The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

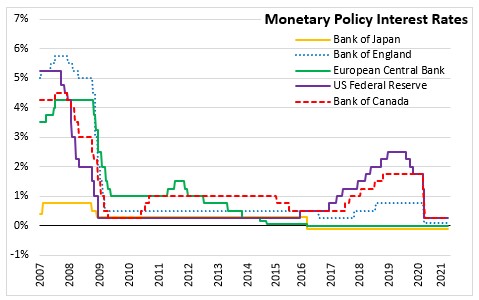

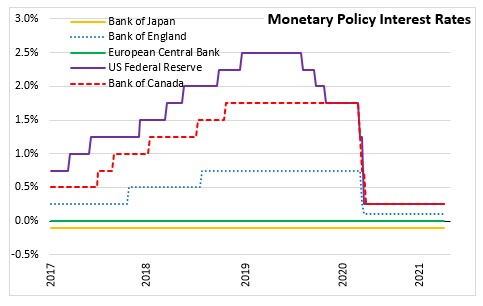

June 16, 2021US MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced that it would keep the target range for the federal funds rate at 0 to 0.25 per cent. The Committee expects to maintain this target rate until labour market conditions are at levels that are consistent with the Committee’s assessment of maximum employment and inflation has risen to 2 per cent and is on track to moderately exceed 2 per cent for a period so that inflation averages 2 per cent over time.

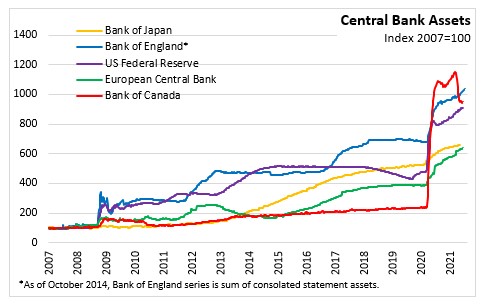

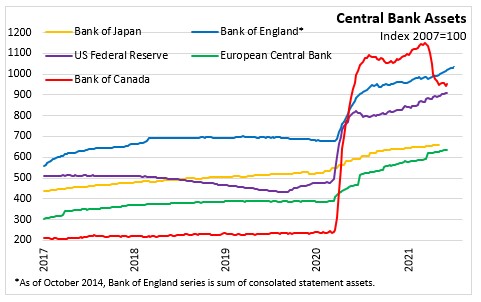

Additionally, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and agency mortgage-backed securities by at least $40 billion per month. The Federal Reserve expects to continue this until substantial progress has been made towards the goals of maximum employment and price stability. This is expected to provide support to the flow of credit to households and businesses and ensure smooth functioning of the financial markets.

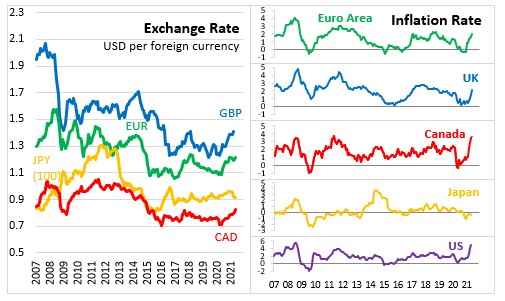

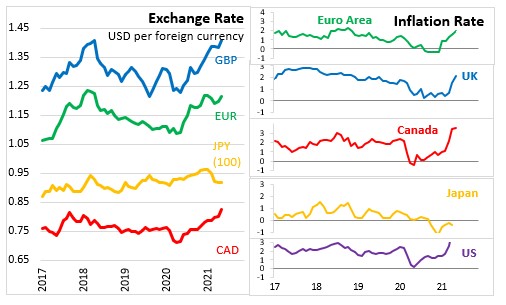

Economic recovery in the United States (US) has gained momentum with progress on vaccinations and continued policy support. While activity in the sectors that rely on personal interactions remain weak, recent economic indicators show improvements. Inflation has also increased in recent months, but the Federal Reserve notes that this uptick is mostly due to transitory factors such as base-year effects. Financial conditions remain supportive given the accommodative policy measures in place to support economic growth and the flow of credit to households and businesses.

It is expected that progress on vaccine rollout will help lift the containment measures and reduce the impacts of the pandemic on the economy, but the path of the recovery is still dependent on the course of the pandemic.

The Federal Reserve projects real GDP will expand 7.0% in 2021 followed by a more moderate growth of 3.3% in 2022 and 2.4% in 2023. Longer-run annual growth rate is projected to be around 1.8%. The Federal Reserve’s June projections for real GDP represents an upgrade from their March projections for 2021 and 2023.

Projections for the unemployment rate are 4.5% in 2021, 3.8% in 2022 and 3.5% in 2023. Inflation rate projections are 3.4% in 2021, 2.1% in 2022 and 2.2% in 2023. The June inflation projections for the forecast period are higher than the March projections. The median Federal Funds rate projection is 0.1% through 2023. The longer-run Federal funds rate is estimated at 2.5%.

The Committee noted that it will continue to monitor the economic situation and is prepared to adjust the monetary policy as needed to achieve maximum employment and inflation at 2 percent over the longer run. The next scheduled FOCM meeting will be held on July 27/28, 2021.

Source: US Federal Reserve, FOMC Statement, Summary of Economic Projections (June 16, 2021)

<--- Return to Archive