The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

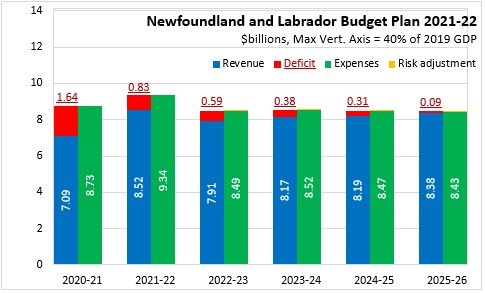

June 01, 2021NEWFOUNDLAND AND LABRADOR BUDGET 2021-22 The Province of Newfoundland and Labrador has tabled its 2021-22 Budget (the last provincial budget for this fiscal year). Newfoundland and Labrador anticipates a deficit of $826 million in the 2021-22 fiscal year. Deficits are projected to decline in the following four fiscal years.

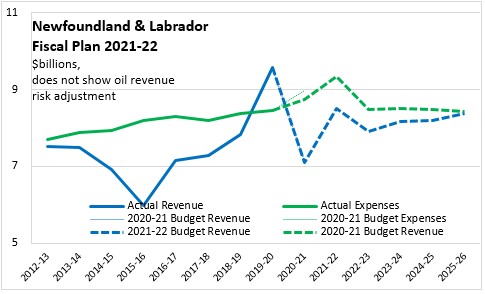

Newfoundland and Labrador's 2020-21 Budget was released after the declaration of the COVID-19 and its short run projections showed an increase in expenditures and a sharp decline in revenues.

Part of the decline in revenues in 2020-21 was attributable to a one-time payment from the Federal government recorded in the 2019-20 fiscal year. However, there were also notable declines in income and sales taxes as a result of the pandemic. Although total revenues are expected to rebound by over $1.4 billion in 2021-22, they are projected to decline again by $600 million in 2022-23. More stable revenue growth is projected to emerge thereafter.

Newfoundland and Labrador's expenditures are expected to rise by $600 million in 2021-22 as the province continues to respond to the pandemic. However, expenditures are projected to decline by $859 million in 2022-23 and are projected to be even lower by 2025-26.

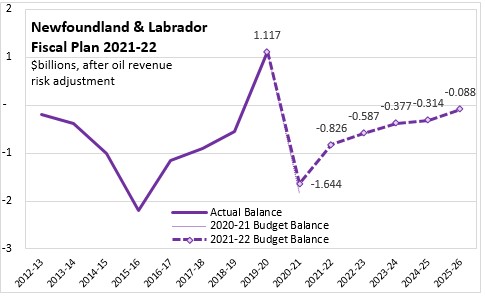

Newfoundland and Labrador's deficit peaked at $1.644 billion in 2020-21. In 2021-22, this deficit is expected to be halved and further improvements are projected in the next four fiscal years.

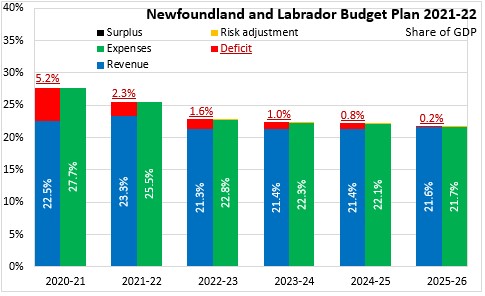

Measured as a share of GDP, the footprint of provincial government amounts to 27.7% of the provincial economy. As nominal GDP recovers after the COVID shock and rebound in oil prices, the provincial goverment share of GDP is projected to narrow to 25.5% in 2021-22. Limited expenditure growth and rising nominal GDP are projected to further reduce the footprint of Newfoundland and Labrador's government to 21.7% of GDP by 2025-26.

Newfoundland and Labrador's deficit amounts to 2.3% of GDP in 2021-22, down from 5.2% in 2020-21. In the next two fiscal years, Newfoundland and Labrador's deficit is projected to shrink to less than 1% of GDP.

Newfoundland and Labrador's net debt as a share of GDP was 46.3% at the end of the 2018-19 fiscal year. The one-time Federal payment made in 2019-20 improved the Province's fiscal position to a surplus of over $1.1 billion and reduced the debt to GDP ratio to 42.2% by the end of 2019-20.

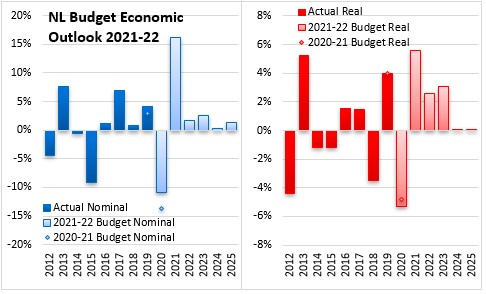

Newfoundland and Labrador's economy is very senstitive to oil investment and production activity. The 2021-22 Budget assumes a near term oil price of USD $64/bbl and a slight decline in subsequent years. The outlook for Newfoundland and Labrador's economy anticipates a rebound along with vaccine rollout and easing of travel restrictions in 2021. Increased iron ore production and commodity prices are also expected to contribute to a 5.6% increase in real GDP in 2021. After declining in 2021, capital investment is projected to grow again in 2022 as oil investments re-start after suspension. Newfoundland and Labrador's real GDP is projected to rise by 2.6% in 2022. Over the medium term, Newfoundland and Labrador's economic growth is expected to slow because of fiscal restraint as well as a weak outlook for major project spending (unless additional oil exploration and development projects are approved).

Key Measures and Initiatives

After the recent election, Newfoundland and Labrador's provincial government received the report of the Premier's Economic Recovery Team. This report made several recommendations to modernize government and services to address the Province's fiscal challenges. Newfoundland and Labrador's 2021-22 Budget commits the Provincial government to additional consultations on the report, but makes some commitments to improving the province's fiscal position:

- introduction of balanced budget legislation with a return to balance in 5 years (in 2026-27)

- increasing personal income tax rates for those earning over $135,974 (currently taxed at marginal rates of 17.3% up to $190,363 and 18.3% on income over this amount). There will be tax brackets for those earning between $135,974 and $190,363 (17.8% marginal rate), those earning between $190,364 and $250,000 (19.8% marginal rate), those earning between $250,001 and $500,000 (20.8% marginal rate), those earning between $500,001 and $1,000,000 (21.3% marginal rate) and those earning over $1,000,000 (21.8% marginal rate). These increases are expected to add $15.3 million to provincial revenues.

- evaluating increases to HST

- reorganizing and streamlining NALCOR and reviewing the oil corporation

- reviewing all Crown Corporations and organizations

- reviewing provincial real estate assets, the Liquor Corporation and offshore oil and gas projects

- consolidating the Centre for Health Information, the 911 service and the English School District into government departments

- creating integrated corporate services (payroll, finance, accounting, HR, IT, procurement) for the four regional health authorities

- inviting partnerships for ferry services

- establishing a refundable Physical Activity Tax Credit valued up to $2,000 per family

- implementing a 20 cent/litre sugar sweetened beverage tax as well as increasing tobacco taxes by three cent/cigarette and 6 cent/gram of fine cut

- amending the Memorial University Act to give the institution greater autonomy while eliminating the annual tuition offset over 5 years and freezing expansion of the University's physical footprint

Newfoundland and Labrador Budget 2021-22

<--- Return to Archive