The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

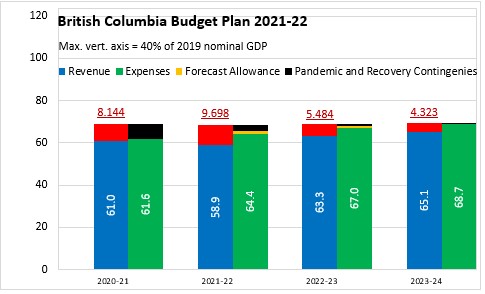

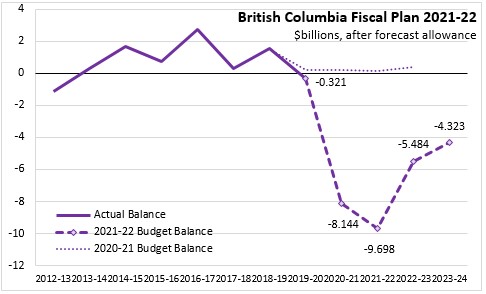

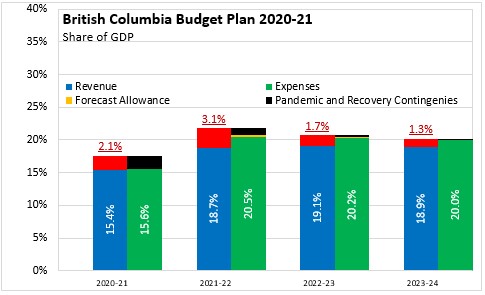

April 21, 2021BRITISH COLUMBIA BUDGET 2021-22 British Columbia has tabled its 2021-22 Budget, with a deficit estimates at $9.698 billion (3.1% of GDP), up from $8.144 billion (2.1% of GDP) estimated for the 2020-21 fiscal year. For 2021-22, the British Columbia government includes $3.25 billion in pandemic and recovery contingencies as well as a $1 billion forecast allowance. In the 2020-21 results, there was a $7.51 billion pandemic and recovery contingency. After 2021-22, the British Columbia Budget plan shows narrowing deficits, but there remains a deficit of $4.323 billion (1.3% of GDP) in 2023-24.

British Columbia expects that its Budget will be balanced in the 7-9 year time horizon (2028-29 to 2030-31).

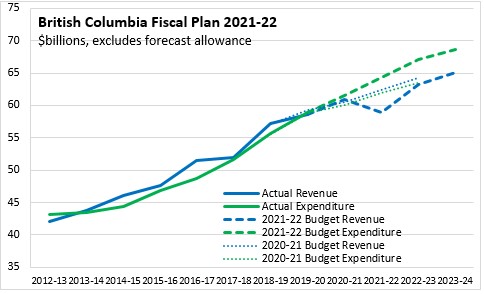

British Columbia's 2020-21 fiscal plan was published prior to the full understanding of the impacts of COVID-19 on the Province's fiscal situation. British Columbia's revenues for 2020-21 are currently forecast to be higher than anticipated in the 2020-21 Budget. However, revenues estimated for 2021-22 are now substantially lower than expected in last year's plan. British Columbia's expenditures are now estimated to be considerably higher than anticipated in the previous budget.

Where British Columbia's 2020-21 Budget anticipated a series of small surpluses, the 2021-22 Budget projects larger deficits.

The size of the British Columbia government in the provincial economy is projected to rise to 20.5% of GDP in 2021-22. This is projected to decline slightly to 20.0% by 2023-24.

British Columbia's 'taxpayer-supported' debt was 15.0% of GDP at the end of 2019-20. In 2020-21, this increased to 20.3% of GDP. For 2021-22, taxpayer-supported debt is projected to increase again to 22.8% of GDP. By 2023-24, British Columbia's taxpayer-supported debt is expected to be 26.9% of GDP.

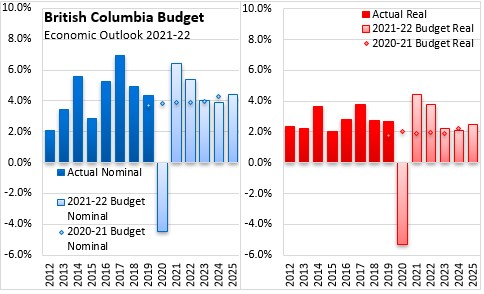

British Columbia's economy is expected to report a similar shock and rebound as many other economies affected by COVID-19. British Columbia's current economic outlook anticipates that real GDP fell by 5.3% in 2020 and is poised to rebound with gains of 4.4% in 2021 and 3.8% in 2022. Consumer confidence and restoration of export markets are expected to be the drivers of economic growth once the population is largely vaccinated (assumed by September 2021). This outlook has been tempered with an elevated level of prudence (0.5% in 2021 and 2022) compared with the private sector consensus, reflecting significant uncertainty about the course of the pandemic, vaccination and variants of the virus.

Key Measures and Initiatives

British Columbia's Budget priorities fall into four areas: Supporting People and Families, Protecting Health and Safety, Helping Businesses Through the Pandemic and Strong Economic Recovery.

Supporting People and Families:

- Doubling $10/day child care spaces and increasing the wage enhancement for child educators to $4/hour.

- Providing free public transportation for children under 12

- Adding $60 million to fund Indigenous participation in land and resource activities

- $59 million for Indigenous health services

- $175/month increases to income and disability assistance

- Doubling the Senior's Supplement

Protecting Health and Safety

- COVID-19 vaccinations, testing/tracing and screening for long term care facilities

- $585 million for hiring 3,000 health care workers

- $45 million to address systemic racism against Indigenous peoples in the health care system

- $97 million to build mental health supports for youth

- $330 million for substance-use treatment and recovery

Helping Businesses Through the Pandemic

- Many business support initiatives were announced last fall in the StrongerBC Economic Recovery Plan

- $100 million in additional support for tourism recovery, including anchor attractions

- $20 million for community destination development grants

- Doubling the Arts Infrastructure Program

- Supporting hospitality industries with $50 million in Circuit Breaker Business Recovery Grants and a cap on fees charged to restaurants by delivery companies

Strong Economic Recovery

- $40 million for high speed internet and cellular coverage in rural and remote communities

- $83 million in operating and capital funding for BC Parks to expand trails/campsites and backcountry infrastructure

- $30 million for initiatives to celebrate the 150th anniversary of BC's entry into confederation

- $500 million over 3 years for the InBC Strategic Investment Fund to attract high growth businesses and talent to the province

- $506 million to reduce emissions, invest in clean energy/technology and prepare for climate change

- $130 million for initiatives to support zero emissions transportation (rebates, active transportation, hydrogen economy)

- $160 million for cleantech and industrial emissions reductions

British Columbia Budget 2021-22

<--- Return to Archive