The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

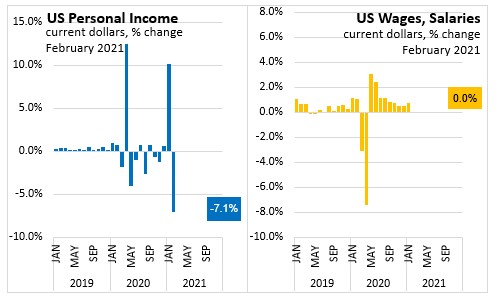

March 26, 2021US PERSONAL INCOME AND OUTLAY, FEBRUARY 2021 Personal Income (Feb 2021 vs Jan 2021, seasonally adjusted annualized $values)

The US Bureau of Economic Analysis reported that US personal income declined $1,516.6 billion, or 7.1% from the previous month in February 2021. The decline in personal income was mainly due to the decrease in government social benefits to persons.

US personal disposable income declined $1,532.3, or 8.0% over the same period. In real per capita terms, US disposable personal income declined 8.2% in February.

US personal consumption expenditures were down $149.0 billion or 1.0% in February.

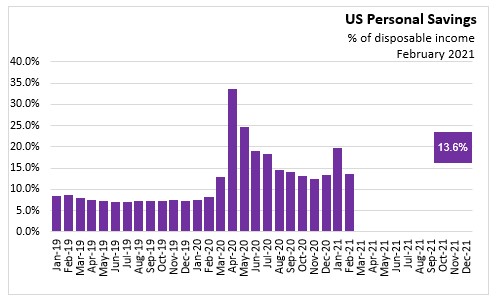

Personal savings (disposable personal income minus personal consumer expenditures, interest paid, and transfers to government and the rest of the world) declined $1,390.9 billion month-over-month to $2,410.4 trillion in February. The personal savings rate was 13.6% of disposable income in February 2021.

QUOTATIONS

COVID-19 Impact on February 2021 Personal Income and Outlays

The estimate for February personal income and outlays was impacted by the continued government response to COVID-19. Economic impact payments associated with the Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act of 2021 (which was enacted on December 27, 2020) declined sharply in February and unemployment benefits continued, but at a lower level. Additionally, restrictions and closures continued in some areas of the United States. The full economic effects of the COVID-19 pandemic cannot be quantified in the personal income and outlays estimate because the impacts are generally embedded in source data and cannot be separately identified. For more information, see “Effects of Selected Federal Pandemic Response Programs on Personal Income.”

The decrease in personal income in February was more than accounted for by a decrease in government social benefits to persons. Within government social benefits, “other” social benefits, specifically the economic impact payments to households, decreased. The CRRSA Act authorized a round of direct economic impact payments that were mostly distributed in January.

Source:

US Bureau of Economic Analysis. Press release, February 2021

US Bureau of Economic Analysis. retrieved from FRED, Federal Bank of St Louis, Table 2.6. Personal Income and Its Disposition, Monthly NIPA, Monthly

<--- Return to Archive