The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 05, 2021SURVEY ON BUSINESS CONDITIONS, IMPACT OF COVID-19: Q1 2021 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has conducted a fourth iteration of the Canadian Survey on Business Conditions. From January 11 to February 11 Statistics Canada surveyed businesses to collect information on the pandemic's impact and on businesses' expectations moving forward. Additional details are available for businesses by majority ownership and international activities.

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business, by ownership and by international activities. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances.

Business expectations

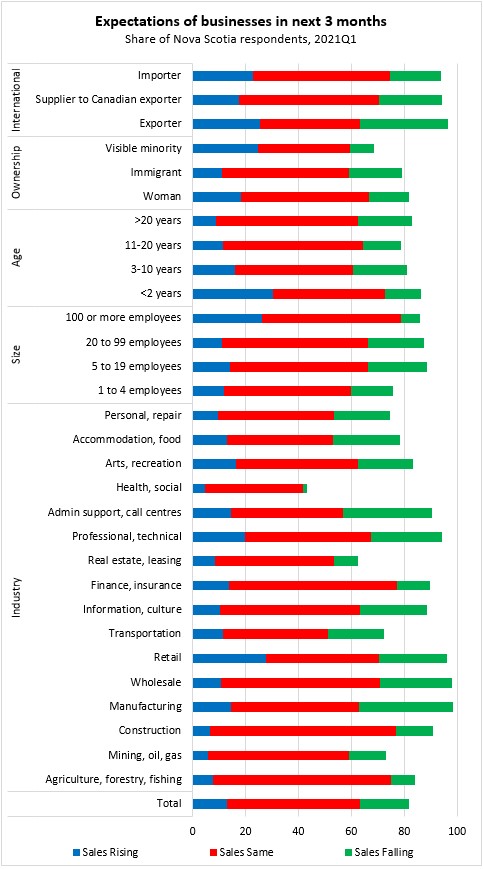

Most Nova Scotia businesses expect stable or rising sales in the next three months, though a notable portion (18.6%) expect falling sales. Expectations of declining sales were more prevalent among manufacturers, wholesalers, information/culture businesses and administrative support/call centre businesses.

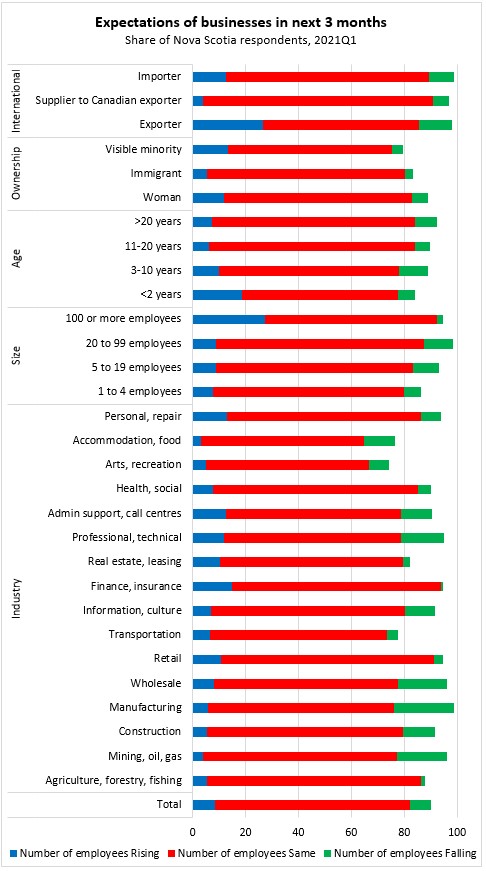

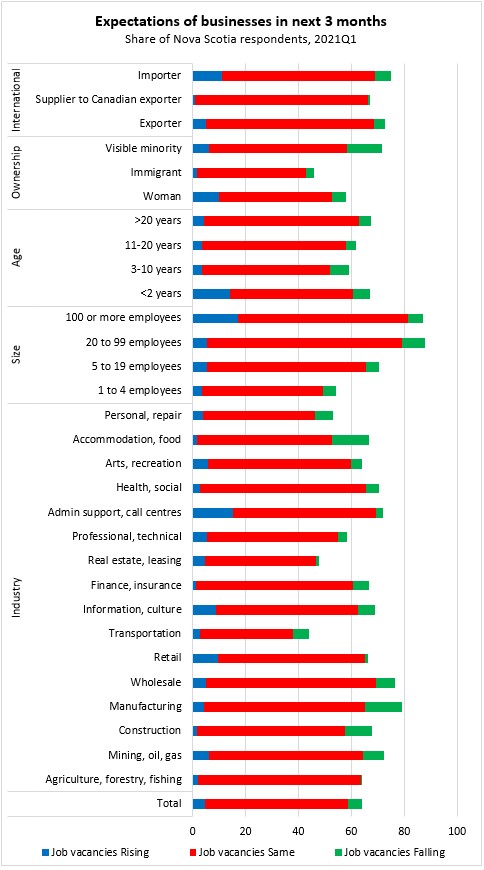

Employment and job vacancies are also expected to remain stable for the majority of businesses in most industries in the coming three months. A higher portion of businesses in manufacturing and wholesale trade expect declining employment.

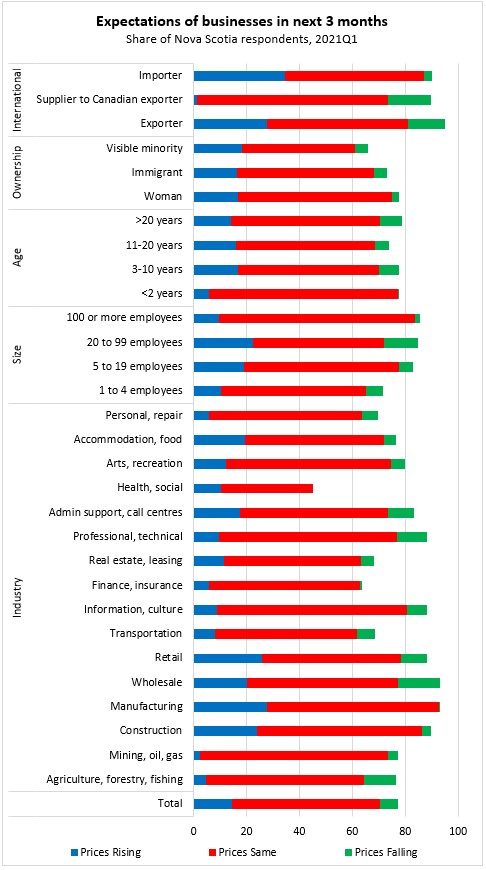

More than 70% of businesses anticipate stable or rising output prices.

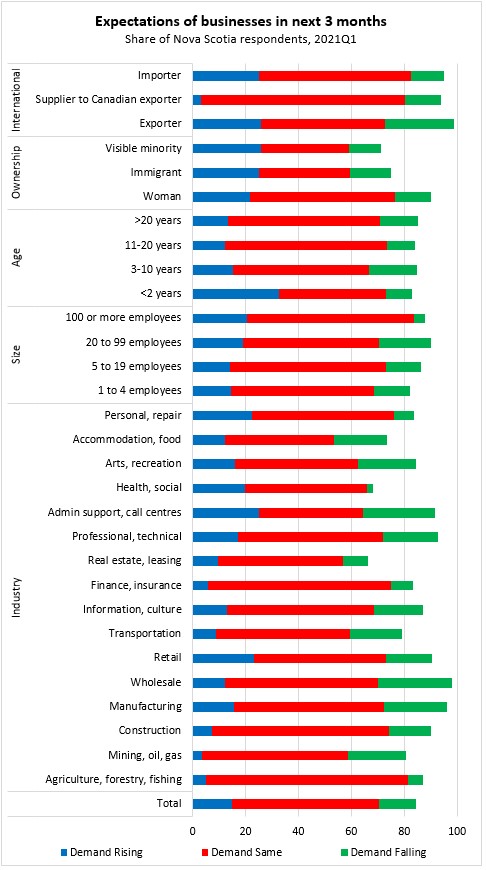

Demand is also expected to be stable or rising for over 70% of Nova Scotia businesses in the next three months. There were a larger portion of Nova Scotia businesses expecting declining demand in manufacturing, wholesale, admin support/call centres, professional/technical services and arts/recreation.

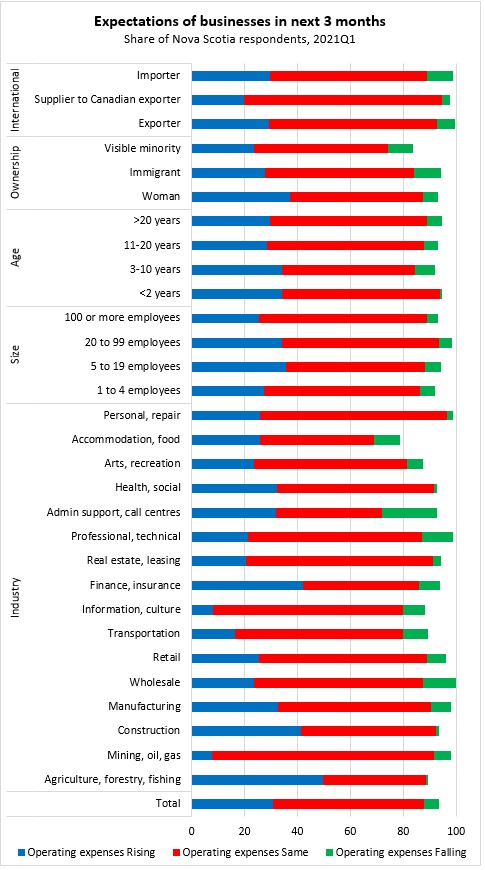

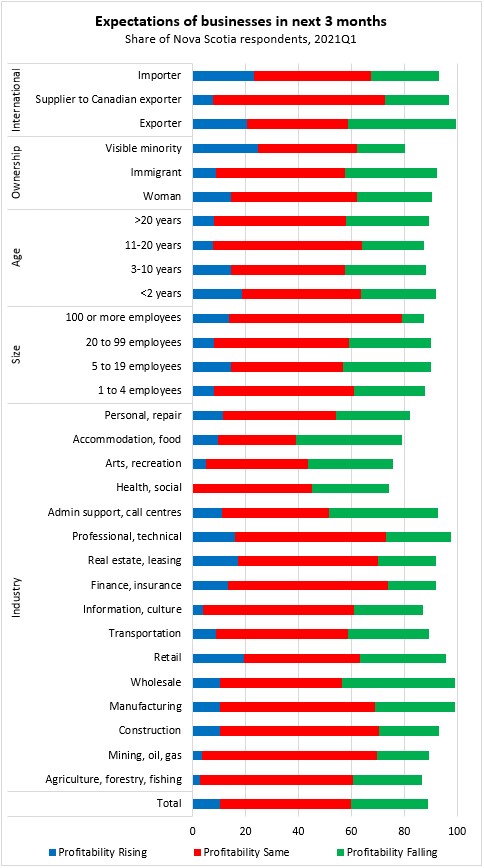

About 75% of Nova Scotia businesses report expectations of stable or rising operating income. However, over 30% also report rising operating expenses. Overall profitability is expected to decline among 29.1% of businesses while it remains stable for 49.3%.

Capital expenditures are projected to rise for 14% of businesses and to stay the same for 58%. Just under 10% of businesses expect declining capital expenditures.

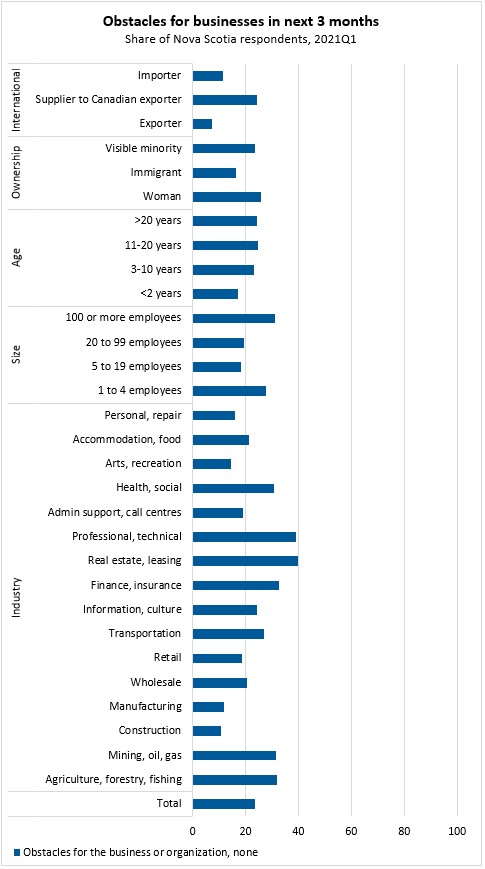

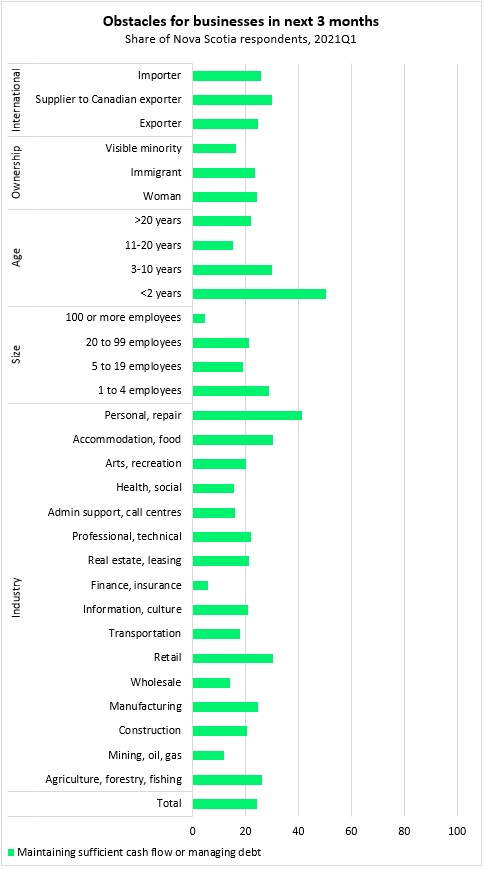

Obstacles for businesses

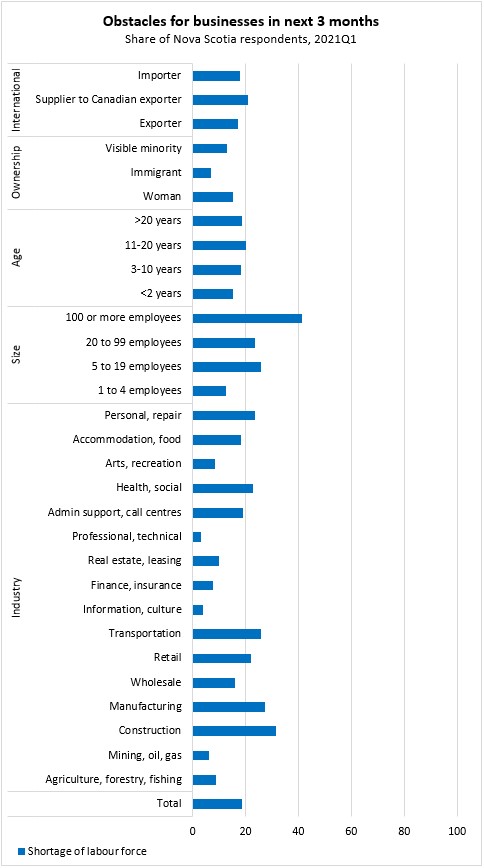

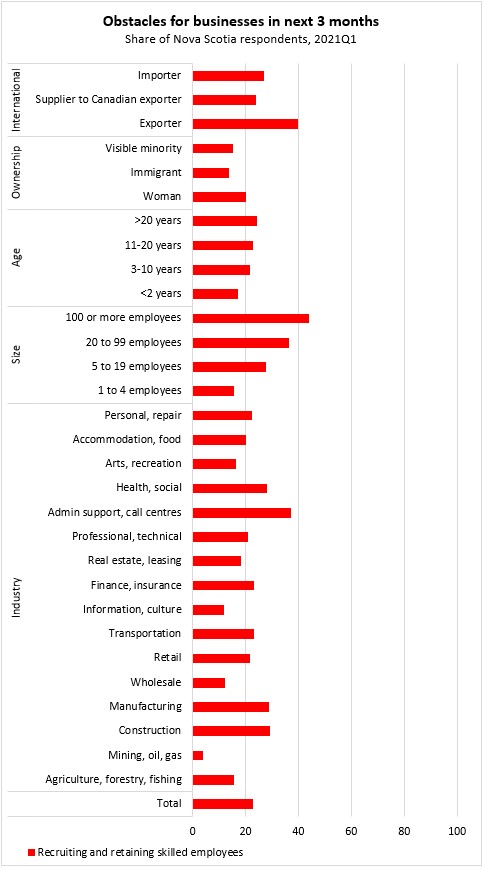

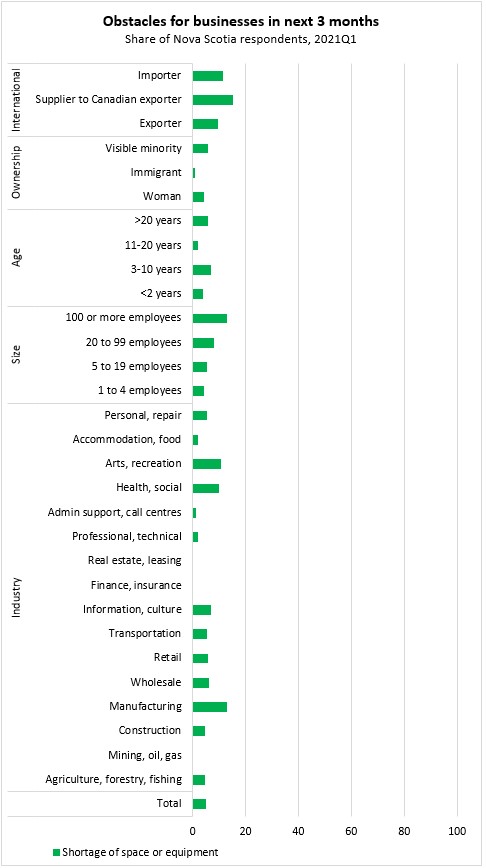

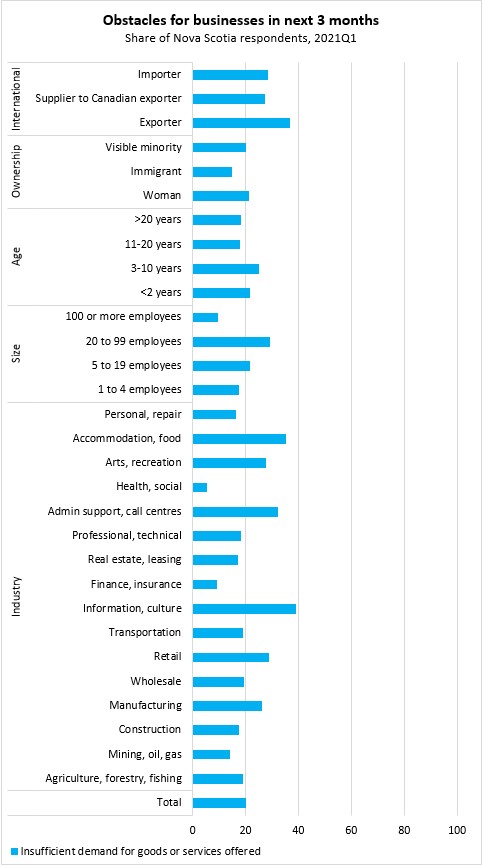

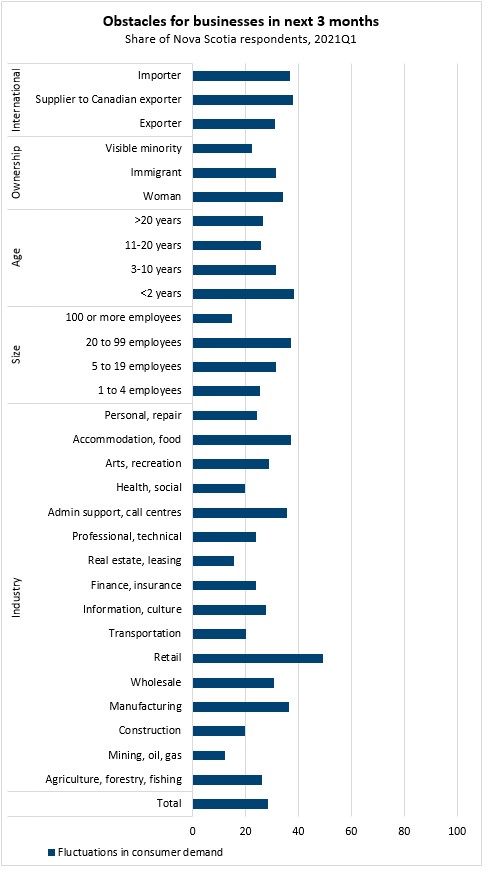

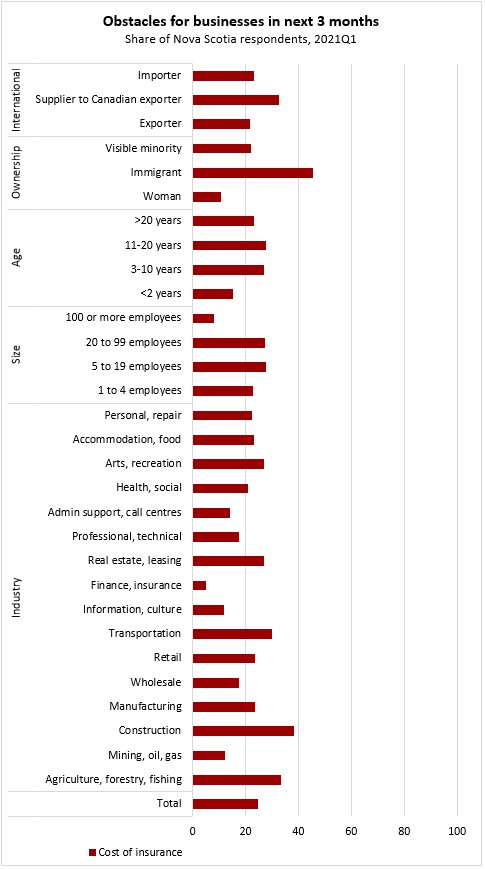

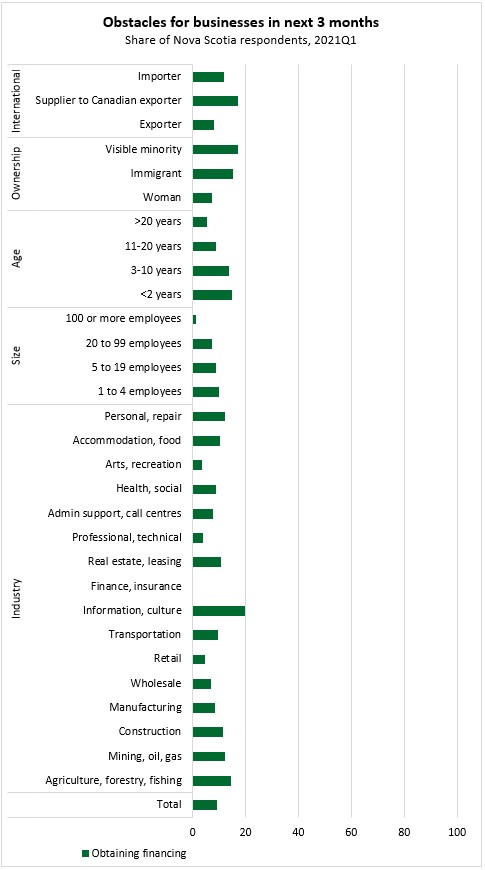

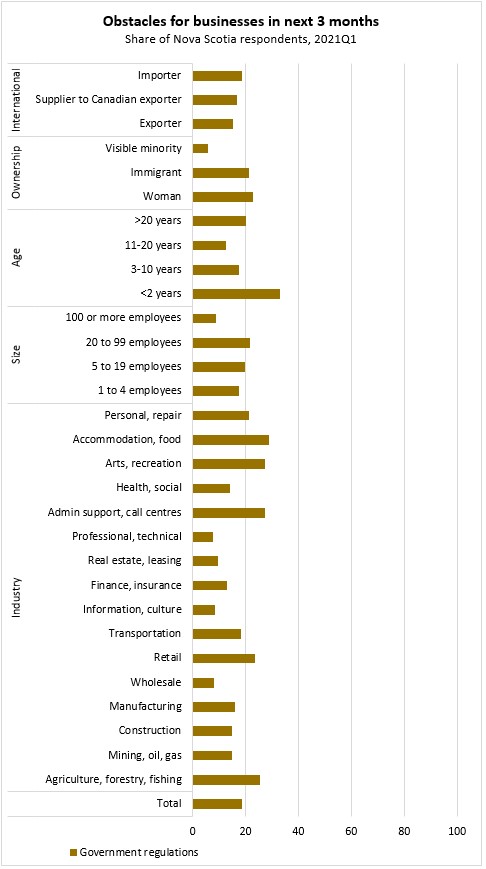

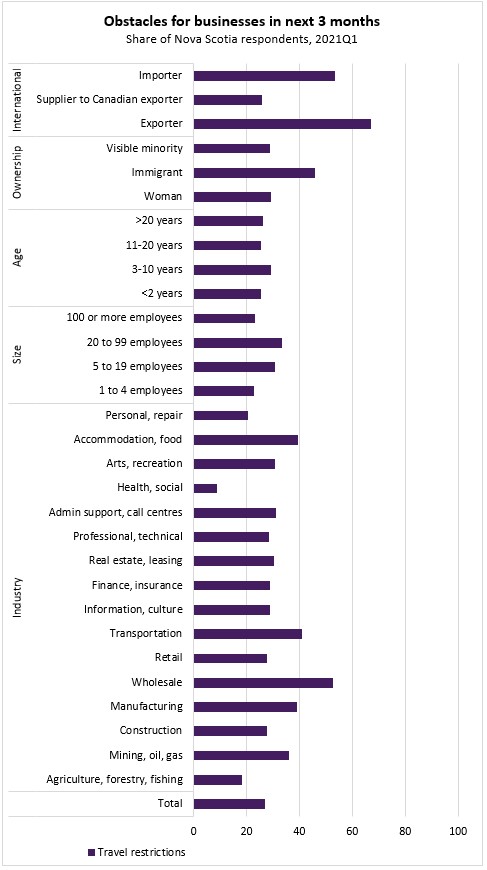

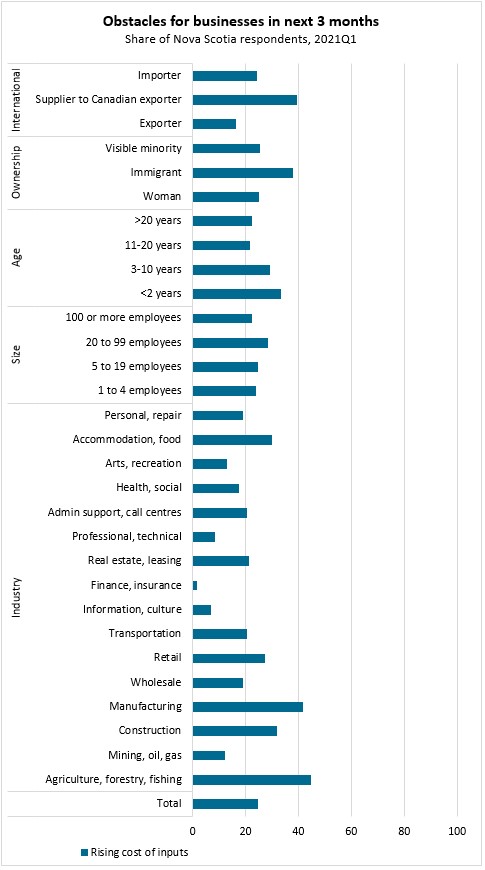

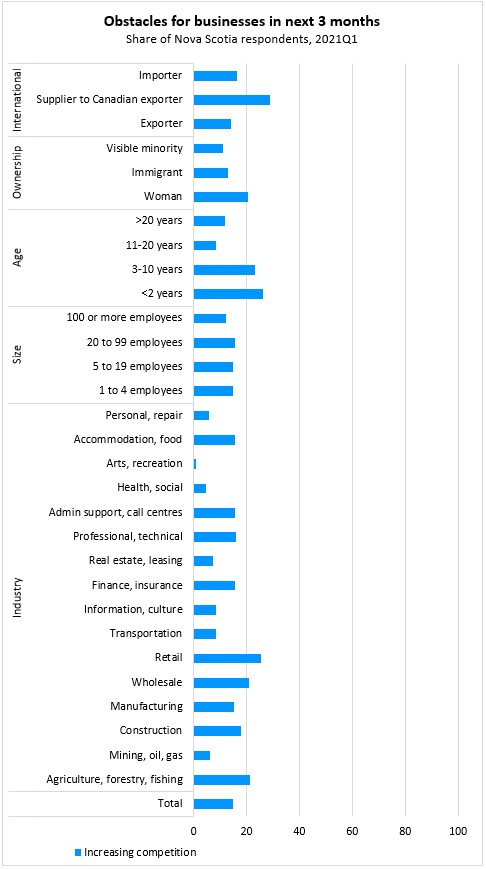

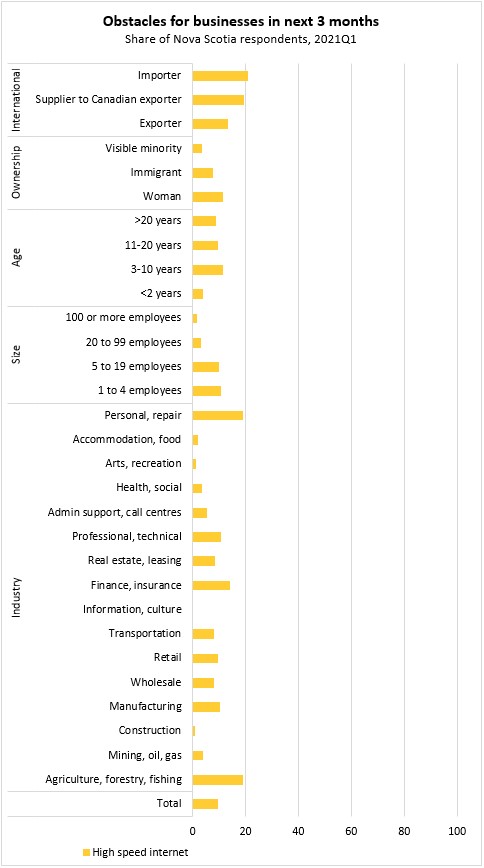

In the next 3 months, 23.6% of businesses expect no obstacles. However, many report obstacles from fluctuating demand (28.5%), travel restrictions (26.8%), supply chains (26.3%), rising input costs (24.8%), cost of insurance (24.7%), maintaining cash flow/sustaining debt (24.4%), recruiting skilled employees (22.7%), insufficient demand (20.7%), labour shortage (18.7%) and government regulations (18.6%). Lower portions of businesses expect obstacles with space shortages, inventory levels, obtaining financing, exporting, high speed internet and intellectual property protections.

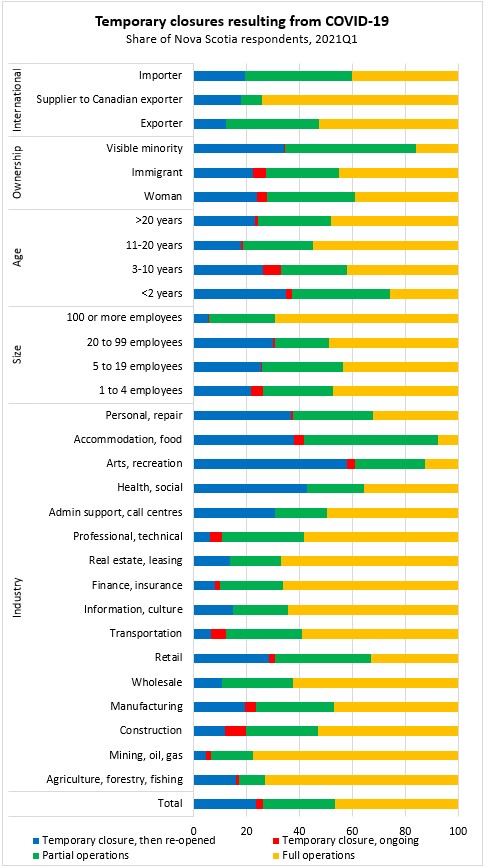

Temporary closures and re-openings, plans for sale/closure

Over the course of the pandemic, 46.7% of Nova Scotia businesses maintained full operations while 27.2% maintained partial operations. Among Nova Scotia businesses, 23.6% reported a temporary closure as well as subsequent re-opening while 2.6% report ongoing closures. Closures were notably more prevalent among health/social businesses (which includes daycares), arts/recreation, accommodation/food and personal/repair services. Closures were also more prevalent among newer businesses as well as among businesses whose owners identify with a visible minority population.

In the next year, 78.3% of businesses report no plans to close, sell or transfer the business.

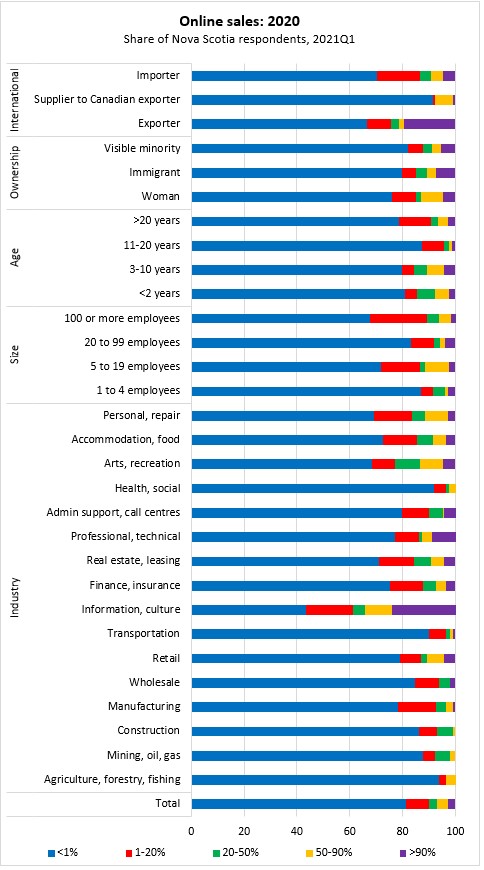

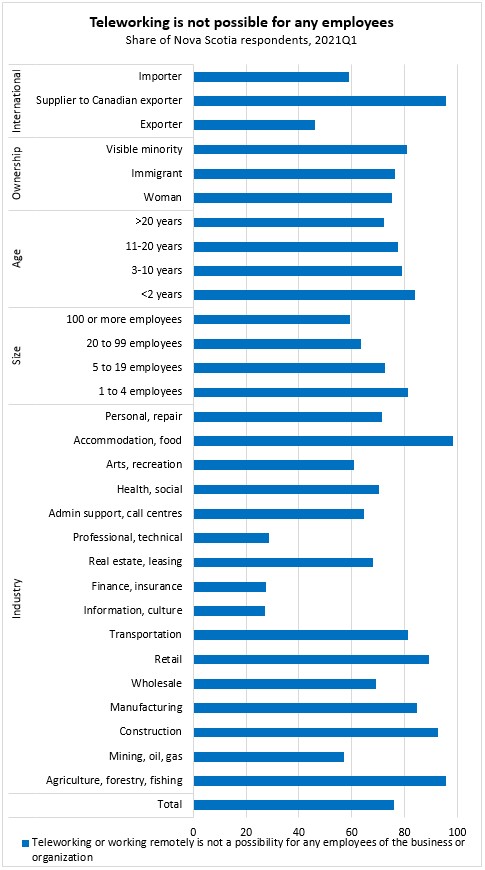

Online sales and telework

Over 80% of businesses report few online sales. Exporters and information/culture businesses are the exception, reporting a larger portion of online sales in 2020.

Telework is not an option for employees of 75.9% of Nova Scotia businesses. However, telework is a notably more common possibility for those who work in finance/insurance, professional/technical services, information/culture as well as among exporters.

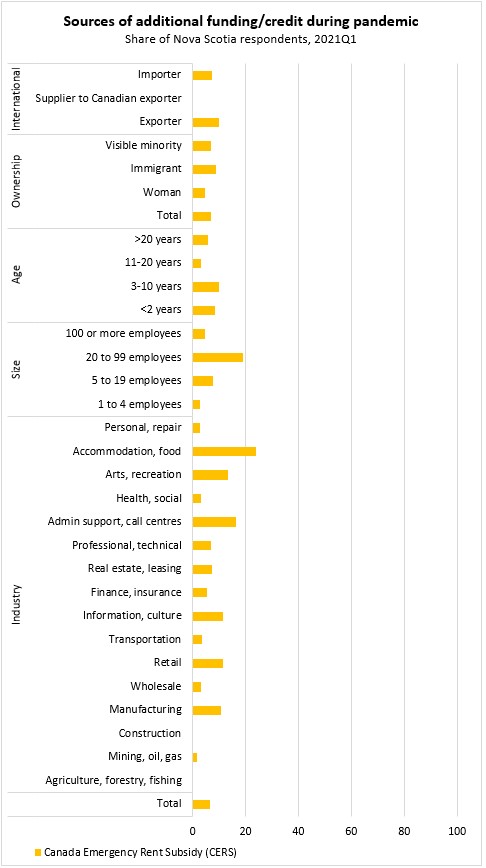

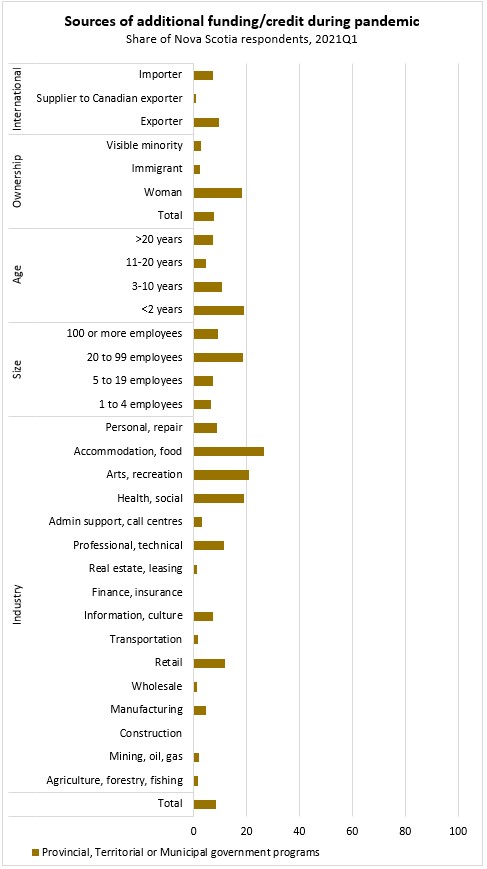

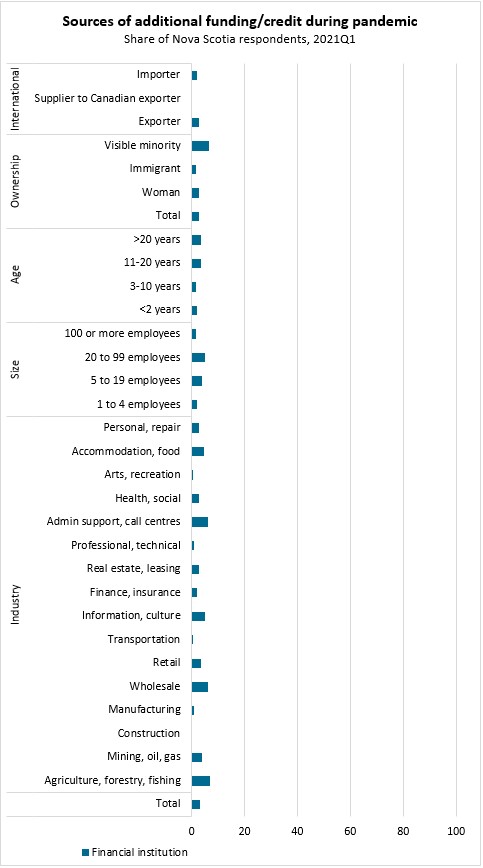

Sources of additional funding or credit

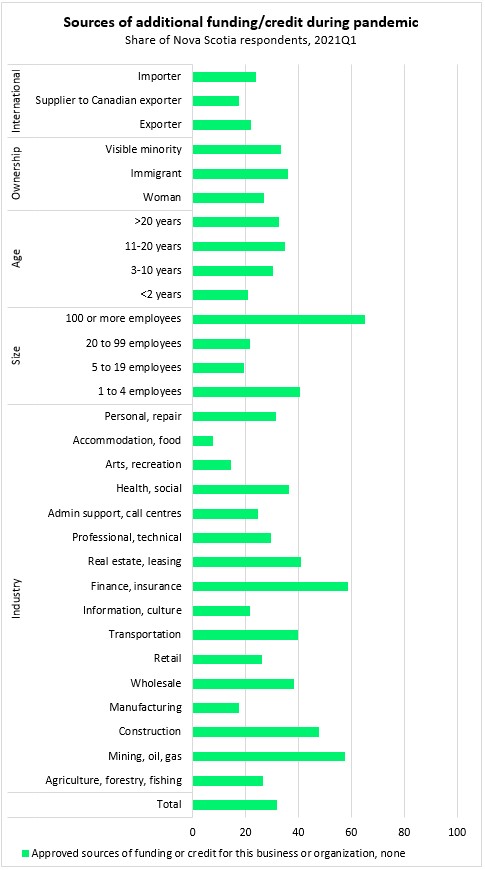

Among Nova Scotia businesses, 31.8% reported no sources of additional funding or credit during the pandemic.

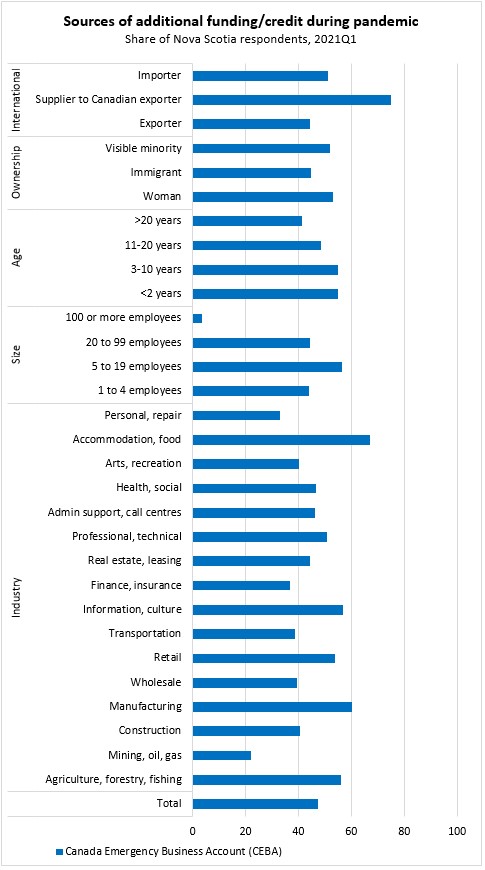

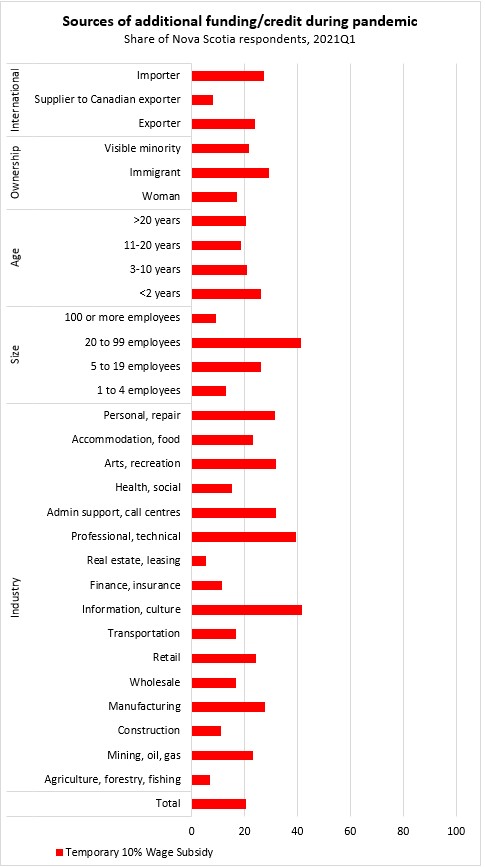

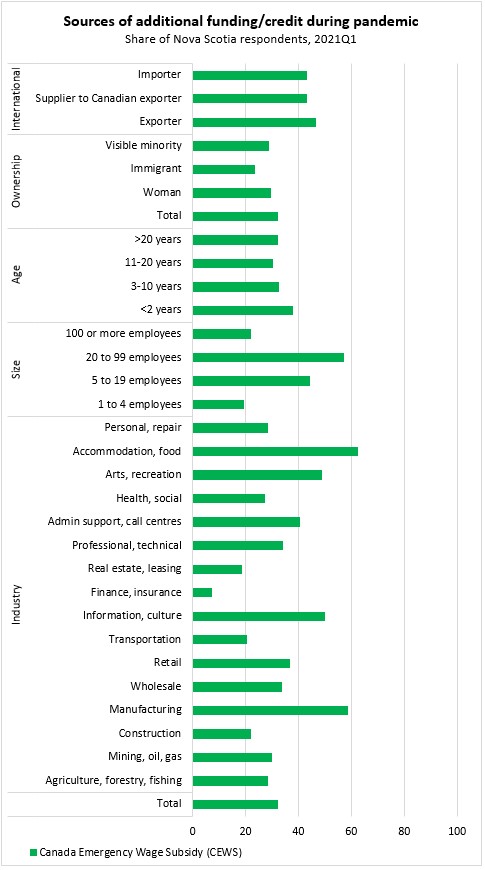

From additional funding sources available, the highest uptake was reported for the Canada Emergency Business Account (47.4%), the Canada Emergency Wage Subsidy (32.3%) and the temporary 10% wage subsidy (20.5%). Use of provincial supports was reported by 8.3% of Nova Scotia businesses, but much of this support was targeted to specific industries, particularly accommodation/food, arts/recreation and health/social. Uptake of Federal rent supports, innovation assistance, regional relief as well as Export Development Corporation and Business Development Bank of Canada financing was very low.

In addition, only 3.1% of Nova Scotia businesses sought additional funding from a financial institution. Just over one third (33.5%) of Nova Scotia businesses report that they cannot take on more debt, while 38.3% report potential to take on more debt.

Sources:

Statistics Canada. Table 33-10-0307-01 Business or organization expectations over the next three months, by business characteristics

Table 33-10-0308-01 Business or organization obstacles over the next three months, by business characteristics

Table 33-10-0309-01 COVID-19 impact on business or organization status, by business characteristics

Table 33-10-0311-01 Plans to transfer, sell, or close business, by business characteristics

Table 33-10-0316-01 Percentage of total sales made online in 2019 and 2020, by business characteristics

Table 33-10-0320-01 Approved funding or credit due to the COVID-19 pandemic, by business characteristics

<--- Return to Archive