The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 27, 2021BANK OF CANADA MONETARY POLICY The Bank of Canada announced today that it will hold its target for the overnight rate at the effective lower bound of 0.25%, with the Bank rate at 0.50% and the deposit rate at 0.25%. The Bank also noted that it is maintaining its forward guidance on holding policy rates at their effective lower bound until Canada’s economic slack is absorbed, and the 2%inflation target is sustainably achieved. Based on the Bank’s projections, these objectives will be achieved in the middle quarters of 2022. The quantitative easing program will be ended ($2 billion per week of purchasing Government of Canada bonds) with only reinvestment of maturing bonds continuing.

Global Economy

Economic activity continues to improve around the world but remains uneven with a firmer situation in advanced economies than in emerging-market economies (EMEs). Higher vaccination rates and more generous stimulus measures explain the differences in growth rates.

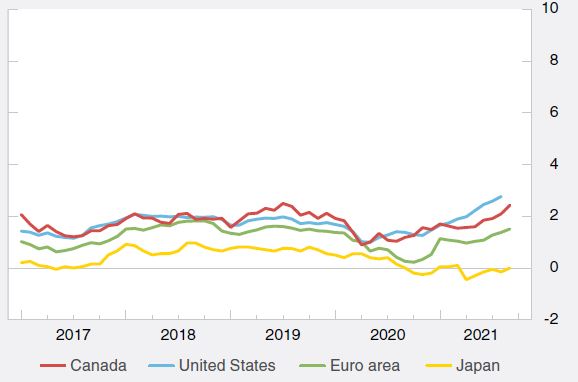

Inflation has risen above target in many advanced economies – including US, Canada, UK and Germany. Some central banks have reduced pace of asset purchases. Rapid increase in inflation rates this year is less pronounced for advanced economies when considered over the 2-year time period of the pandemic when rates were below targets.

Price changes over two-year period, annualized

Major energy disruptions in various part of the world are affecting economic activity and pushing up costs. Supplies of many goods are constrained by transportation bottlenecks and supply shortages that are pushing up prices, particularly in North America. These pressures are expected to persist until second half of 2022.Transportation and hospitality prices are starting to rise in certain regions of advanced economies as demand recovers. Durable good prices have increased sharply with strong demand and supply constraints of semiconductor shortage and distancing restrictions at ports and factories slowing production.

Higher food and energy prices and exchange rate pass-through are adding to further price pressures in EMEs. Food price contributing to EMEs inflation with their larger share of consumption in food. Brazil, Russia, and Mexico have tightened monetary policy. Inflation remains relatively low in Japan and China. The Bank of Canada notes that global divergences inflation is result of differences in economic slack, exchange rate movements, historical experiences with inflation and inflation expectations.

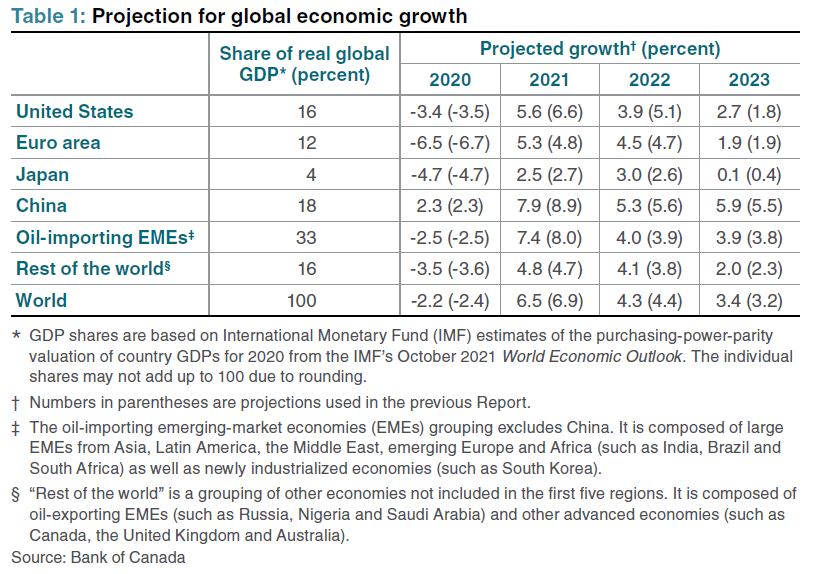

The Bank of Canada projects global real GDP growth to be slower than anticipated in its July 2021 forecast with an increase 6.5% in 2021, 4.3% in 2022, and 2.5% in 2023. Growth is projected to be slower for both advanced economies and EMEs with downward revisions in 2021 and 2022. This is due to the Delta variant’s larger impacts on consumption in China, EMEs and United States; weaker US government expenditures, persistent supply-chain disruptions, and regulatory changes in China weighing on housing and business investment.

The US labour market recovery is progressing more slowly than anticipated. Job openings are at record highs and employment rates are below pre-pandemic levels for most categories of workers. US GDP growth is expected to slow in the second half of 2021 as extraordinary government transfers wind down and transportation bottlenecks and shortages limit production. US growth in 2022 and 2023 is expected to be supported by consumption growth as households spend savings accumulated during the pandemic and the government adds USD$1.5 trillion over eight years for spending on infrastructure and research and development.

China’s GDP growth has slowed recently amid renewed pandemic containment measures, energy shortages, as well as fiscal and monetary tightening. Property sector regulations are causing slowing housing activity while some developers experience financial distress.

Canadian Economy

The Canadian economy is growing robustly as high vaccination rates allow easing of containment measures. The Delta variant has required some ongoing public health precautions and weighed on consumer confidence.

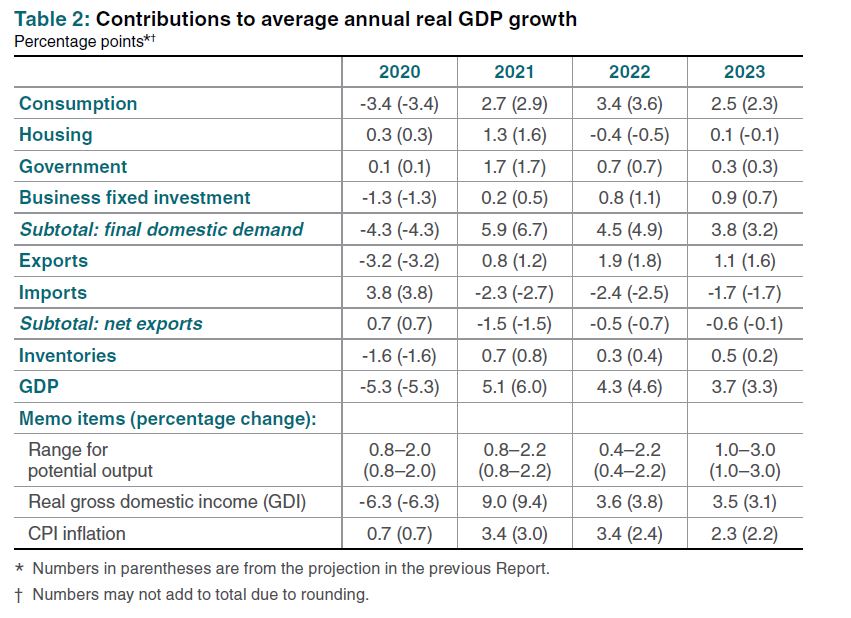

Strong demand along with persistent supply constraints have limited production and increased costs. Bottlenecks and shortages are leading to production slowdown (notably for Canada’s motor vehicle assembly), delayed or cancelled purchases, and reduced investment. The Bank of Canada’s projections for real GDP growth have been revised down to 5.1% in 2021, 4.3% in 2022 and 3.7% in 2023.

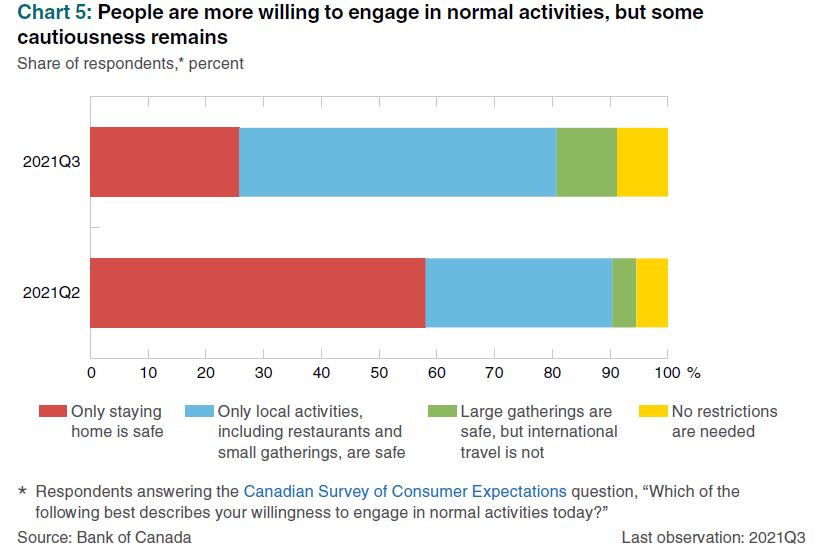

Consumption growth is leading Canada’s recovery with a rebound in in-person spending combined with elevated good purchases. However, people remain cautious about large gatherings and international travel. Housing resale and construction activity have declined form historically high levels, particularly for single-family starts. However, housing markets remain tight and high disposable incomes and low borrowing rates continue to support solid levels. Exports and business investment are expected to rebound with foreign demand, but shortages of key inputs are weighing on production.

Canada’s job gains have been robust as in-person services have resumed. However, unemployment remains elevated, and hours worked remains lower. The closure and reopening of the economy have worsened the search frictions in Canada’s labour market with signs of both continued slack and acute shortages in some sectors.

Consumer price index (CPI) inflation is expected to remain elevated into 2022 with ongoing supply disruptions and higher energy prices. Inflation is then expected to ease to about 2% at the end of 2022. In the Bank of Canada’s projections, inflation rises modestly in 2023 as excess demand drives prices before returning to target in 2024. Inflation projections were revised up 0.4 percentage points in 2021 and 1 percentage point in 2022 for 3.4% increases in both years. CPI inflation for 2023 is expected to be 2.3%.

Bank of Canada: Rate Announcement; Monetary Policy Report - October 2021

<--- Return to Archive