The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

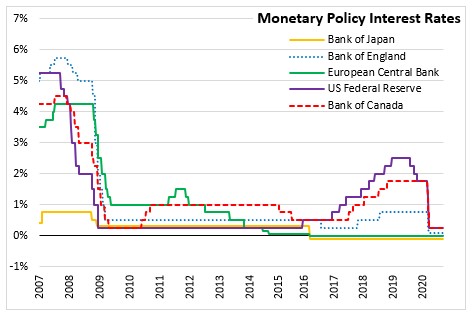

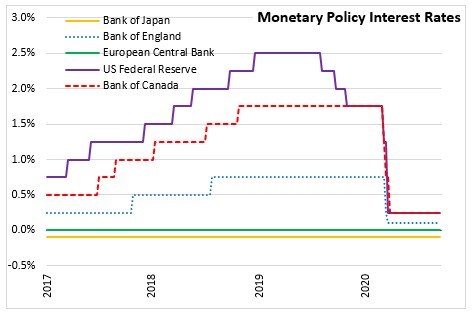

December 09, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at the effective lower bound of 0.25 per cent in its scheduled interest rate announcement today. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent. The Bank is also continuing its quantitative easing (QE) program, with large scale asset purchases of at least $4 billion per week of Government of Canada bonds.

Economic activity both in Canada and globally continued to rebound as anticipated in the Bank of Canada’s October Monetary Policy Report (MPR). While the recent increase in the number of cases is expected to slowdown economic recovery, news of the development of an effective vaccine is expected to signal that pandemic related measures will end and economic activity will resume to more normal levels. Near term, accommodative monetary and fiscal policies will provide support to households and businesses across the world.

Economic activity in Canada rebounded sharply with a 40.5% growth (seasonally adjusted annual rate) in the third quarter of 2020. This rebound was consistent with the Bank’s expectations following the decline in the second quarter. Recovery in the labour market continues as Canada has recovered 81% (2,431 million) of April peak employment losses (-3,004 million) as of November. However, economic recovery remains uneven across different sectors.

The Bank expects economic momentum in the forth quarter to be stronger than expected in the October MPR. However, a new round of restrictions announced in several provinces to contain the second wave of the pandemic could weight on recovery in the first quarter of 2021. It is expected that the federal government’s stimulus measures will help support economic recovery until a vaccine is widely available.

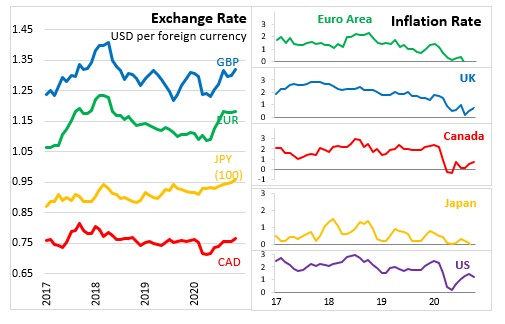

With stronger demand pushing up prices for most commodities, CPI inflation in Canada increased 0.7% in October 2020. Measures of core inflation have been below 2 per cent, consistent with an economy where demand has fallen by more than supply. The Bank expects economic slack to weigh on inflation over the near term.

The Bank notes that extraordinary monetary policy support is needed to keep Canada’s economic recovery on its track. The Bank reconfirmed its commitment to hold the policy rate at the effective lower bound until economic slack is absorbed, and the 2 percent inflation target is sustainably achieved. The October MPR expects these conditions to continue until into 2023. The QE program currently in place will continue until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.

The next scheduled date for announcing the overnight rate target is January 20, 2021. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

Bank of Canada: Rate announcement

<--- Return to Archive