The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

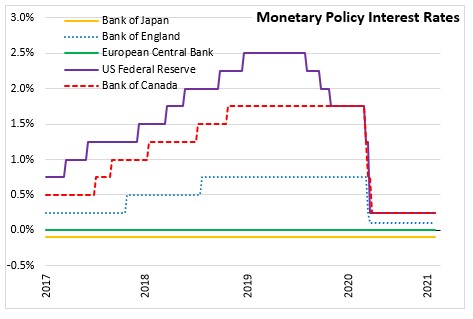

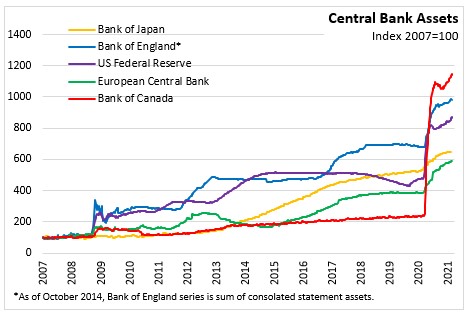

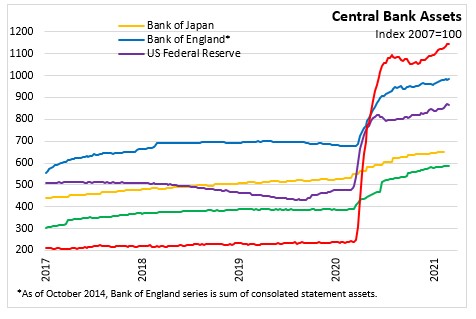

March 10, 2021BANK OF CANADA MONETARY POLICY The Bank of Canada announced today that it will hold its target for the overnight rate at the effective lower bound of 0.25%, with the Bank rate at 0.50% and the deposit rate at 0.25%. The Bank also noted that it is maintainin its forward guidance and quantitative easing program at its current pace of at least $4 billion per week.

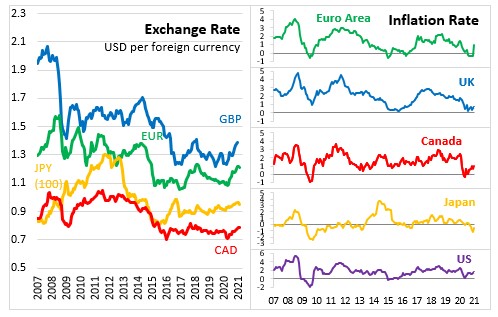

Economic activity both in Canada and globally continues to recover from the depths of the COVID-19 pandemic although the recovery is uneven across regions and sectors. With ongoing government support, global financial conditions remain highly accommodative.

In Canada, the resurgence of COVID-19 and containment measures have slowed down economic recovery. However, recent economic indicators signal continued economic activity across sectors that do not rely heavily on personal interactions. Canada's economy grew 9.6% in the final quarter of 2020 supported mainly by gains in inventory accumulation. The Bank now expects Canadian economy to see a positive growth in the first quarter of 2021 which is an upgrade compared to a decline projected in the January Monetary Policy Report.

With stronger demand pushing up prices for most commodities, CPI inflation in Canada increased 1.0% in January 2021. The Bank expect inflation to temporarily move close to the 3.0% range over the next few months reflecting base-year effects from price declines in some goods and services experienced at the beginning of the pandemic last year. Additionally recent increases in oil prices are expected to put upward pressure on inflation. However, the Bank projects inflation to moderate as base-year effects dissipate. Measures of core inflation have been fluctuating between 1.3% and 2.0%.

The Bank notes that extraordinary monetary policy support is needed to keep Canada’s economic recovery on its track. The Bank reconfirmed its commitment to hold the policy rate at the effective lower bound until economic slack is absorbed, and the 2 percent inflation target is sustainably achieved. The January MPR expects these conditions to continue until into 2023. The QE program currently in place will continue until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.

The next scheduled date for announcing the overnight rate target is April 21, 2021. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

Bank of Canada: Rate Announcement

<--- Return to Archive