The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 05, 2021BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary announced that it would maintain Bank Rate at 1.0% at its Monetary Policy Committee (MPC) meeting.

In addition, the MPC decided to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion and the target for the stock of government bond purchases at £875 billion. The total target stock of asset purchases will be maintained at £895 billion.

Global GDP growth has accelerated in the second quarter supported by increased vaccination programs and easing of restrictions. However, global growth is expected to slow down in the third quarter, partly reflecting the spread of the Delta variant.

In the United Kingdom, economic activity increased 5.0% in Q2 2021. Driven by a strong pick up in consumer spending, UK GDP growth in the second quarter was higher than projected in the May Monetary Policy Report. While the recent increase in the number of COVID cases linked to the Delta variant is expected to weight on activity in the short-term, UK GDP is expected to increase by around 3.0% in Q3 2021 and reach its pre-pandemic level in the final quarter.

With the demand recovery, the number of full and part-time furloughed jobs has continued to decline but remains at around 2 million at the end of June. The MPC noted that spare capacity has been eroded over the past couple of quarters.

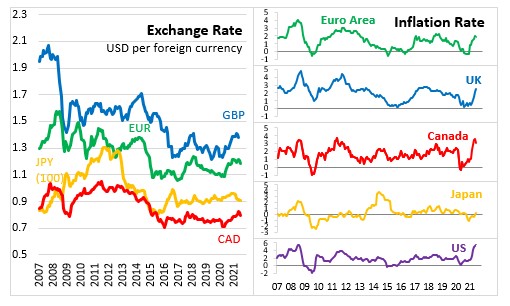

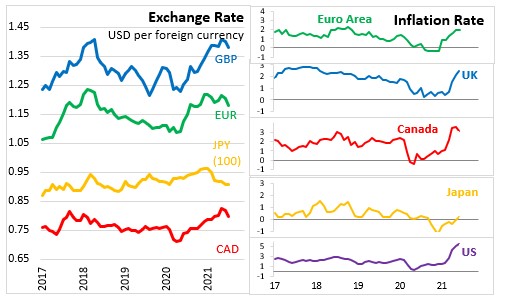

Annual inflation increased to 2.5% in June while core inflation increased to 2.3%. Part of this increase reflects the low base prices seen in the beginning of the pandemic and the subsequent increase in energy prices. Strong global demand, supply shortages and increased shipping costs have added to the price pressures. With further expected rises in goods and energy prices, inflation is projected to increase to around 4.0% in the near term. As global demand rebalances and supply shortages ease, inflation is expected to fall back to the 2.0% range.

The Bank of England expects UK GDP to increase 7.25% in 2021 and 6.0% in 2022. Inflation is expected to increase 4.0% in 2021 and slow down to 2.5% in 2022.

The Monetary Policy Committee noted that if the economy evolves in line with these projections, some modest tightening of monetary policy might be needed to meet the inflation target in the medium term. The next scheduled date for MPC announcement on bank rate is September 23, 2021. The Bank’s next Monetary Policy Report will be published in November 2021.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report - August 2021

<--- Return to Archive