The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 29, 2021SURVEY ON BUSINESS CONDITIONS: Q4 2021 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has conducted a seventh iteration of the Canadian Survey on Business Conditions. In October and early November, Statistics Canada surveyed businesses to collect information on businesses' expectations, obstacles, financing and practices as the economy continues to move beyond COVID-19.

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business and by urban or rural location. There are comparisons of the Nova Scotia average (all industries, ages, sizes, locations) with the national and provincial averages. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances.

Business expectations

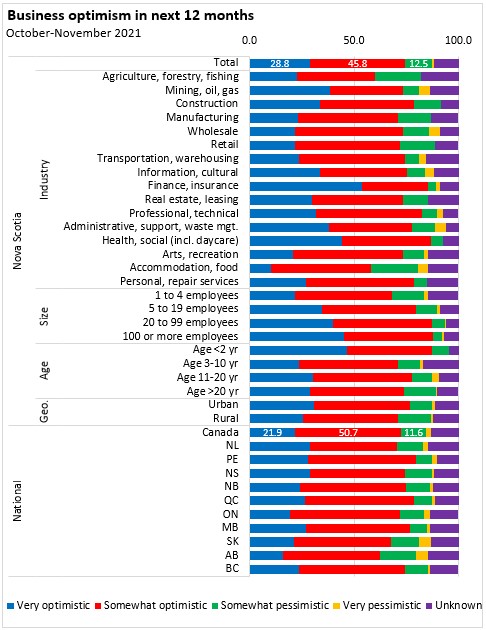

Looking forward over the next 12 months

- 74.6% of Nova Scotia business respondents felt very or somewhat optimistic about business conditions while 13.8% were not optimistic. Across Canada, optimism was strongest in Prince Edward Island and Quebec. Optimism was lowest in Alberta and Saskatchewan.

- Nova Scotia business optimism was stronger in finance/insurance and health care/social assistance (including daycare). Pessimism among Nova Scotia businesses was more prevalent in accommodation/food service and agriculture/forestry/fishing industries.

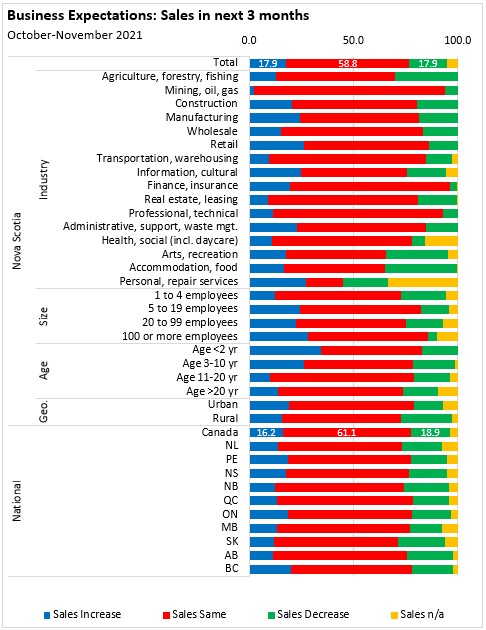

Looking over the next three months:

- 76.7% of Nova Scotia businesses expect stable or rising sales while 17.9% expect a decline. The same share of businesses expect rising sales as expect declining sales. Across Canada, businesses in Prince Edward Island, Quebec, Ontario and British Columbia were more likely to report expectations for rising sales. Declining sales were more widely expected in New Brunswick, Saskatchewan and Alberta.

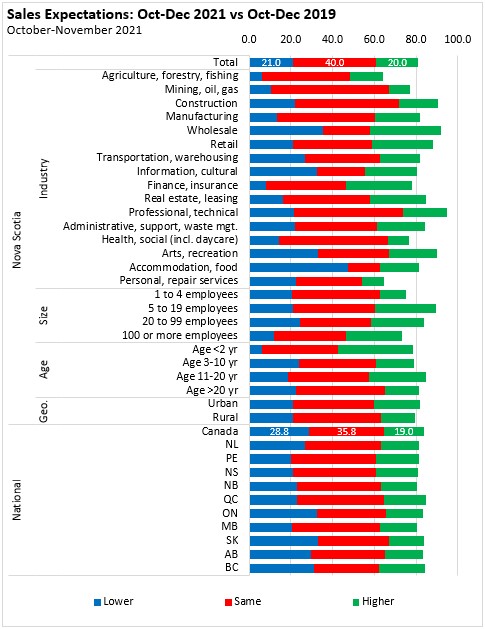

- Businesses were also surveyed to ask whether expected sales over October-December 2021 would exceed sales from October-December 2019 (prior to the pandemic). In Nova Scotia, 21.0% of businesses expected lower sales than in October-December 2019, a smaller portion than the national average (28.8%). Higher sales were expected among 20.0% of Nova Scotia businesses (slightly above the national average of 19.0%), with stronger expectations among finance/insurance, retail and wholesale businesses. Across Canada, more businesses in Ontario and Saskatchewan expect sales to remain below pre-pandemic levels while businesses in British Columbia, Prince Edward Island and Quebec were more likely to expect sales above pre-pandemic levels.

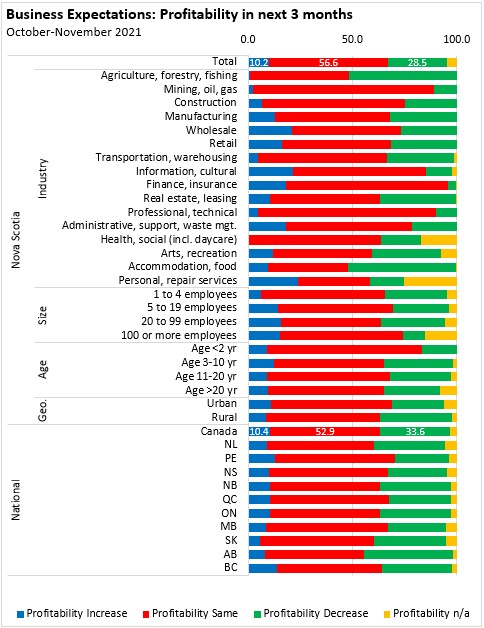

- Business profitability is expected to remain the same for 56.6% of Nova Scotia businesses in the next three months while 10.2% expect rising profitability and 28.5% expect decreasing profitability. Rising profitability is expected more in Nova Scotia's personal/repair services, information/culture and wholesale businesses. Decreasing profitability expectations were more prevalent in Nova Scotia's agriculture/forestry/fishing, eaccommodation/food, real estate/leasing and arts/recreation businesses. Across Canada the outlook for profitability was stronger in Prince Edward Island and British Columbia. Declining profitability expectations were most prevalent in Alberta.

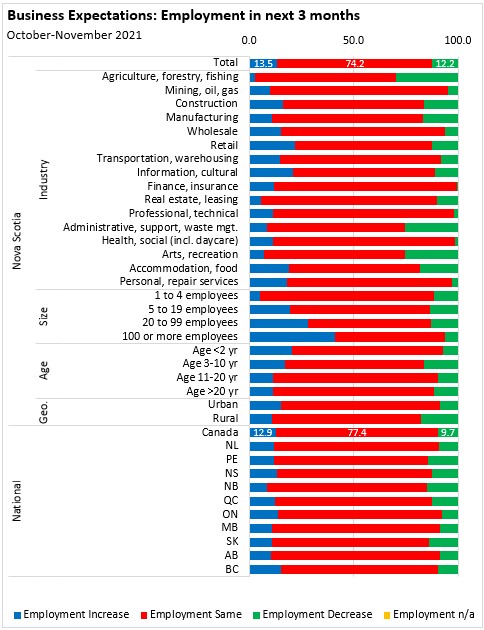

- The outlook for employment was stable for 74.2% of Nova Scotia businesses in the next three months. Rising employment is expected among 13.5% of Nova Scotia businesses while declining employment is expected by 12.2% of Nova Scotia businesses. Rising employment is notably more prevalent among many services industries that were impaired during COVID-19 restrictions as well as in the construction industry. Across Canada, employment expectations are stronger in Nova Scotia, Ontario and British Columbia.

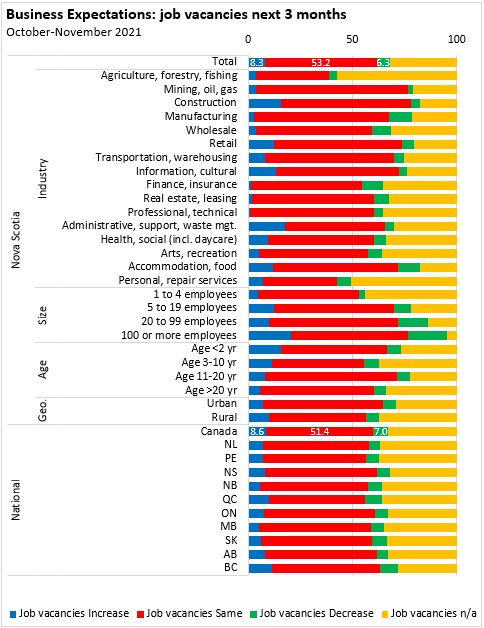

- Job vacancies are expected to rise for 8.3% of Nova Scotia businesses while 53.2% expect job vacancies to be stable and 6.3% expect job vacancies to decline. Job vacancy increases were expected in more businesses that operate in administrative support (including call centres), construction, information/culture and accommodation/food as well as among larger and newer businesses.

Obstacles for businesses

As part of the Survey of Business Conditions, businesses were asked about their obstacles.

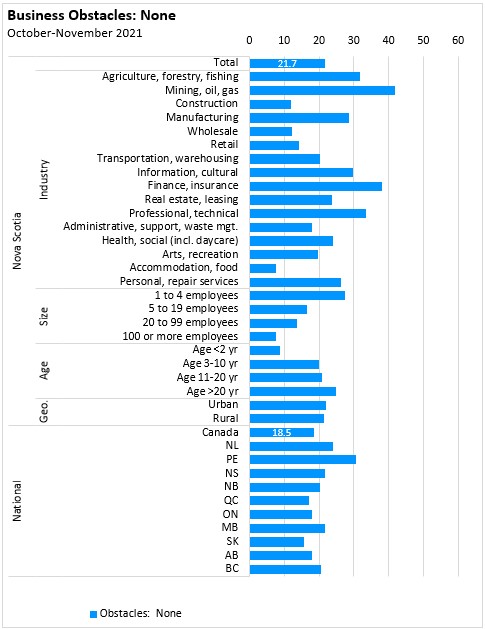

- 21.7% of Nova Scotia businesses reported no substantial obstacles expected in the next three months. Businesses in Nova Scotia's agriculture/forestry/fishing, mining/quarrying, manufacturing, information/culture, finance/insurance and professional/technical services industries were more likely to report no substantial obstacles. Across Canada, 18.5% of businesses reported no obstacles with higher shares in Newfoundland and Labrador, Prince Edward Island, Nova Scotia and Manitoba.

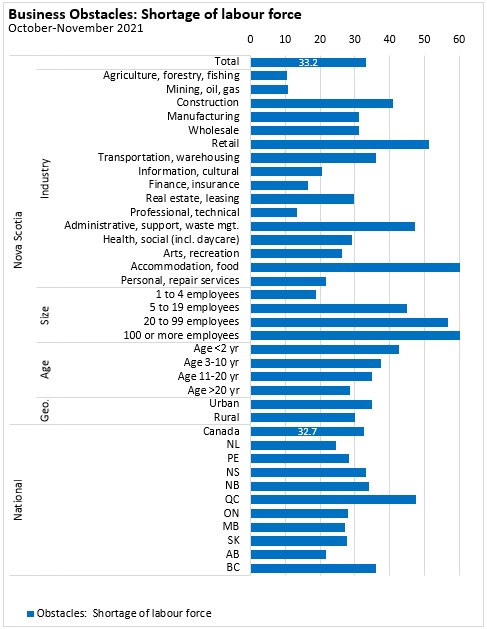

- 33.2% of Nova Scotia businesses report shortages of skilled labour. This was more acute in Nova Scotia's construction, retail, transportation/warehousing, administrative/support and accommodation/food industries as well as among medium and large employers. Across Canada, Quebec and British Columbia businesses report greater obstacles from labour shortage.

- 35.1% of Nova Scotia businesses report obstacles from recruiting skilled labour. The obstacle was more sizable for construction, administrative/support and accommodation/food businesses as well as among larger Nova Scotia businesses. Across Canada, recruitment of skilled labour was an obstacle for more businesses in Quebec, British Columbia and New Brunswick.

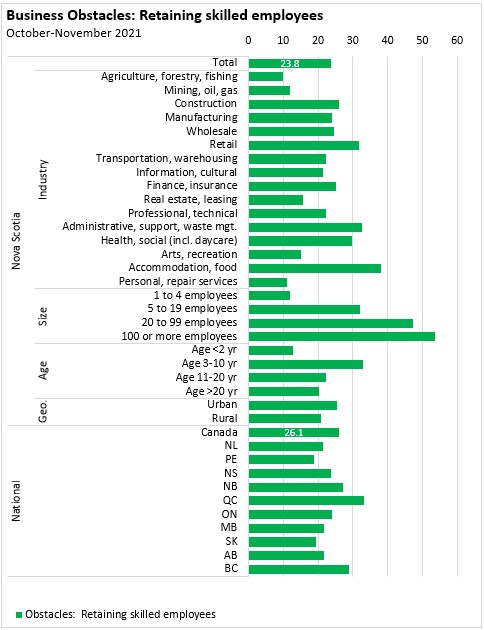

- 23.8% of Nova Scotia businesses report obstacles from retaining skilled labour, more so among larger businesses as well as in administrative/support and accommodation/food industries. Retention of skilled labour was a more common business obstacle in New Brunswick, Quebec and British Columbia.

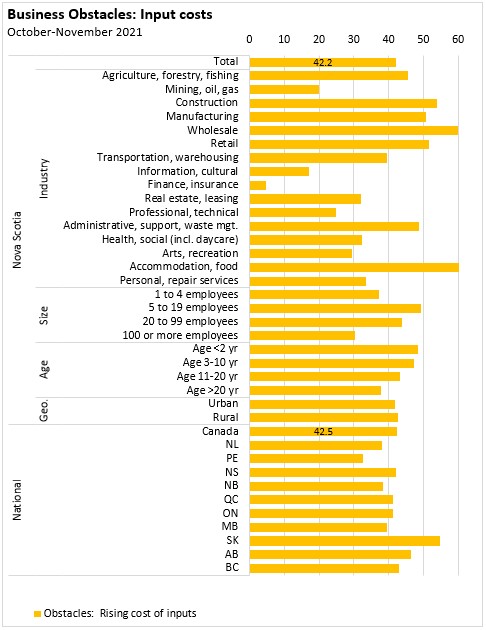

- Rising input costs were cited as an obstacle for 42.2% of Nova Scotia businesses - this was the most commonly cited obstacle in Nova Scotia as well as in every other province except Quebec (where labour shortage and recruiting were bigger obstacles). Input costs was a particularly prevalent obstacle cited by goods-producing industries as well as in wholesale, retail, transportation/warehousing and accommodation/food. Across Canada, Saskatchewan and Alberta reported notably higher obstacles from rising input costs.

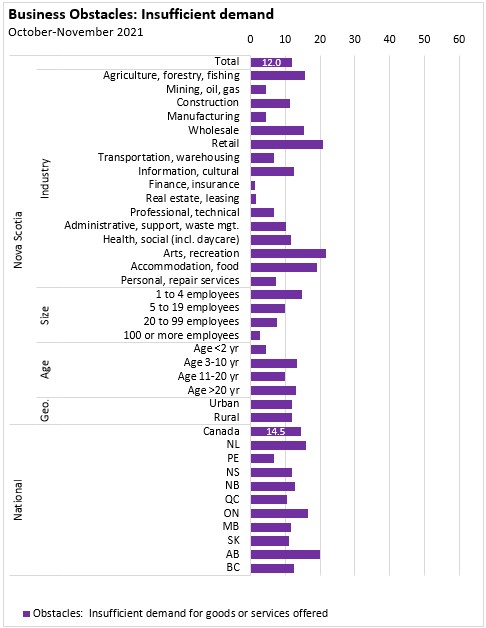

- 12.0% of Nova Scotia businesses report obstacles from insufficient demand, but more of an obstacle for retail, arts/recreation and accommodation/food businesses. Insufficient demand was a more commonly noted business obstacle in Alberta, Newfoundland and Labrador and Ontario.

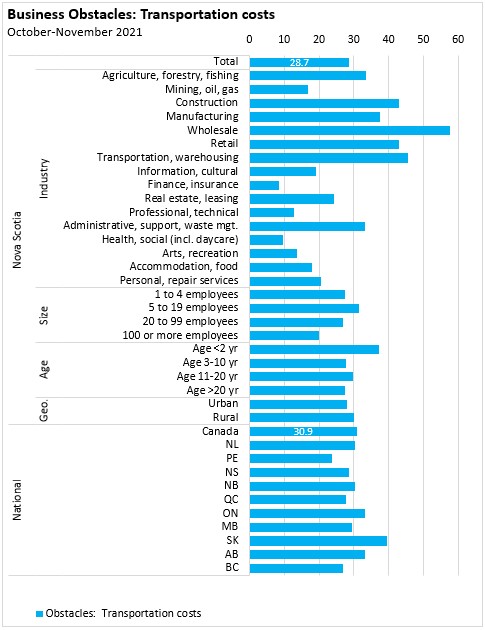

- Transportation costs were an obstacle for 28.7% of businesses in Nova Scotia. This was more common among goods-producing businesses as well as in retail and transportation/warehousing businesses. Transportation costs were larger business obstacles for Ontario, Alberta and Saskatchewan.

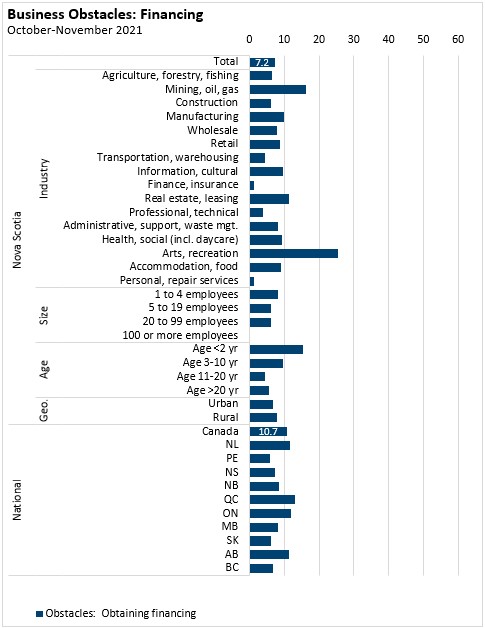

- Financing was an obstacle for only 7.2% of businesses in Nova Scotia. Financing obstacles were higher for mining/oil/gas and arts/recreation businesses. Across Canada, financing obstacles were larger for Ontario, Alberta, Quebec and Newfoundland and Labrador.

- 20.3% of businesses in Nova Scotia report that government regulations were an obstacle. This was higher among businesses in agriculture/forestry/fishing, accommodation/food, manufacturing and retail businesses. Across Canada, government regulations were more of an obstacle for businesses in New Brunswick, Saskatchewan and Alberta.

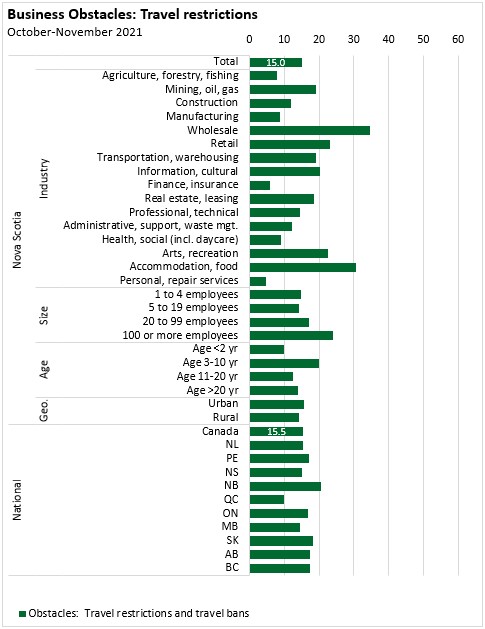

- Travel restrictions were an obstacle for 15.0% of Nova Scotia businesses, with a greater share in wholesale, retail, information/culture, arts/recreation and accommodation/food businesses. Across Canada, travel restrictions were an obstacle for fewer businesses in Quebec but for more businesses in New Brunswick and Saskatchewan.

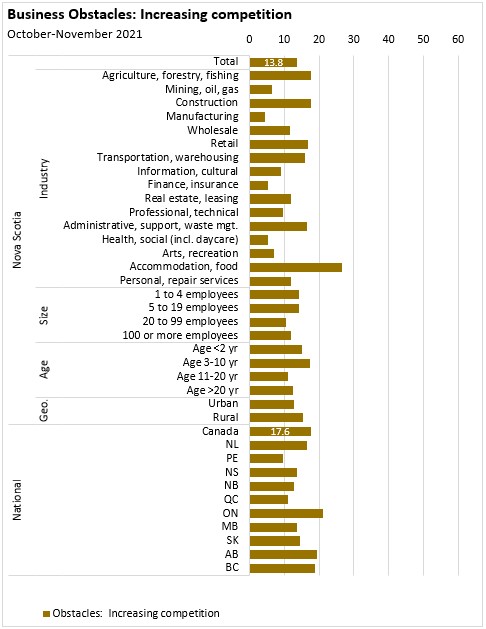

- Rising competition was an obstacle for 13.8% of Nova Scotia businesses; this was more prevalent for Nova Scotia businesses in agriculture/forestry/fishing, construction, wholesale, retail, administrative/support and accommodation/food industries. A higher portion of businesses in Alberta, Ontario and British Columbia noted competition as a business obstacle.

- 17.7% of Nova Scotia businesses reported cash flow and debt management as an obstacle, particularly in accommodation/food, arts/recreation and construction businesses. Newer businesses also face obstacles from cash flow/debt management more commonly. Across Canada, cash flow/debt management obstacles were more common in Alberta, Saskatchewan and Ontario.

- 12.3% of Nova Scotia businesses face obstacles from internet connections, more so in rural businesses and newer businesses. Nationally, 11.5% of businesses report obstacles from internet connections with higher shares in Prince Edward Island and Saskatchewan. Internet connections are a notably smaller obstacle for businesses in British Columbia and Manitoba.

Plans to address labour recruitment and retention obstacles

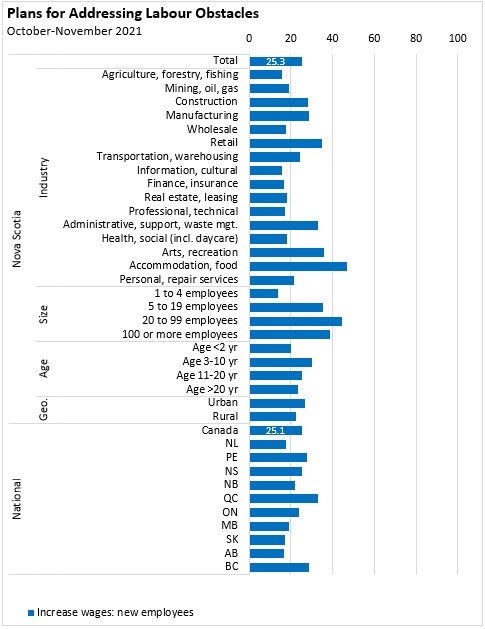

Apart from rising input costs, labour shortages, recruitment and retention were the some of the most widely-reported business obstacles expected in the next three months. Statistics Canada asked for specific plans to address labour-related obstacles.

- 36.3% of Nova Scotia businessses reported no plans to address labour obstacles. Businesses in real estate/leasing, mining/quarrying and professional/technical services were more likely to have no specific plans to address labour obstacles. Across Canada, 39.7% of businesses had no specific plan to address labour obstacles. Businesses in Quebec and Nova Scotia were most likely to have some specific plans for labour obstacles while those in Alberta and Newfoundland and Labrador were least likely to have specific plans to address labour obstacles.

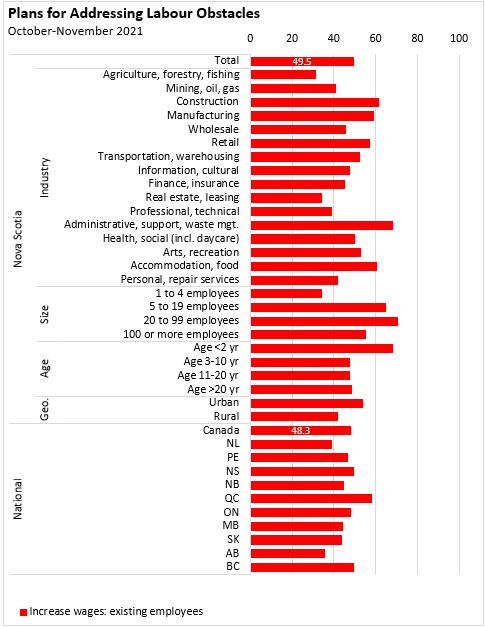

- Among Nova Scotia businesses, increasing wages was the most common plan for addressing labour obstacles. Almost half (49.5%) of Nova Scotia businesses planned to address labour obstacles with higher wages for existing employees while 25.3% of businesses in Nova Scotia planned to raise wages for new employees. Both were similar to national averages.

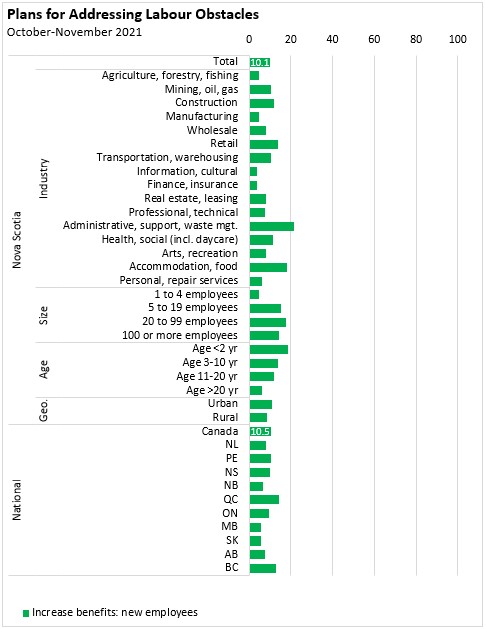

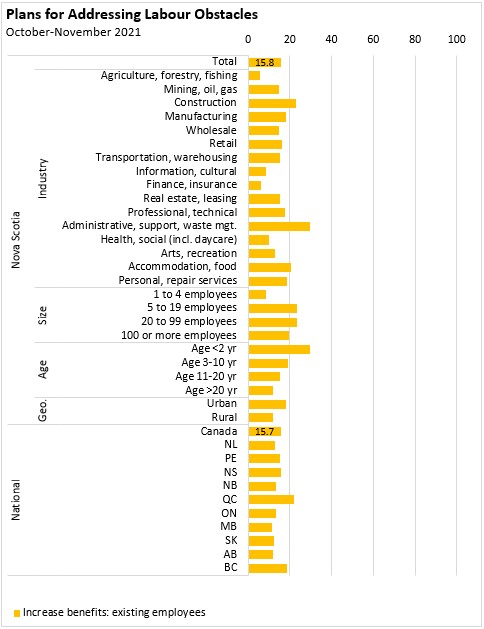

- A lower portion of Nova Scotia businesses planned to address labour obstacles through increase benefits for existing employees (15.8%) or new employees (10.1%).

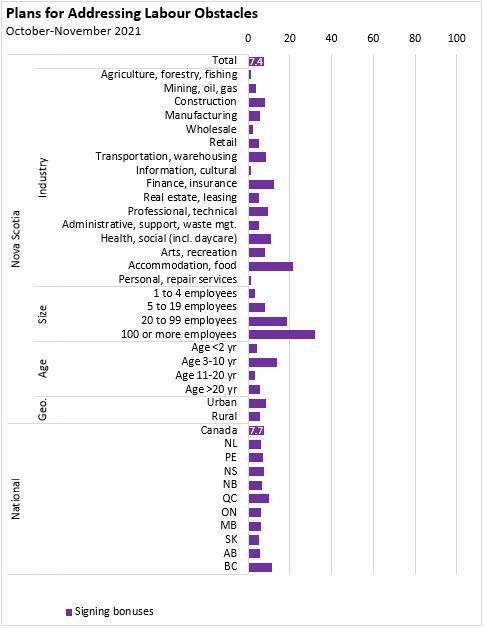

- Signing bonuses were planned by only 7.4% of Nova Scotia companies as a tool for addressing labour obstacles, though this was a more common approach for accommodation/food businesses as well as for large employers.

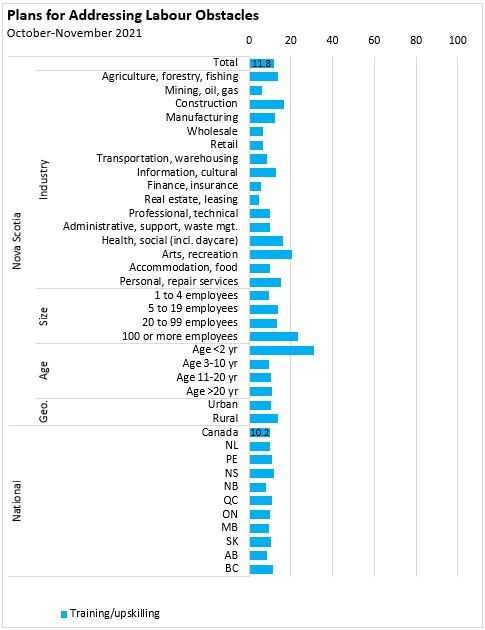

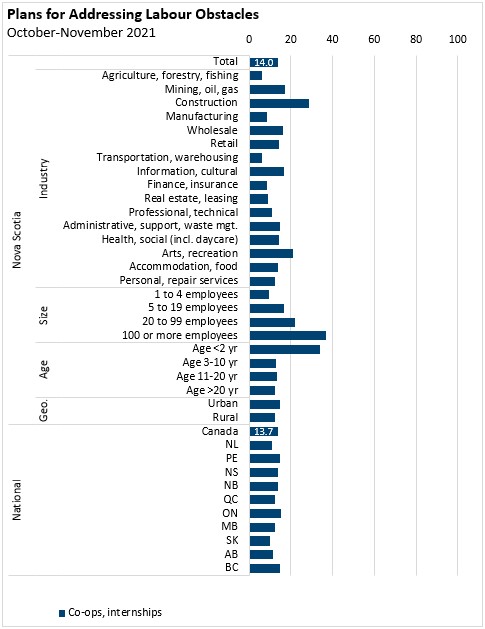

- Training/upskilling (11.8%), co-op placements/internships (14.0%), tuition support for training expenses (10.9%), paid time for learning (15.6%) and micro-credentials (11.1%) were not commonly cited by Nova Scotia businesses as plans to deal with labour obstacles. However, on-the-job training was noted as an approach to labour obstacles for 30.6% of Nova Scotia businesses, particularly in construction and manufacturing as well as among large employers.

Telework and workers in another Province/Territory

Greater use of remote and work-from-home labour may also play a role in addressing labour obstacles.

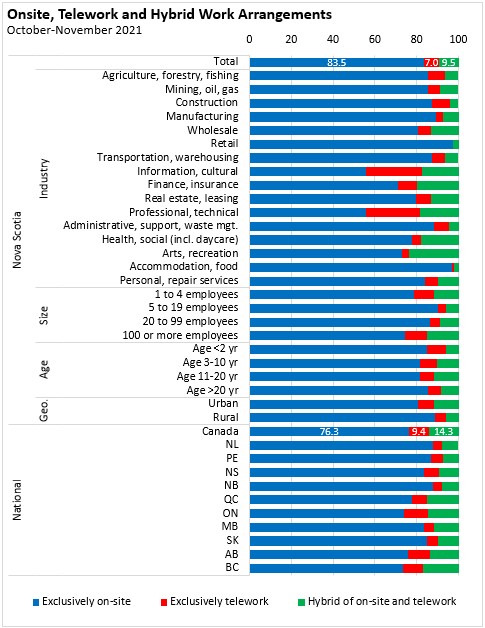

Nova Scotia businesses report that on average 16.5% of their employees will work by telework or hybrid arrangements while 83.5% will be exclusively on-site. Nationally, 23.7% of workers are expected to report by telework or hybrid arrangements while 76.3% continue to work exclusively onsite. Remote and hybrid work arrangements were more common for Nova Scotia's information/culture, finance/insurance, professional/technical and arts/recreation industries as well as for large employers.

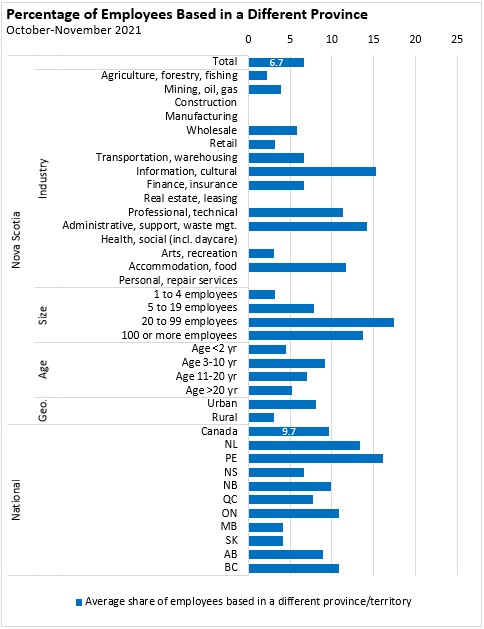

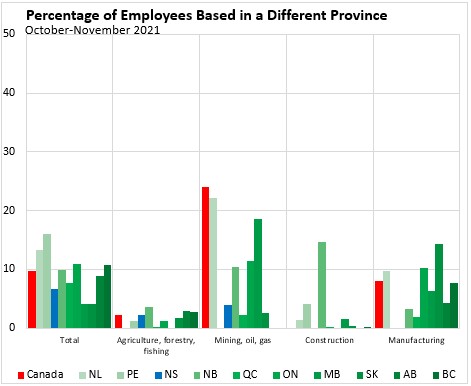

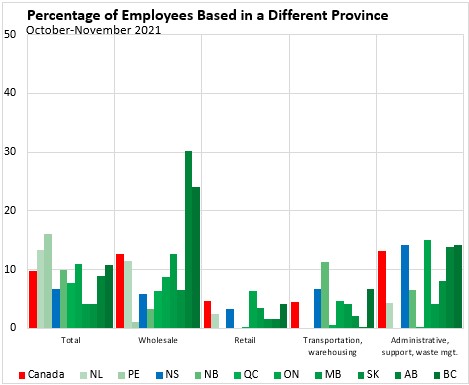

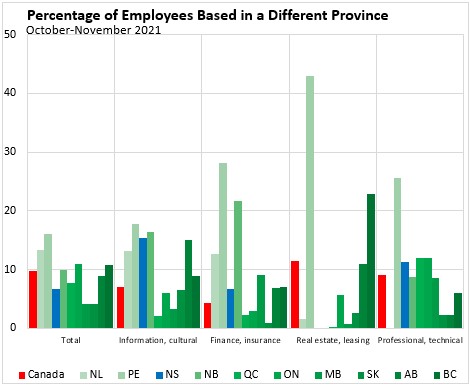

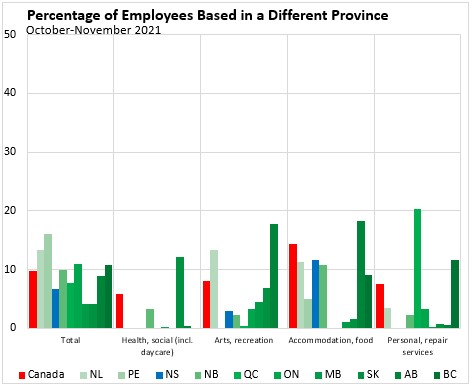

On average Nova Scotia businesses expect only 6.7% of their workers will be based in a different province or territory. This portion was higher in information/culture, administrative/support, professional/technical services and accommodations/food industries. Across Canada, businesses in Newfoundland and Labrador and Prince Edward Island reported the highest average share of employees expected to work from a different province or territory while Manitoba, Saskatchewan and Nova Scotia reported the lowest average shares.

On an industry-by-industry basis, working from another province is more widely expected in lower contact service industries, such as wholesale, administrative/support (which includes call centres) and professional/technical services as well as mining/oil/gas and accommodation/food services.

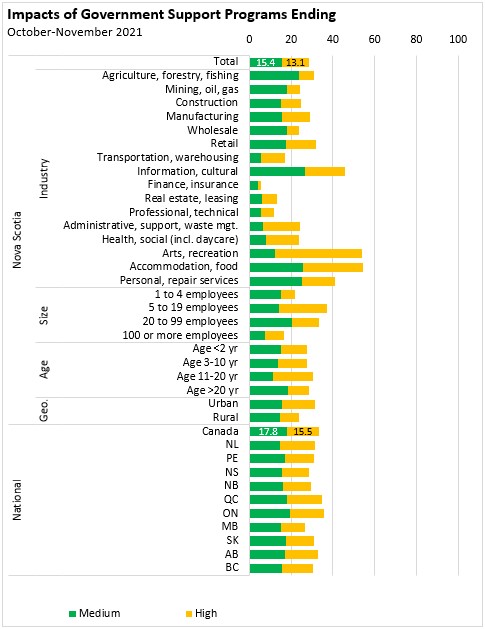

Impact of ending government support programs

As vaccinations against COVID-19 continue to grow, the Federal government has ended or substantially restricted many of its previous support programs. Businesses were asked about the expected impact of the withdrawal of government support programs. Among Nova Scotia businesses, 54.6% believed that there would be no impacts or low impacts from withdrawal of government support programs while 28.5% felt that there would be medium-high impacts. Businesses in Nova Scotia's accommodations/food, arts/recreation, personal repair services and information/culture industries were more likely to report medium to high impacts as government support programs end. Across Canada, businesses in Ontario and Quebec were more likely to report medium to high impacts of the end of government support programs. Medium and high impacts were less likely among businesses in Manitoba and Nova Scotia.

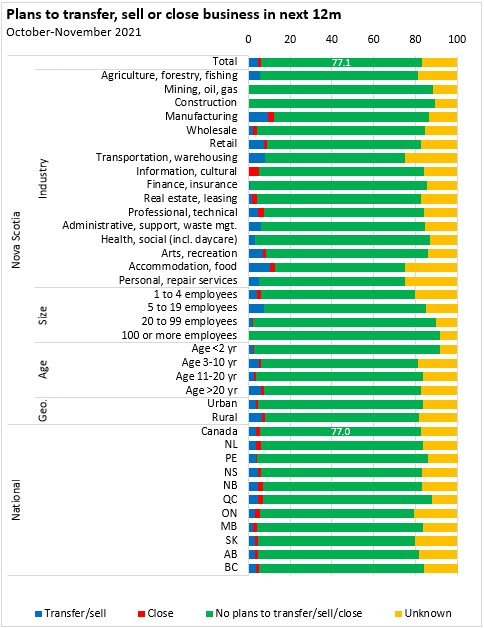

Plans for sale/closure

Over 77% of Nova Scotia businesses have no plans to sell, transfer or close their business in the next 12 months while 5.9% plan to sell, transfer or close the business (17.0% have unknown plans about sale/transfer/closure). Sale/transfer and closure plans were more common among businesses in accommodation/food, manufacturing and retail businesses in Nova Scotia. Across Canada a higher portion of New Brunswick and Quebec businesses plan to sell, transfer or close while a lower portion of Manitoba and Prince Edward Island businesses plan to sell, transfer or close.

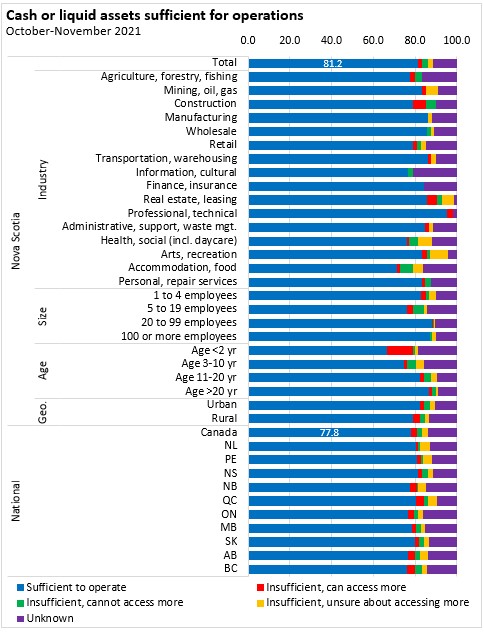

Cash for operations and availability of credit

81.2% of Nova Scotia businesses report having sufficient cash or liquid assets for operations - the highest portion among provinces. A lower portion of Nova Scotia's accommodation/food, health/social (including daycare) and information/culture businesses reported sufficient cash and liquid assets for operations. Across Canada 77.8% of businesses report having sufficient cash or liquid assets; this portion was lower in British Columbia, Alberta and Ontario.

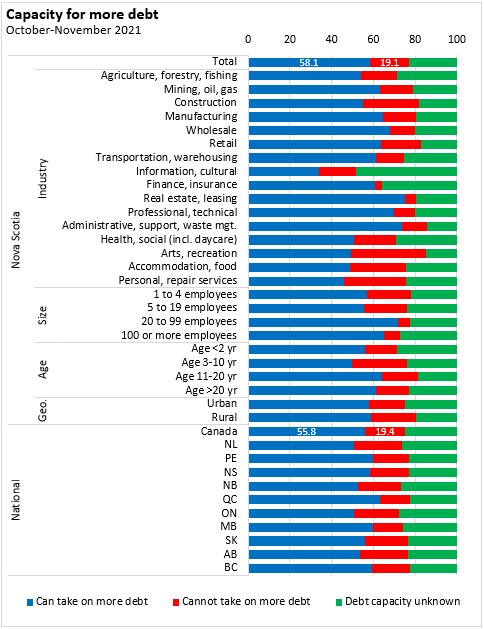

58.1% of Nova Scotia businesses report being able to take on more debt while 19.1% report being unable to take on more debt. Capacity for more debt was lower in Nova Scotia's information/culture, accommodation/food, arts/recreation and personal/repair services businesses as well as among those that were from 3-10 years old.

Use of trade agreements

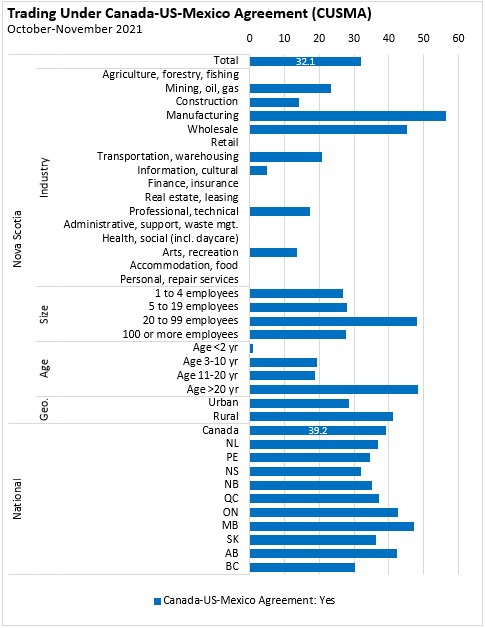

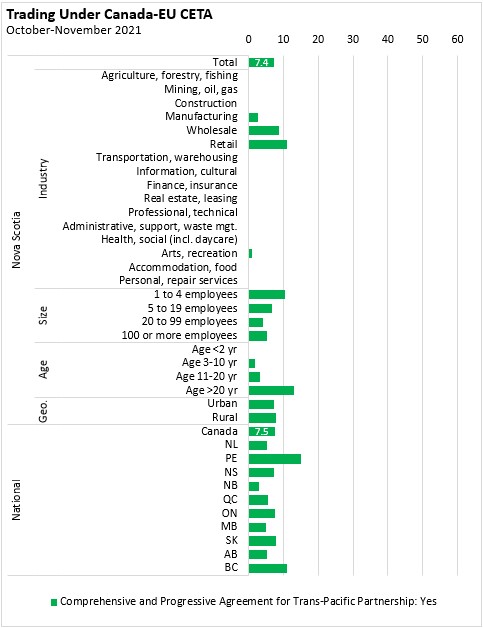

As part of the Survey on Business Conditions, respondents were asked about whether they carry out trade under Canada's major trade agreements with the US and Mexico (CUSMA), the European Union (CETA) or the Pacific countries (CPTPP). Note that many businesses (particularly services) operate in industries with products that are not commonly traded.

- Just under one third (32.1%) of Nova Scotia businesses trade using the terms of CUSMA. This was notably higher for manufacturing enterprises as well as for medium sized businesses. Across Canada, 39.2% of businesses trade under CUSMA, with higher shares of businesses in Ontario, Manitoba and Alberta.

- 8.9% of Nova Scotia businesses trade with the EU under the CETA agreement. 9.6% of Canada's businesses trade under CETA, with higher shares in Quebec and Prince Edward Island.

- 7.4% of Nova Scotia businesses trade under the CPTPP agreement. This was just under the national average of 7.5% of Canada's businesses. Higher shares of businesses in British Columbia and Prince Edward Island trade using the terms of the CPTPP.

Sources: Statistics Canada. Table 33-10-0399-01 Business or organization expectations over the next three months, fourth quarter of 2021; Table 33-10-0400-01 Business or organization obstacles over the next three months, fourth quarter of 2021; Table 33-10-0403-01 Plans to transfer, sell, or close business in the next 12 months, fourth quarter of 2021; Table 33-10-0405-01 Trade agreements business or organization currently carries out trade under, fourth quarter of 2021; Table 33-10-0416-01 Business or organization plans regarding recruitment, retention and training, fourth quarter of 2021; Table 33-10-0417-01 Expected impact of the absence of government support programs on the survival of business or organization, fourth quarter of 2021; Table 33-10-0419-01 Liquidity and access to liquidity over the next three months, fourth quarter of 2021; Table 33-10-0420-01 Ability for the business or organization to take on more debt, fourth quarter of 2021; Table 33-10-0422-01 Average percentage of workforce anticipated to work on-site or telework over the next three months, fourth quarter of 2021; Table 33-10-0424-01 Average percentage of employees based in a different province or territory as employer that are anticipated to telework exclusively, fourth quarter of 2021; Table 33-10-0426-01 Future outlook over the next 12 months, fourth quarter of 2021; Table 33-10-0427-01 Sales expectations from October to December 2021 compared with October to December 2019, fourth quarter of 2021

<--- Return to Archive