The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

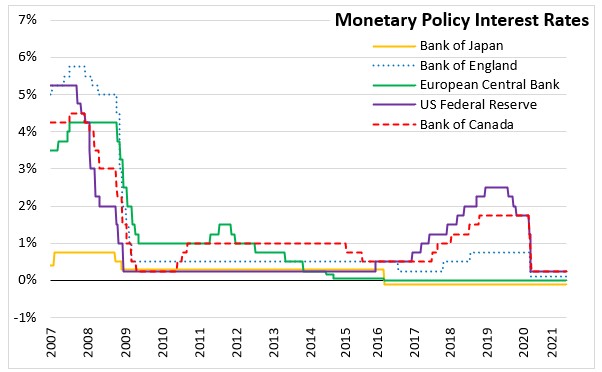

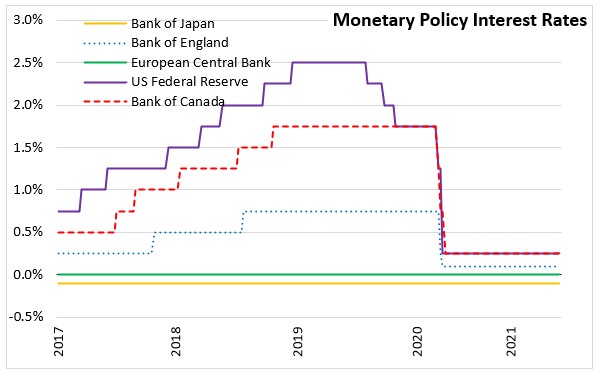

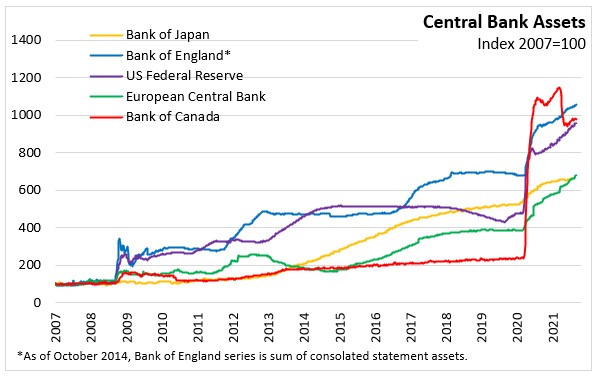

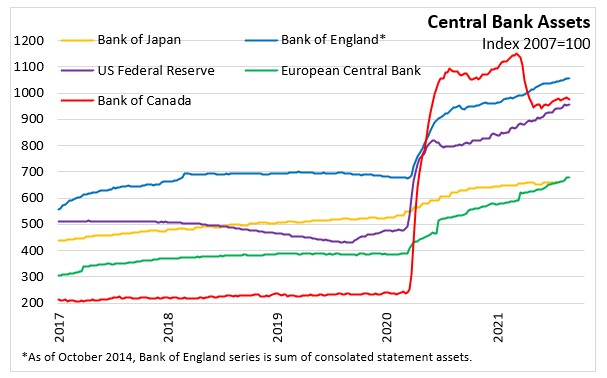

September 08, 2021BANK OF CANADA MONETARY POLICY The Bank of Canada announced today that it will hold its target for the overnight rate at the effective lower bound of 0.25%, with the Bank rate at 0.50% and the deposit rate at 0.25%. The Bank also noted that it is maintaining its forward guidance and quantitative easing program at its current pace of $2 billion per week.

The global economic recovery continues on a solid momentum going into the third quarter of 2021, led by strong growth in the US. However, supply chain disruptions and increasing COVID-19 cases in some regions still pose a risk to the global economic recovery.

In Canada, Gross Domestic Product (GDP) declined by about 1.0% in the second quarter which was weaker than projected in the Bank's July Monetary Policy Report (MPR). The main driver behind this contraction was the decline in exports, specifically in the auto sector due to supply chain problems. Housing market has also cooled down from recent high levels. The main positive contributions came from consumption, business investment and government spending.

As the third wave restrictions were eased in many provinces, employment rebounded in June and July. However, the Bank notes that there is still considerable slack in the economy and some groups, particularly low-wage workers, are still disproportionately affected.

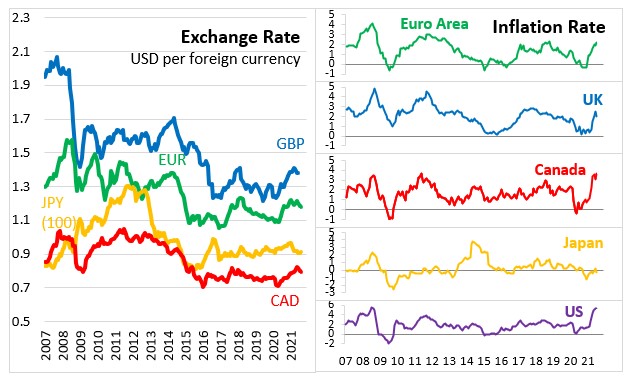

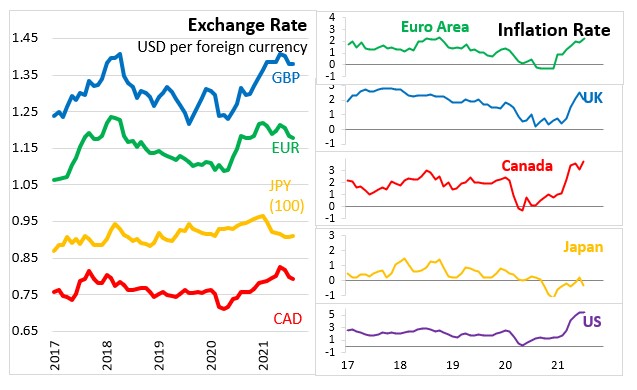

CPI inflation in Canada increased 3.7% in July 2021 reflecting the impacts of the base-year effect, higher gasoline prices and supply bottlenecks. Core inflation was also up primarily due to temporary factors and base year effects. The Bank expects the upward pressure on inflation coming from these factors to be transitory. However, the Bank noted that inflationary developments will be closely monitored as the magnitude and persistence of the temporary factors are uncertain.

The Bank notes that extraordinary monetary policy support is needed to keep Canada’s economic recovery on its track. The Bank reconfirmed its commitment to hold the policy rate at the effective lower bound until economic slack is absorbed, and the 2 percent inflation target is sustainably achieved. The July MPR expects these conditions to continue until the second half of 2022. The QE program currently in place will continue until the recovery is well underway and will be calibrated to provide the monetary policy stimulus needed to support the recovery and achieve the inflation objective.

The next scheduled date for announcing the overnight rate target is October 27, 2021. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published at the same time.

Bank of Canada: Rate Announcement

<--- Return to Archive