The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 14, 2021BANK OF CANADA MONETARY POLICY The Bank of Canada will hold rates at the effective lower bound with the overnight target rate at 0.25%, the Bank Rate at 0.50% and the deposit rate at 0.25%. Reflecting the continued progress in economic recovery, the Bank is adjusting its quantitative easing program with the weekly net purchases of Government of Canada bonds lowered to a target of $2 billion, from the previous target of $3 billion.

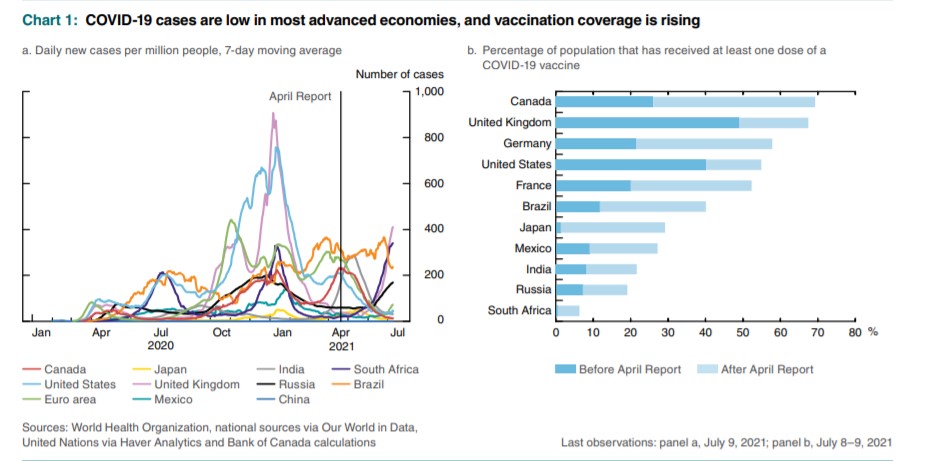

Progress on vaccinations, particularly in advanced economies, is supporting global economic recovery. However, a full and worldwide recovery will be slow as the impacts of the pandemic and vaccination coverage remains uneven across regions. As widespread immunity is expected to take longer in emerging and developing economies, the pace of global economic recovery will be dependent on the health and economic implications of new variants of the virus.

Global Economy

Following a weaker than expected performance in the first quarter of 2021, the global economic recovery is gaining strength. In advanced economies, higher vaccination rates and policy support is providing a solid ground for continued recovery while low vaccination rollout is creating uncertainty for emerging-market economies.

Demand for goods continues to boost manufacturing and trade sectors and support global economic growth. The easing of containment measures in advanced economies resulted in increased spending on services. However, input costs have been on the rise due to supply shortages and have restrained manufacturing production in recent months.

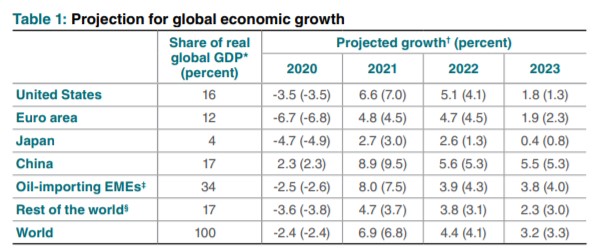

The Bank expects global growth in Gross Domestic Product (GDP) to increase 6.9% in 2021 following a 2.4% contradiction in 2020. Reflecting the fading impacts of policy stimulus, global growth is expected to moderate to 4.4% in 2022 and 3.2% in 2023.

Compared to the April 2021 Monetary Policy Report (MPR), the Bank expects the level of global GDP to be 0.3% higher by the end of 2023. Key factors driving up this upward revision include households in advanced economies using excess savings accumulated during the pandemic to increase spending, and $1.5 trillion in new US government spending over eight years staring in 2022.

In the United States, a quick reopening of economic activities combined with substantial fiscal stimulus in the first half of 2021 supported strong GDP and employment growth. Industrial production has also been increasing despite the global shortages of semiconductors and bottlenecks. The Bank of Canada estimates that US GDP exceeded its pre-pandemic level in the Q2 2021 even though employment remains 7 million lower than pre-COVID levels.

Both total inflation measured by personal consumption expenditure price indexes and core inflation have been above 3.0% in recent months. The increase in core inflation is driven by a surge in demand supported by fiscal support while higher energy prices have boosted total inflation. The Bank of Canada expects US inflation to decrease gradually as the impacts of these temporary factors fade but remain above 2.0% over the 2021-2023 period. Overall, the Bank of Canada projects US GDP to grow 6.6% in 2021, and slow down to 5.1% in 2022 and 1.8% in 2023.

Economic growth in the Euro Area is estimated to gain strength as more businesses started to reopen. Economic recovery is expected to gain momentum in the second half of the year and remain strong in 2022. Total inflation is expected to peak in the second half of 2021 reflecting the impacts of transitionary factors. As the economic recovery continues, core inflation is expected to gradually increase over the next two years.

The containment measures introduced in the first quarter of 2021 slowed growth in China’s economy. Strong manufacturing production and exports are continuing to support economic activity with modest household spending and services sector growth. Consumer price inflation remains low while there have been some increases in producer prices. The Bank of Canada expects China’s GDP to grow 8.9% in 2021 and slowdown to 5.6% in 2022 and 5.5% in 2023 as policy support is gradually withdrawn.

Reflecting the lower vaccination coverage, the emergence of new variants of the COVID-19 virus has resulted in new restrictions in emerging-market economies. This is expected to weigh on economic growth in the second quarter of 2021, especially in India. Given the higher risks of new outbreaks and restrictions, economic recovery is expected to be slow.

Oil prices have been increasing as demand outpaced supply in recent months. The prices of Brent, West Texas Intermediate and Western Canadian Select oil are each $10 higher than in the April MPR report. The Organization of the Petroleum Exporting Countries (OPEC) and some non-OPEC oil producers (OPEC+) increased their production from May to July, and discussed further quota increases Increased demand with the reopening of major economies could push prices higher in the near term. Prices for base metals and agricultural products have also increased modestly since the April MPR report. Non-energy commodity prices are expected to remain elevated over the next two years because of strong global demand.

Canadian Economy

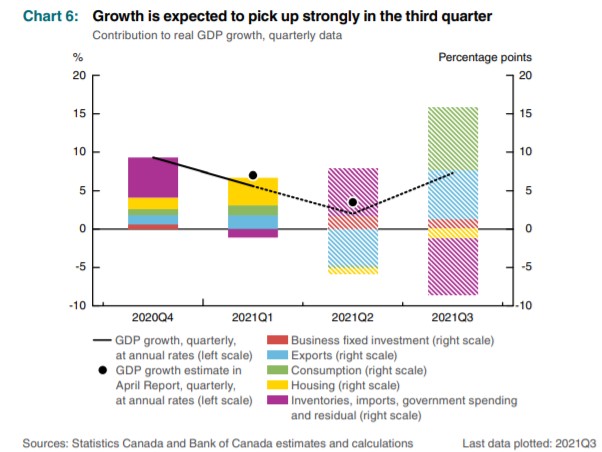

Economic activity in Canada has been weaker than expected in the first half of 2021 as softer housing activity, supply chain problems and the third wave weighted on growth. Containment measures introduced to limit the third wave slowed down economic recovery and caused employment losses in April and May 2021. However, growth is expected to accelerate in the third quarter and finish off the year on strong footing driven by brooder immunity, fewer active cases, and increased easing of restrictions.

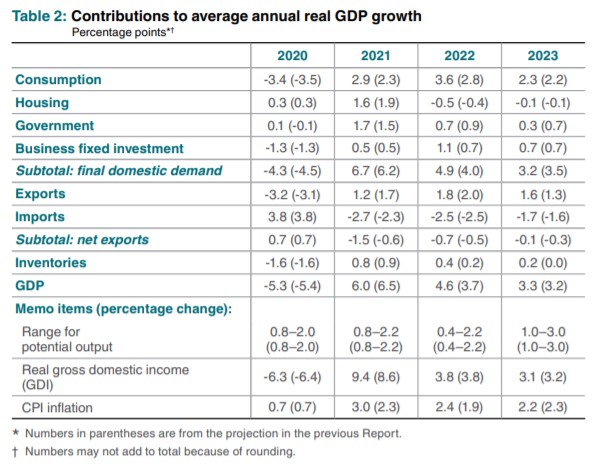

The Bank of Canada notes that consumer confidence is now at its pre-pandemic levels. As the economy continues to reopen and an increased share of population is vaccinated, consumer spending is expected to increase, especially on services such as transportation, recreation, and food and accommodation. Canada GDP is projected to grow 6.0% in 2021, 4.6% in 2022 and 3.3% in 2023.

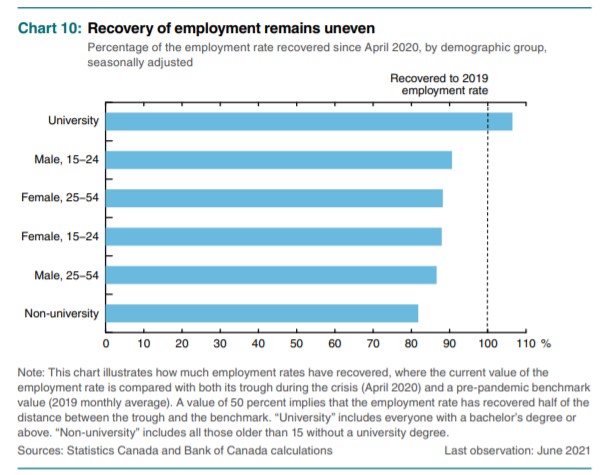

The labour market remains volatile with gains and losses driven mostly by changes in pandemic related restrictions. While a portion of the losses caused by the renewed restrictions in April and May has been recovered in June, the employment rate is still 1.7 percentage points lower than February 2020 level. The Bank of Canada noted that roughly 550,000 additional people would need to be hired to reach the pre-pandemic employment level. The total amount of hours worked in June was about 4.0% below the pre-pandemic level.

Job gains in June were strong for women and young workers but employment of low-wage workers remains far below the pre-pandemic levels. The Bank also noted that the share of unemployed people who have been without a job for 27 weeks or more is at its highest level since the series began. As long-terms of unemployment have been associated with skill erosion and lower attachment to the labour market, continued weakness in the labour market may cause long-term damage, specifically for young people and workers with fewer skills.

The Bank estimates that the output gap to be between -3.0% and -2.0% in Q2 2021. The Bank of Canada notes that a range for the output gap of 1 percentage point has been reported in the MPR for some time but this range may understate overall uncertainty around the output gap given the exceptional circumstances created by the pandemic.

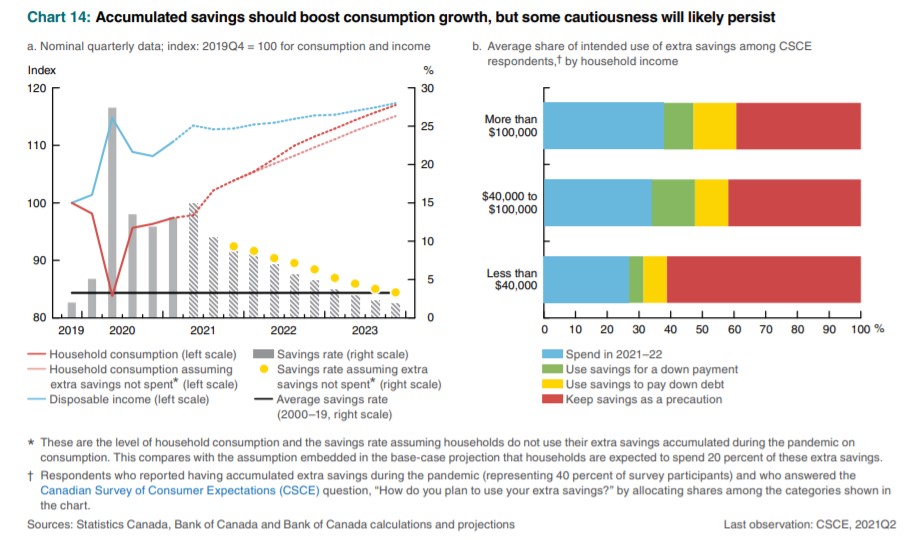

The Bank of Canada expects households to spend 20% of the extra savings they accumulated during the pandemic as the economy continues to reopen. Growth in labour income driven by continued labour market recovery is expected to substitute for declining government transfers. However, some consumers may be slower to resume normal activities even after full reopening and could hold extra savings due to economic concerns.

Housing activity is expected to soften from its recent record-level highs but will remain higher than the pre-pandemic level. The increased demand for single-family homes caused by the pandemic is expected to gradually decline. With increasing population growth, continued recovery in labour market conditions and increased savings, housing demand is expected to remain strong over the next two years. The increase seen in housing prices seen over the last year is expected to moderate as new construction will add to the supply of houses and balance out demand.

Goods exports are expected to strengthen as improved global demand and higher commodity prices offset the negative impact of the recent appreciation of the Canadian dollar. The strong rebound in US industrial productions should provide support to Canadian exports of machinery and equipment, and non-energy commodities. Service exports are expected to rebound strongly from low levels as travel restrictions are lifted but some business travel may not return as technology and behaviour changes could be permanent.

Energy exports are expected to increase over the medium term driven by relatively high oil prices. Existing pipeline and rail transportation capacity combined with the expected pipeline expansions is expected to provide sufficient capacity for increased export volumes.

Excluding oil and gas sector, investment is expected to pickup in 2021 as domestic and global demand increases and business confidence improves. Investments in digitalization, automation and e-commerce may speed up and be permanent – supporting spending in warehousing and logistics but not retail space. Public and private investment is expected to benefit from the measures in the latest federal budget.

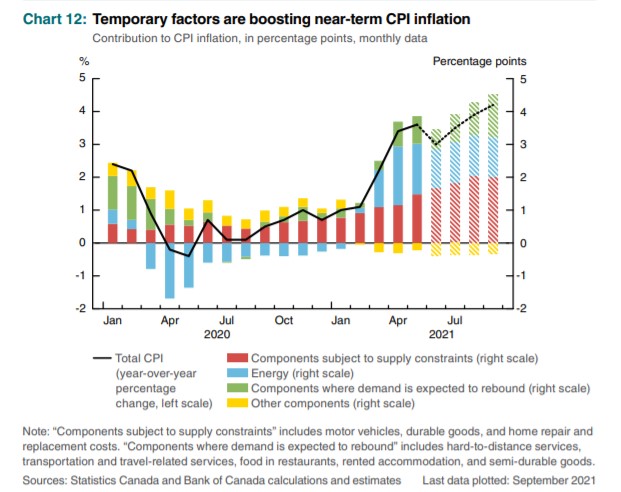

Inflation dynamics over 2020 and 2021 have been highly impacted by the supply and demand imbalances driven by the COVID-19 pandemic. The Bank of Canada notes that it will be hard to predict how the supply and demand imbalances will evolve with reopening of activities and the associated structural changes in the economy.

CPI inflation has been increasing in recent months and is expected to hover around 3.0% range for the remainder of the year. The Bank of Canada notes that this temporary increase in inflation has been driven by three factors; increased gasoline prices from very low levels seen a year ago, recovery in other prices driven by reopening of the economy and pent-up demand, and gains in the prices of goods such as motor vehicles that are cause by supply constraints.

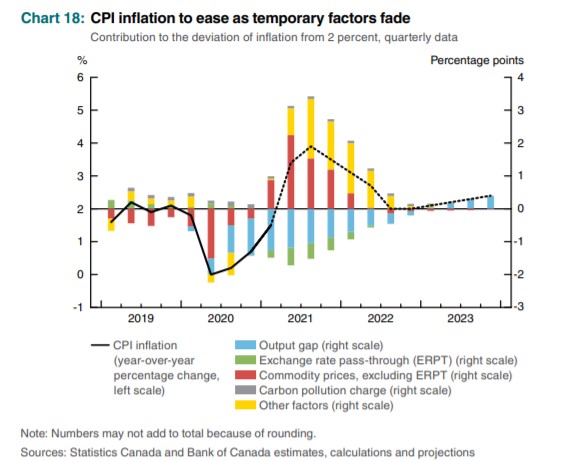

As the impacts of temporary factors start to ease, CPI inflation is expected to decline by the start of 2022. Following that, economic slack is expected to become the primary factor influencing inflation projections over the medium term.

The inflation outlook continues to be highly uncertain due to the different impacts the virus and restrictions had on various sectors, businesses, and workers. This results in a higher degree of uncertainty about the amount of slack in the economy and increases the uncertainty of inflation projections. The Bank of Canada projection for CPI inflation are 3.0% in 2021, 2.4% in 2022, and 2.2% in 2023. Compared to the April MPR, inflation projections have been revised up for 2021 and 2022 and revised down for 2023.

The next scheduled date for announcing the overnight rate target is September 8, 2021. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 27, 2021.

Bank of Canada: Rate Announcement; Monetary Policy Report - July 2021

<--- Return to Archive