The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

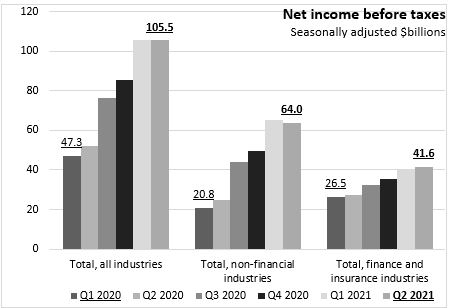

August 24, 2021QUARTERLY FINANCIAL STATISTICS FOR ENTERPRISES, Q2 2021 In Q2 2021, Canadian enterprise net income before taxes (seasonally adjusted) decrease by $0.4 billion to $105.5 billion. Net income before taxes was down $1.3 billion for non-financial corporations and was up $0.9 billion in finance and insurance corporations.

Compared with Q2 2020, net income before taxes increased by $53.4 billion: $39.2 billion for non-financial corporations and $14.2 billion for finance and insurance corporations.

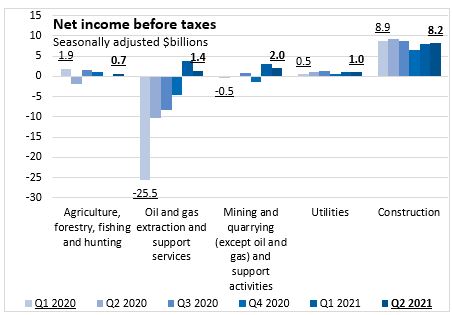

Oil and gas extraction (and related support activities) reported the largest improvements in net income before taxes, narrowing a $10.3 billion loss in Q2 2020 to a profit of $1.4 billion in Q2 2021. There was also a $2.2 billion improvement in net income before taxes in mining and quarrying (and related support). Construction net income remained relatively stable through 2020 and first half of 2021.

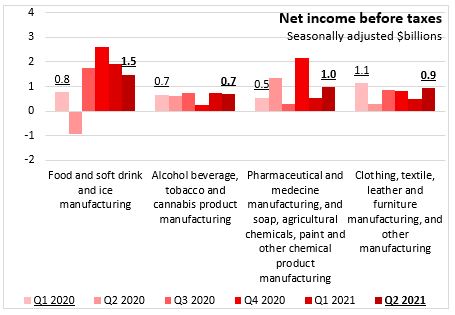

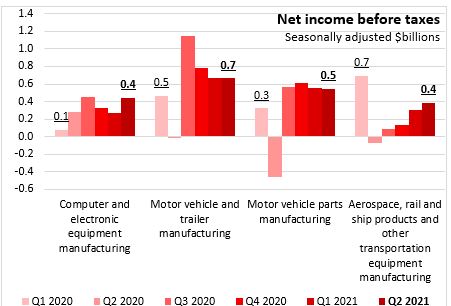

Across many manufacturing industries, there was substantial erosion in net income in Q2 2020. Since then, net income before taxes has recovered fully or partially for many manufacturing industries. For Q2 2021, net income was up in the most in Pharmaceutical and medicine manufacturing, and soap, agricultural chemicals, paint and other chemical product manufacturing; Clothing, textile, leather and furniture manufacturing, and other manufacturing; and Petroleum and coal product manufacturing. Food and soft drink and ice manufacturing had the largest decline.

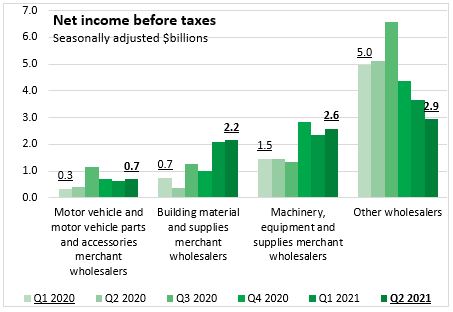

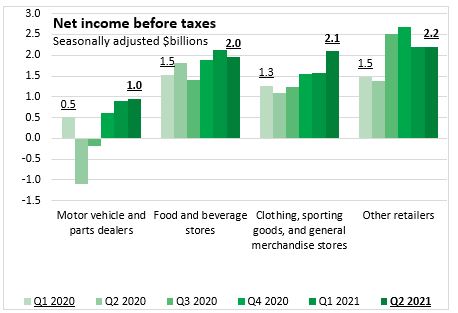

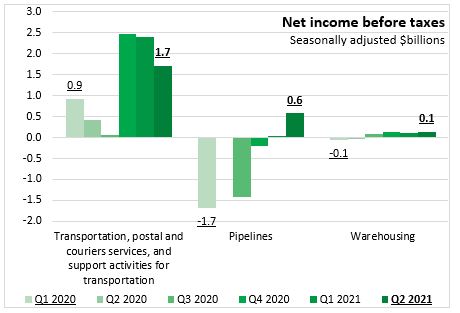

In service industries associated with distribution of goods (wholesale, retail, transportation/warehousing), net income before taxes was up notably compared to last year for building material wholesalers, machinery equipment wholesalers, motor vehicle/parts retailers (recovering from losses in Q2 2020),clothing, sporting goods and general merchandise stores, pipelines and transportation/postal/couriers.

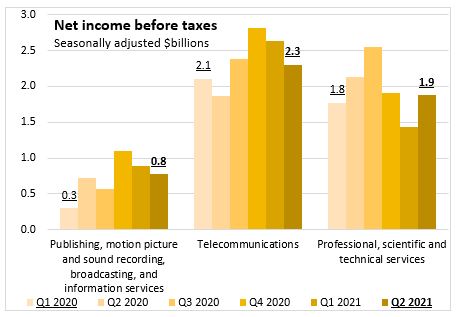

Net income before taxes has increased for publishing/broadcasting/information services as well as telecommunications compared to Q2 2020. New income for professional, scientific and technical services gained compared to last quarter (+$0.4 billion) but is still lower than Q2 2020.

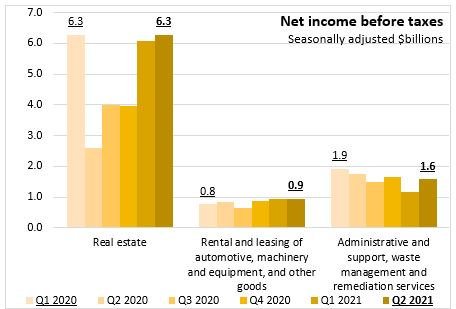

Real estate corporate net income was particularly high in Q1 2020 before it fell in Q2 2020. Net income for real estate corporations has recovered in Q2 2021.

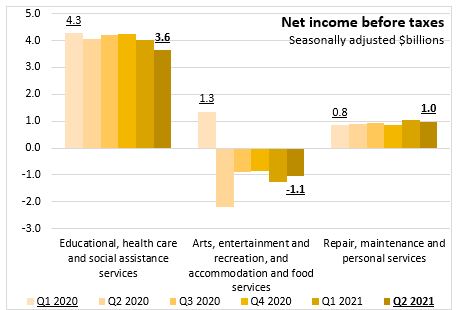

Net income for the arts, entertainment and recreation, and accommodation and food services sector have been particularly hard hit by the pandemic. These corporations continue to post negative net income before taxes.

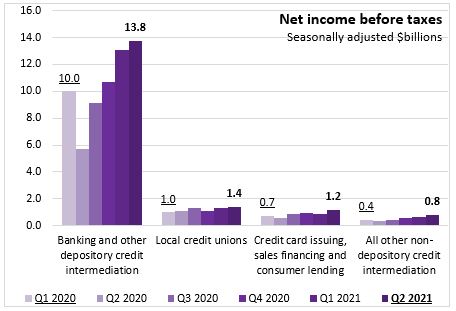

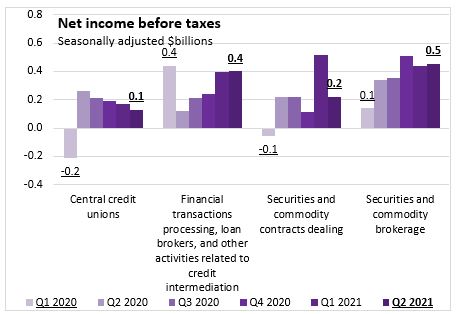

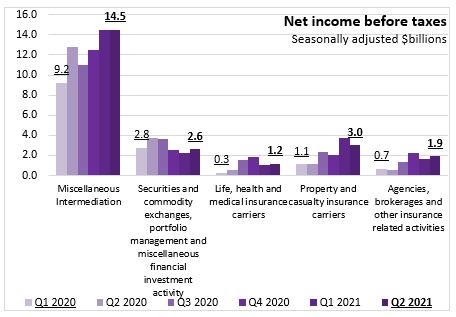

Among financial corporations, increasing net income is particularly concentrated in banking/depository credit intermediation as well as miscellaneous intermediation. Both sectors have seen increases since Q2 2020 and exceed there Q1 2020 levels.

Source: Statistics Canada. Table 33-10-0226-01 Quarterly balance sheet and income statement, by industry, seasonally adjusted (x 1,000,000)

<--- Return to Archive