The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 04, 2021BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary announced that it would maintain Bank Rate at 1.0% at its Monetary Policy Committee (MPC) meeting today.

In addition, the MPC decided to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion and the target for the stock of government bond purchases at £875 billion. The total target stock of asset purchases will be maintained at £895 billion.

Since the MPC’s November Monetary Policy Report (MPR), start of Covid vaccination programs in several countries around the world has improved the economic outlook. However, recent increases in the number of COVID cases including newly identified strains of virus and the associated restrictions have weighted on economic recovery both in the UK and globally.

The Bank notes that while the pace of UK GDP growth slowed in the fourth quarter of 2020, economic activity is projected to increase to around 8% below the level it was in Q4 2019. This level is stronger than projected in the November MPR with activity less affected by the new round of restrictions as more businesses were better prepared compared to the initial lockdown period.

The Bank projects UK GDP to fall by around 4% in the first quarter of 2021. This level of economic activity will be about 12% below its Q4 2019 level. As the COVID vaccine rollouts continue to ease containment measures, UK’s GDP is projected to reach to pre-COVID levels over 2021.

The outlook for the economy remains highly uncertain and will depend mainly on the evolution of the pandemic, measures taken to protect public health and the responses of households, businesses and financial markets to these developments. In the MPC’s central projections, restrictions on economic activity in the UK are assumed to ease over Q2 and Q3, and to have unwound fully by the end of the third quarter.

In addition, the new Trade and Co-operation Agreement with the European Union have been in place since January 1, 2021. It is expected that the new trading agreement will results in some barriers to trade and will result in lower trade in both goods and services between the UK and EU. The Bank projects both trade and economic activity to be lower in the first half of 2021 as firms adjust to the new agreement. The reduction in exports and the impact on domestic supply chains is projected to lower GDP by around 1% in 2021 Q1. However, the impacts of the new agreement are expected to dissipate by the end of the second quarter.

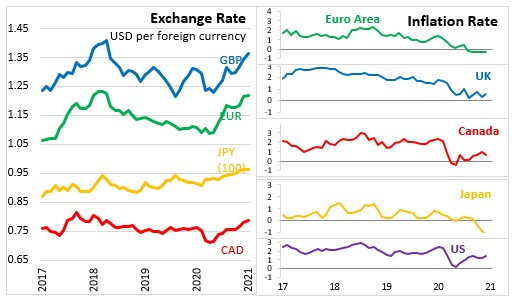

CPI inflation increased 0.6% in December 2020, up from a 0.3% increase recorded in November. The Bank estimates CPI to remain around this rate in January and February 2021 before increasing over the rest of the first half of 2021. The increase in CPI will be mainly due to recent rises in oil and gas prices, and the temporary cut to VAT in hospitality sector due to end in April 2021.

The Committee notes that it will continue to monitor the situation carefully and stands ready to take whatever additional action is ready to achieve its target. The Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably. The next scheduled date for MPC announcement on bank rate is March 18, 2021.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report February 2021

<--- Return to Archive