The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

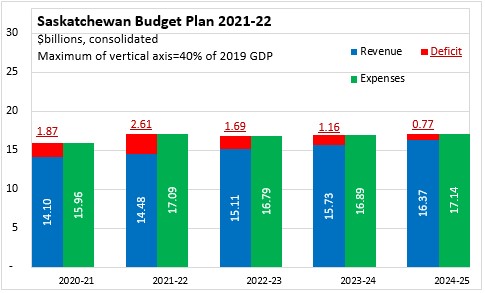

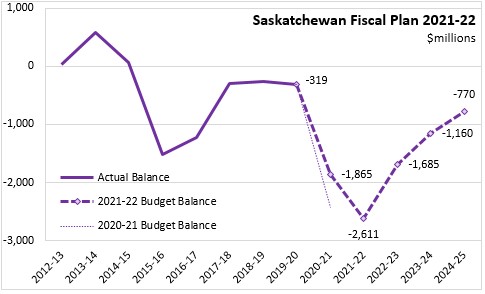

April 07, 2021SASKATCHEWAN BUDGET 2021-22 Saskatchewan's 2021-22 Budget estimates a deficit of $2.61 billion in 2021-22, up from $1.87 billion forecast for 2020-21. Over the next three fiscal years, Saskatchewan's budget deficits are projected to narrow, but not to close. The Saskatchewan Budget is not expected to be balanced until 2026-27.

In its 2020-21 fiscal plan, the Province of Saskatchewan presented its expectation of near term revenue declines and expenditure increases associated with the COVID-19 pandemic. The 2021-22 fiscal plan updates and extends these projections. Revenue declines in 2020-21 were milder than anticipated, while expenditures grew somewhat more slowly. In 2021-22, revenues are projected to recover almost to their 2019-20 levels, but expenditure growth accelerates. In the next three fiscal years, expenditures are projected to fall and then rise while revenues continue to grow at a steady pace.

Saskatchewan's budget deficit improved to $1,865 million for 2020-21, which is smaller than anticipated in the 2020-21 Budget. Saskatchewan's budget deficit is expected to peak at $2,611 million in 2021-22 before narrowing in subsequent fiscal years.

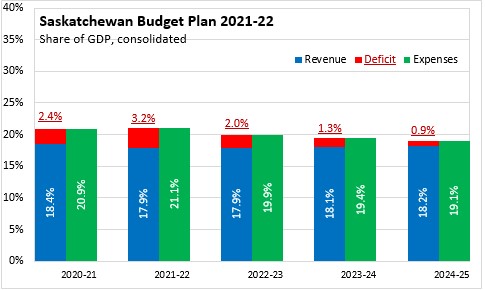

Saskatchewan's budget deficit is expected to peak at 3.2% of GDP in 2021-22 before falling to 0.9% by 2024-25 as the deficit declines and the economy grows again.

The footprint of Saskatchewan's government relative to its GDP is expected to peak at just over 21% in 2021-22 before falling to just above 19% by 2024-25 as the economy recovers while expenditure growth is limited.

Saskatchewan's net debt is forecast to have risen to 19.0% of GDP at the end of 2020-21. In 2021-22 this is projected to rise to 21.7%. In the subsequent three fiscal years, Saskatchewan's debt is projected to rise to 26.3% of GDP.

As a commodity-producing region, Saskatchewan's economy faced dual shocks from both COVID-19 as well as the decline in oil investment that followed the steep drop in oil prices in 2020. Saskatchewan's real GDP is estimated to have fallen by 4.2% in 2020 (7.8% in nominal terms). As commodity markets recover and high crop yields are sustained, Saskatchewan's real GDP is expected to rebound with growth of 3.4% in 2021 (5.9% nominal) and 3.2% in 2022 (4.1% nominal). Rising business and consumer confidence is expected in the near term with continued vaccine rollout.

Key Measures and Initiatives

Saskatchewan's 2021-22 Budget prioritizes protecting the population from COVID-19, building infrastructure for public service and growing the economy as the world recovers from COVID-19.

Key initiatives include:

- $90 million for COVID-19 response (vaccination, protective equipment, lab capacity, physician costs)

- Increased mental health and addiction funding of $23.4 million (to $458 million)

- Hiring 100 continuing care aides

- $3.1 billion in capital investments

- $174.8 million for a 10% electricity rebate

- $285 million Auto Fund Recovery Rebate

- Establishing international trade and export offices in China, India, Japan and Singapore

- Royalty relief for methane emission reduction programs.

- Extending the Home Renovation Tax Credit to include expenditures made in 2022

- Reinstating the Active Families Benefit ($150/year per child)

- The small business tax rate (set to 0% on October 1, 2020) will be returned to 1% on July 1, 2022 and to 2% on July 1, 2023

- Extending the Technology State-up Incentive through 2025-26

- Introducing a new Vapour Products Tax and adding a heat-not-burn category to the tobacco tax to bring these products in line with existing tobacco taxes

- Adding a tax of $150 per year for electric vehicles to equalize contributions to road infrastructure with internal combustion vehicles that pay fuel taxes

Saskatchewan Budget 2021-22

<--- Return to Archive