The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 19, 2020STOCK AND CONSUMPTION OF FIXED CAPITAL 2019 Statistics Canada has released details of fixed capital assets for 2019.

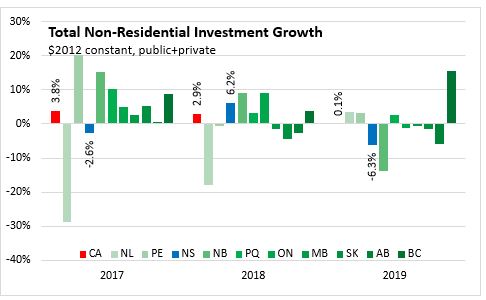

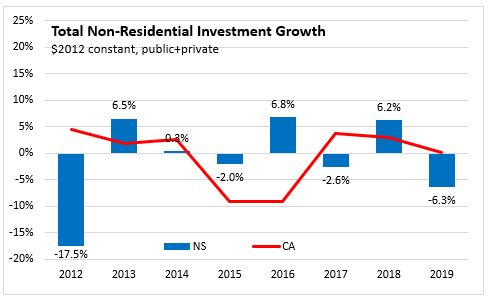

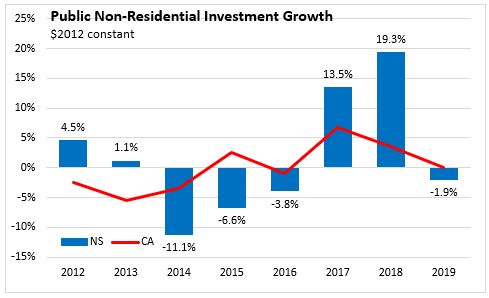

Nova Scotia non-residential investment (all figures in real terms - adjusted to 2012 constant prices) decreased 6.3% while national investment was up 0.1%. Over the last six years, Nova Scotia's investment in non-residential fixed capital has alternated between increases and declines. In comparison, non-residential capital investment declined in Canada in 2015 and 2016 as oil prices fell and investment activity slowed. However, Canada's non-residential investment returned to growth in 2017 and 2018 before being essentially flat in 2019.

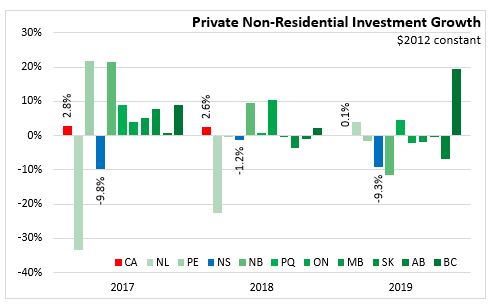

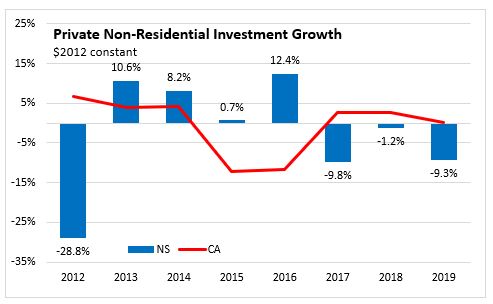

Private sector non-residential investment was down 9.3% in Nova Scotia in 2018, following a decline of 1.2% in 2018 and 9.8% in 2017. There were gains from 2013 through 2016. National private sector non-residential investment growth slowed to 0.1% 2019 after growing by 2.6% in 2018 and 2.8% in 2017.

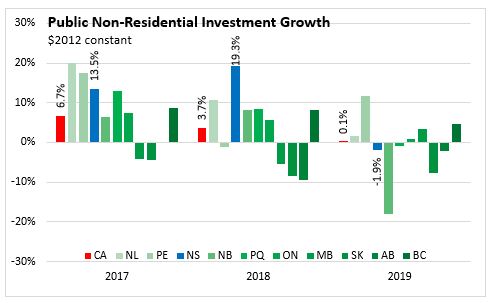

Canada public non-residential investment slower it's pace of growth from 2017 and 2018 to be up 0.1% in 2019. Nova Scotia had the largest increase in public non-residential capital investment (+19.3%) among provinces in 2018 with increases in Federal government, defense services, educational services, and local government. In 2019, Nova Scotia non-residential public investment was down 1.9%.

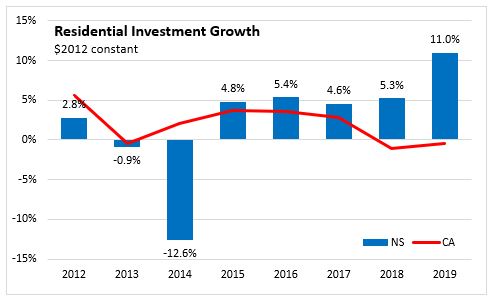

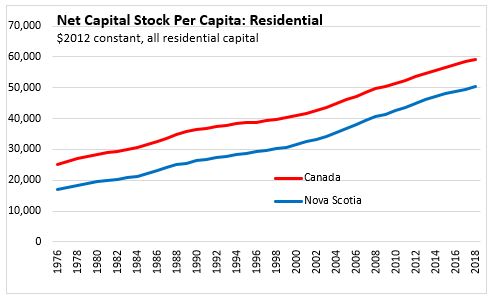

Nova Scotia's real investment in residential structures (including both new dwellings and renovations) had grown steadily in recent years, and accelerated to 11.0% growth in 2019. Residential investment across Canada declined 0.5 per cent in 2019.

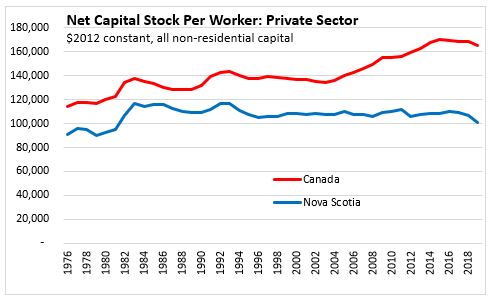

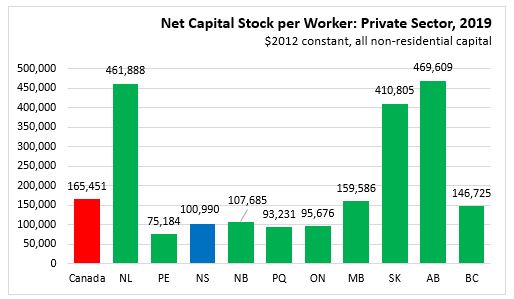

Over the long run, Nova Scotia's real private sector investment per worker has been below national average. In previous years, Nova Scotia real investment per worker has been short of the national average as investment projects in resource-rich provinces outpaced non-resource provinces. The net capital stock per worker for the private sector was $100,990 in Nova Scotia in 2019 compared to the national average of $165,451.

Among provinces, Alberta, Saskatchewan and Newfoundland and Labrador all had substantially higher capital stock per worker, concentrated in resource industries.

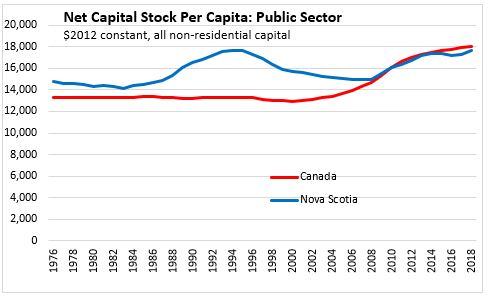

Public capital stock per capita has been more equal across the country. Nova Scotia's public capital stock per resident was $17,920 in 2019 while the national average was $18,180. Alberta had the highest public capital stock at $25,050 while Prince Edward Island had the lowest at $15,439.

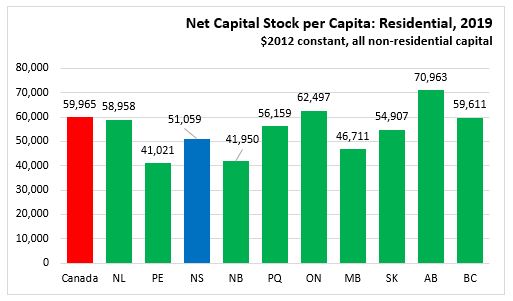

Residential capital stock per capita has been rising steadily, reaching $51,059 in Nova Scotia and $59,965 in Canada for 2019. The highest residential capital stock per capita was in Alberta at $70,963 while the lowest was in Prince Edward Island at $41,021.

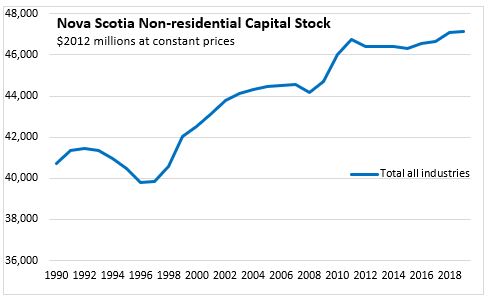

There has been considerable change in the net non-residential capital stock available for Nova Scotia industries. Overall net capital stock increased from 1997-2007 and again from 2009-2011. There was a period where net capital stock was stable as investment in new assets only kept pace with depreciation. Since 2015, there has been a gradual increase in net non-residential capital stock.

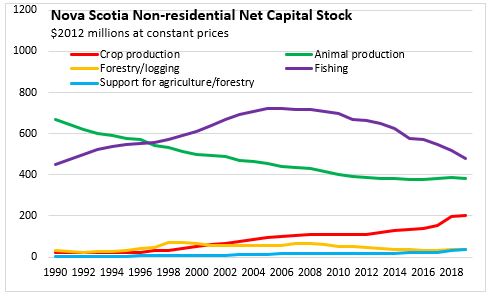

Among agriculture, forestry and fishing, the bulk of capital stock is found in the fishing and animal production industries. Capital stock in the fishing industry increased steadily through 2006 but has been declining since then. Capital stock in animal production had been on a lengthy decline before starting to stabilize in recent years. Although smaller, there has been a steady rise in capital stock in the crop production sector. Forestry/logging industry capital stock has been declining steadily.

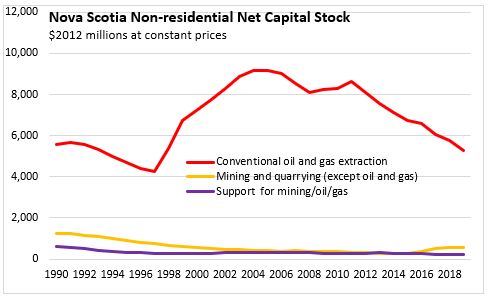

The largest net capital stock among any industry in Nova Scotia is found in the oil and gas extraction industry - mostly in engineering assets and intellectual property products. Declines in the net stock of engineering assets for existing fields has contributed to a large decline in overall oil/gas industry assets despite increasing intellectual property assets resulting from exploration activities.

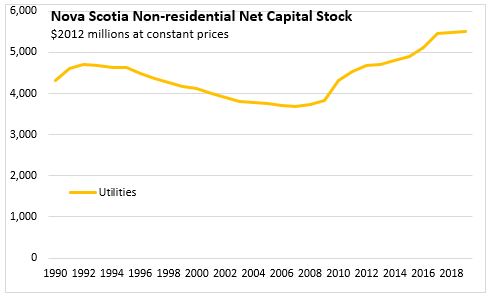

After declining in the 1990s and early 2000s, there has been a rebound in the net capital stock of Nova Scotia's utilities industries.

After a long rise in net capital stock for the construction sector, the capital stock has declined in recent years.

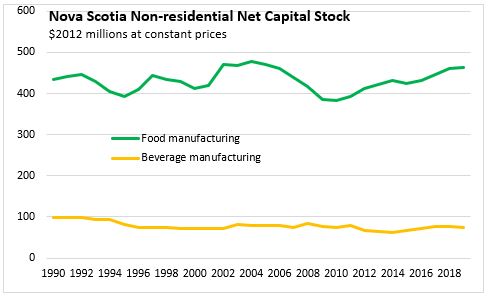

Among manufacturing industries, net capital stock has recently been growing in the food manufacturing sectors.

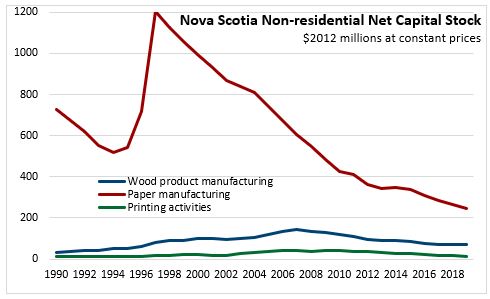

Capital stock in the forest products sector has been in sharp decline, particularly for the paper sector after the installation of the new paper machine at Port Hawkesbury in the late 1990s. The decline in wood product industry capital stock started more recently in 2007.

Among other large industrial manufacturers, there was a large decline in capital stock for petroleum/coal products manufacturing coinciding with the closure of the Dartmouth refinery. There have been steady declines in capital stock for plastics/rubber products producers as well as chemical manufacturers.

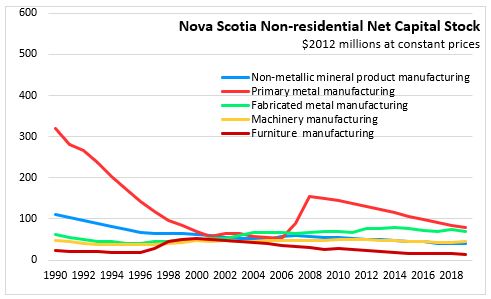

There have been declines in net capital stock among several other smaller manufacturing industries, though there have been periodic increases in capital stock for primary metal manufacturing and fabricated metal manufacturing.

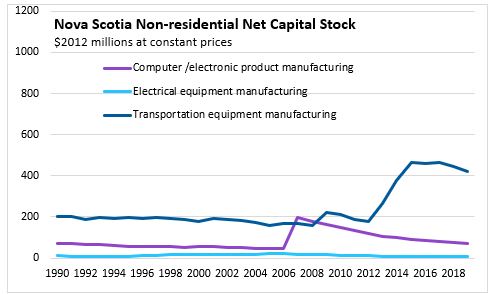

The reconstruction of the Halifax Shipyard is evident in the rise of net capital stock in transportation equipment manufacturing.

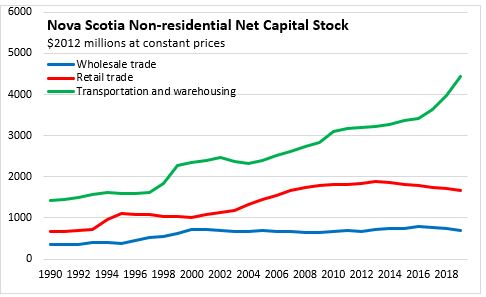

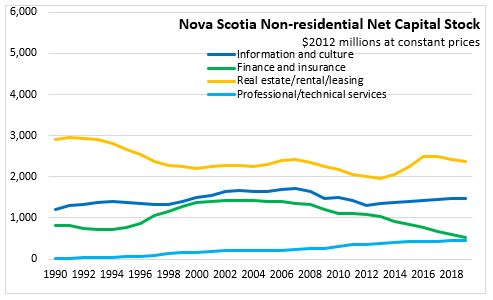

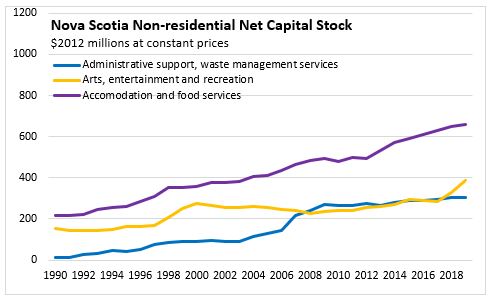

Goods sectors are more capital intensive than service-producing industries. However, service industries are generally larger than goods, which make up less than 20 per cent of Nova Scotia's provincial GDP. Net capital stock has been rising in many service sectors, notably transportation, information/culture (recent), professional/technical services, administrative support/waste management, accommodation/food and arts/entertainment/recreation (recent). Although retail trade and finance/insurance reported increasing capital stock in the early 2000s, there have been declines in recent years. The wholesale trade industry's net capital stock has been stable since 2000.

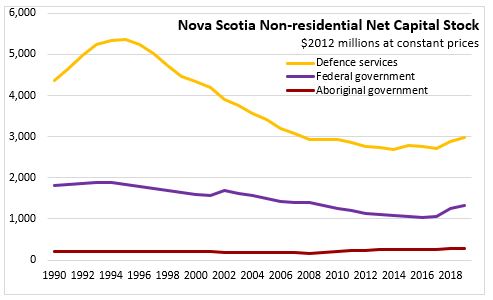

Within the government sector, there has been a notable decline in net capital stock for defence services as well as for other Federal government services since the 1990s. Net capital stock among aboriginal government services has been increasing for the last 10 years.

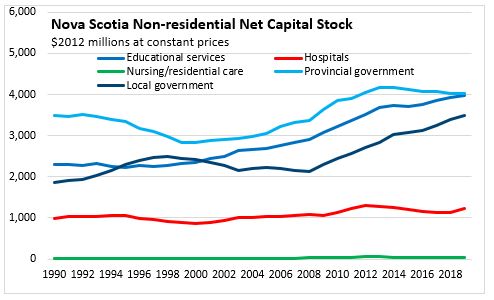

Among provincial and local government services, there have been gradual declines in provincial government and hospital capital stock (increased in 2019) but increases in local government and educational capital stock.

Source: Statistics Canada. Table 36-10-0096-01 Flows and stocks of fixed non-residential capital, by industry and type of asset, Canada, provinces and territories (x 1,000,000); Table 36-10-0099-01 Flows and stocks of fixed residential capital by type of asset, provincial and territorial (x 1,000,000); Table 14-10-0027-01 Employment by class of worker, annual (x 1,000); Table 17-10-0005-01 Population estimates on July 1st, by age and sex

<--- Return to Archive