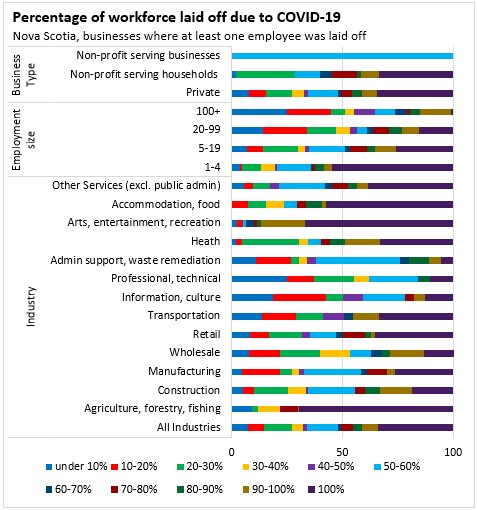

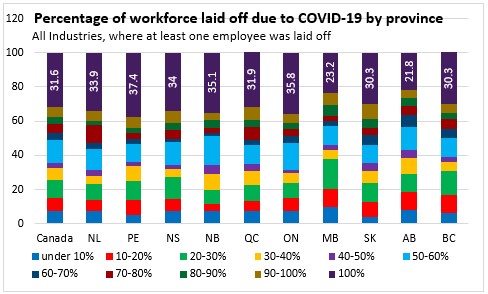

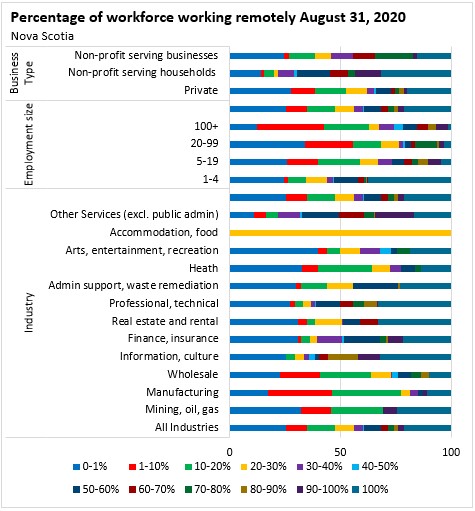

The results reported here are a selection of the impacts found by province, by industry, by size of business (measured by number of employees) and by business type (government agency, private business, non-profit organization serving households, non-profit organization serving business). The horizontal axis in all charts measures the share of businesses reporting each outcome.

Layoffs

Across Canada, 36.5 per cent of businesses had laid off at least one employee since the start of the pandemic. Among businesses with at least one layoff, 64.3 per cent had laid off half or more of their workforce, with the majority of operations in arts, entertainment and recreation (84.0%), health care and social assistance (80.6%), and accommodation and food services (74.0%) sectors reporting layoffs of half or more.

For Nova Scotia businesses with at least one layoff, 65.7 per cent had laid off half or more of their workforce since the start of the pandemic, with the highest rates reported for Arts, entertainment, recreation (95.0%), Other Services (excluding public administration) (78.5%), Agriculture, forestry, and fishing (78.1%) and Accommodation and food services (76.5%).

Nationally, 31.6% of operations (with at least one layoff) have laid off 100 per cent of their workers since the start of the pandemic, with operations in Ontario, Prince Edward Island, New Brunswick more likely to report layoffs of all employees when at least one employee is laid off

Teleworking and Working Remotely

Teleworking and working remotely have become more prevalent since the start of the pandemic. Prior to February, 23.4 per cent of businesses reported some degree of remote or telework arrangement. Telework was more common in British Columbia and less prevalent in Atlantic Canada and the prairie provinces. Remote and telework was more common in information/culture as well as professional/technical services and less common across goods-producing industries.

Nationally, 27.2 per cent of businesses reported that all of their workforce was teleworking or working remotely on August 31, 2020. Information and cultural (80.9%), Professional, scientific and technical services (69.6%), and Finance and insurance (58.1%) operations were more likely to have over half of employees working remotely.

For Nova Scotia, 39.2 per cent of businesses reported over half of employees teleworking and working remotely, compared to 51.3 per cent nationally. For industries with available data for Nova Scotia, the majority of operations in the Information and cultural sector (61.6%), Professional, scientific and technical services (61.6%), and Other services (excluding public administration) (67.4%) reported having over half of employees working remotely.

The majority of businesses in Quebec, Ontario and British Columbia reported having over half of employees teleworking and working remotely.

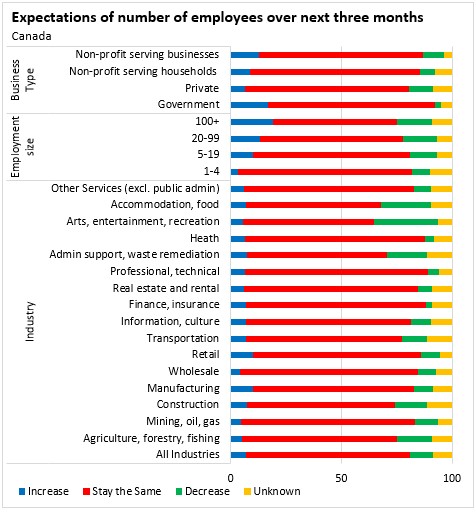

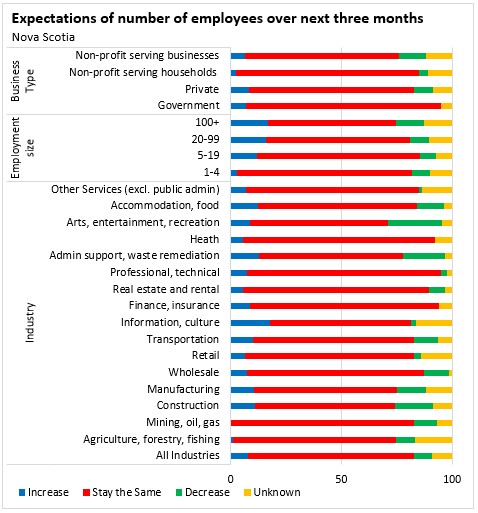

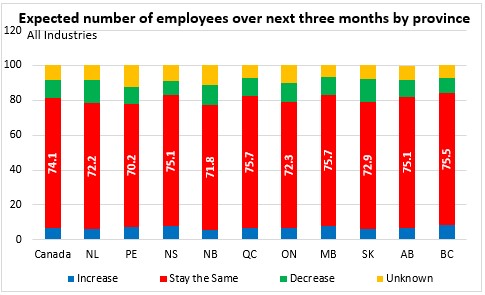

Expected Number of Employees

Across Canada, 74.1 per cent of businesses expected their number of employees to remain the same over the next three months, while 10.4 per cent expected their number of employees to decrease. Over one-quarter of businesses in the arts, entertainment and recreation sector (28.9%) and almost one-quarter of businesses in the accommodation and food services sector (22.5%) expected to reduce their number of employees over the next three months, the highest proportions among all sectors.

For Nova Scotia, 75.1 per cent of businesses expected their number of employees to remain the same over the next three months, while 8.1 per cent expected their number of employees to decrease. Businesses in the Arts, entertainment and recreation sector (24.1%), Administrative and support, waste management and remediation services (18.8%) and Construction (16.8%) were the most likely to report expected decreases in employment.

Business in Newfoundland and Labrador, Saskatchewan and New Brunswick were more likely to report an expected decrease in employment over the next three months compared to other provinces.

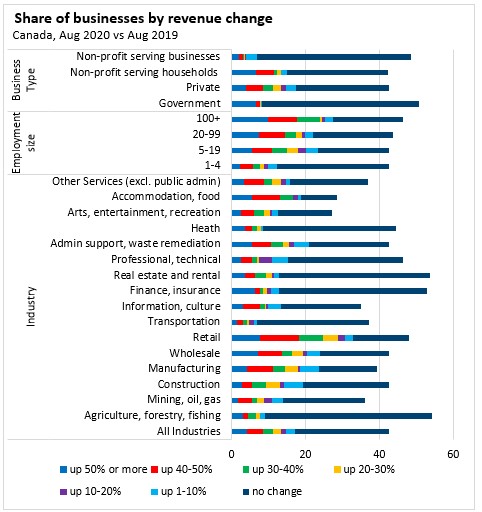

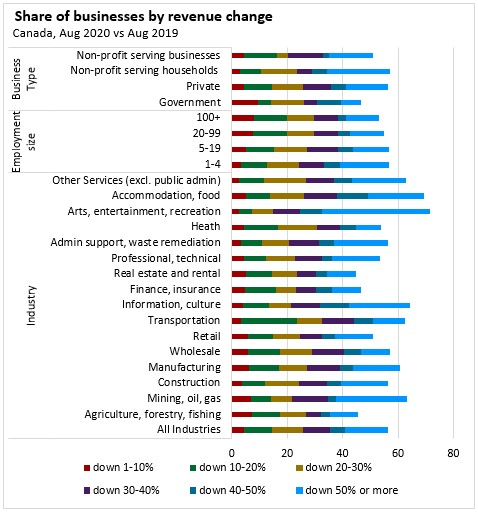

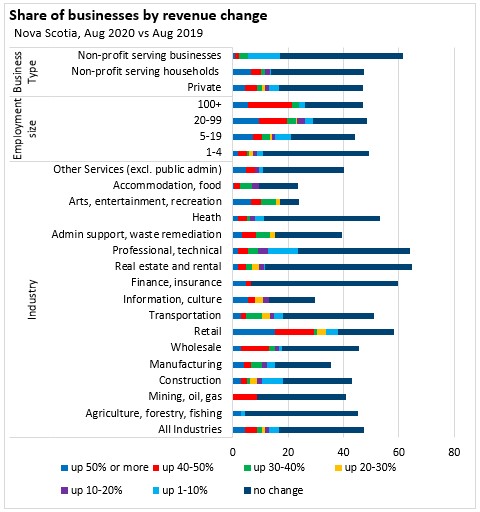

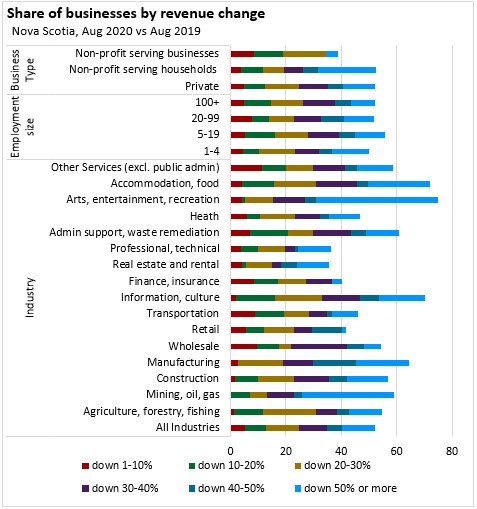

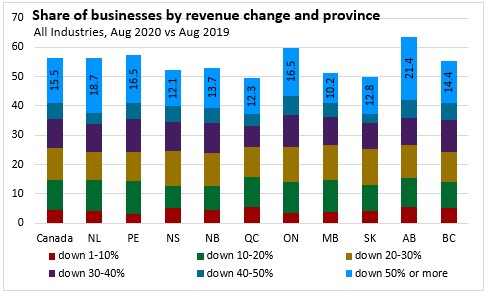

Change in Business Revenues

Nationally, 42.7 per cent of businesses reported that August 2020 revenues were up or unchanged compared to August 2019. Almost one-third (30.8%) of businesses reported that their revenues in August 2020 were down 30% or more, year over year, while 15.5 per cent of businesses reported that their revenues were down by half or more.

In Nova Scotia, 47.4 per cent of businesses reported that August 2020 revenues were up or unchanged compared to August 2019. Just over one quarter (27.9%) of businesses reported that their revenues in August 2020 were down 30% or more, year over year, while 12.1 per cent of businesses reported that their revenues were down by half or more. Among operations in the Arts, entertainment and recreation sector, 43.9 per cent reported a drop in revenues by half or more, while 60.7 per cent reported a decrease of 30 per cent or more. Nearly half of accommodation and food services (45.5%), manufacturing (45.3%) and Mining, oil, and gas (46.2%) operations report revenue declines of 30 per cent or more.

Across provinces, business in Alberta, Ontario and Prince Edward Island were more likely to report revenue down in August, year-over-year.

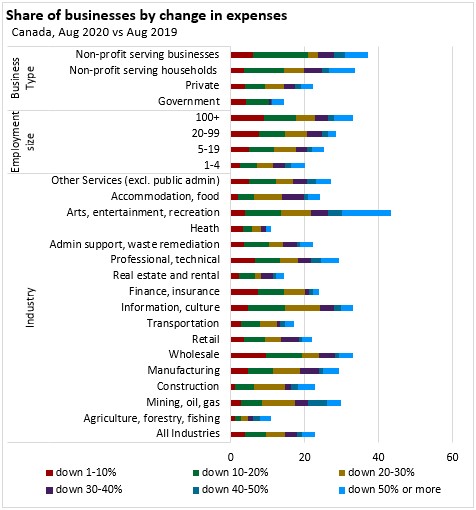

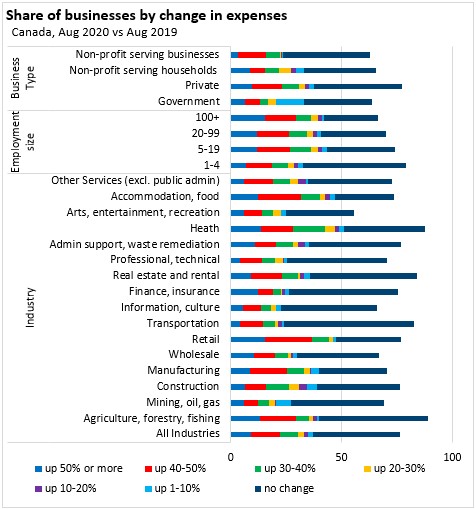

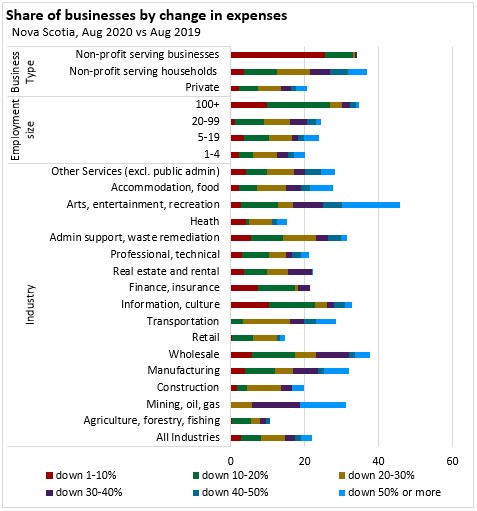

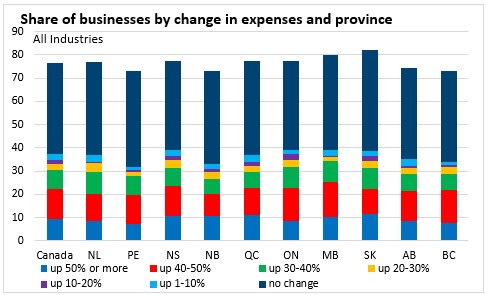

Change in Business Expenses

Across Canada, 37.1 per cent of operations reported rising expenses in August 2020, year-over-year. Approximately half of retail (47.4%), healthcare (51.2%) and Accommodation and food services (46.9%) operations reported rising expenses.

For Nova Scotia, 38.9 per cent of operations reported rising expenses in August 2020, year-over-year. Approximately half of retail (47.2%), healthcare (49.9%), Accommodation and food services (45.0%) and construction (46.3%) operations reported rising expenses.

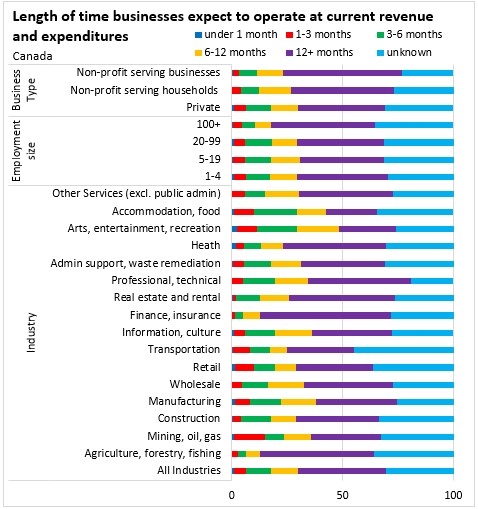

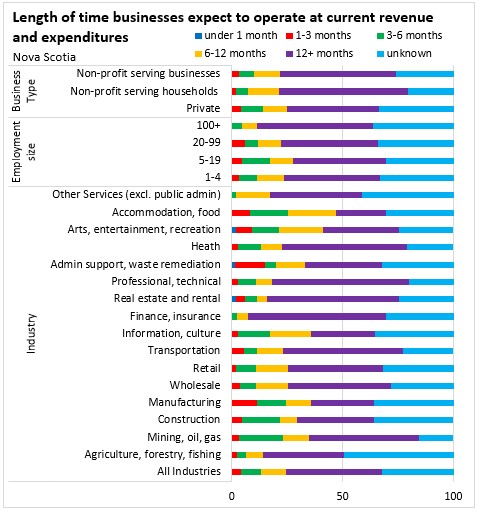

Length of time businesses or organizations expect to continue to operate at current revenue and expenditures

Nationally, nearly one-third (30.4%) of businesses did not know how long they could continue to operate at their current level of revenue and expenditures before considering further staffing actions, closure or bankruptcy, while nearly one-fifth (17.5%) reported they could continue for less than six months. Approximately one-third of businesses in the arts, entertainment and recreation (29.4%) and accommodation and food services (29.2%) sectors reported that they could continue to operate at their current level of revenue and expenditures for less than six months before considering further staffing actions, closure or bankruptcy.

In Nova Scotia, 32.5 per cent of businesses stated did not know how long they could continue to operate without major changes. There was 13.2 per cent of business in Nova Scotia that reported that they could continue to operate at their current level of revenue and expenditures for less than six months before considering further staffing actions, closure or bankruptcy.

Additional results about the impact of COVID-19 on respondent businesses are available from Statistics Canada.

Sources:

Table: 33-10-0273-01 Business or organization obstacles over the last three months, by business characteristics

Table: 33-10-0274-01 Percentage of workforce teleworking or working remotely, and percentage of workforce anticipated to continue primarily teleworking or working remotely after the pandemic, by business characteristics

Table: 33-10-0275-01 Extent to which use of various methods to provide goods or services to customers or users is expected to change over the next three months, by business characteristics

Table: 33-10-0276-01 Impact of COVID-19 on business or organization status, by business characteristics

Table: 33-10-0277-01 Current or planned actions or measures in place due to COVID-19, by business characteristics

Table: 33-10-0278-01 Current or planned actions or measures in place for parents employed by the business or organization, by business characteristics

Table: 33-10-0279-01 Layoffs since the start of the COVID-19 pandemic, by business characteristics

Table: 33-10-0280-01 Of businesses where at least one employee was laid off, percentage of workforce laid off and rehired due to COVID-19, by business characteristics

Table: 33-10-0281-01 Business or organization revenue from August 2020 compared with August 2019, by business characteristics

Table: 33-10-0282-01 Business or organization expenses from August 2020 compared with August 2019, by business characteristics

Table: 33-10-0283-01 COVID-19 impacts on various expenditures, by business characteristics

Table: 33-10-0284-01 Approved funding or credit due to COVID-19, by business characteristics

Table: 33-10-0285-01 Reasons business or organization did not access any funding or credit due to COVID-19, by business characteristics

Table: 33-10-0286-01 Liquidity and access to liquidity, by business characteristics

Table: 33-10-0287-01 Business or organization ability to take on more debt, by business characteristics

Table: 33-10-0288-01 Business or organization space, by business characteristics

Table: 33-10-0289-01 Level of difficulty expected in procuring personal protective equipment or supplies, by business characteristics

Table: 33-10-0290-01 Reasons why difficulty is expected in procuring personal protective equipment or supplies, by business characteristic

Table: 33-10-0291-01 Likelihood of various measures being permanently adopted once the pandemic is over, by business characteristics

Table: 33-10-0292-01 Statements regarding operations of the business or organization, by business characteristics

Table: 33-10-0293-01 Length of time businesses or organizations expect to continue to operate at current revenue and expenditures, by business characteristics

Table: 33-10-0294-01 Expectations of prices charged over the next three months, by business characteristics

Table: 33-10-0295-01 Expectations of number of employees employed by business or organization over the next three months, by business characteristics

Table: 33-10-0296-01 Plans to acquire or invest in other businesses or organizations in the next year, by business characteristics

Table: 33-10-0297-01 Plans to transfer, sell, or close, by business characteristics

<--- Return to Archive